Form 990 Schedule R 2020

What is the Form 990 Schedule R

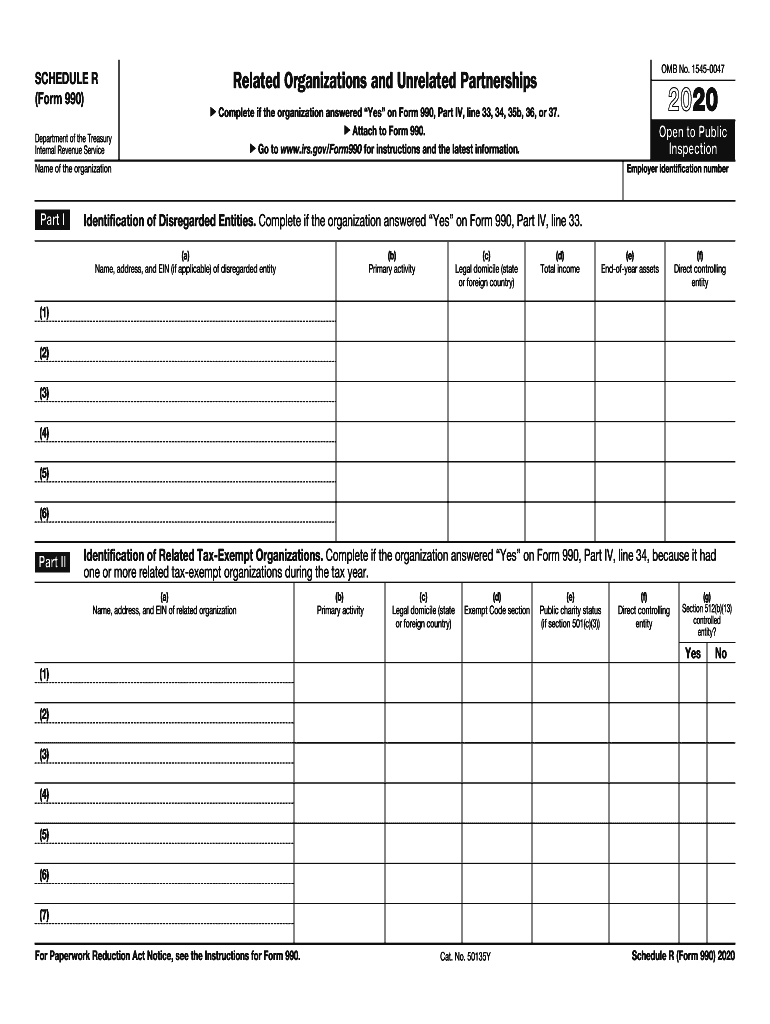

The IRS 990 Schedule R form is a crucial document for tax-exempt organizations in the United States. It is used to report information regarding related organizations and unrelated business activities. This form helps the IRS understand the relationships between tax-exempt entities and their affiliated organizations. The Schedule R is an essential part of the Form 990 series, which is filed annually by tax-exempt organizations to provide transparency about their financial activities and compliance with tax regulations.

How to use the Form 990 Schedule R

To effectively use the IRS 990 Schedule R form, organizations must first determine if they have any related organizations or engage in unrelated business activities. If applicable, they should complete the form by providing detailed information about these entities. This includes names, addresses, and the nature of the relationship. The completed Schedule R should be attached to the main Form 990 when filing. Properly utilizing this form ensures compliance with IRS regulations and helps avoid potential penalties.

Steps to complete the Form 990 Schedule R

Completing the IRS 990 Schedule R involves several key steps:

- Gather necessary information about related organizations, including their names, addresses, and tax identification numbers.

- Identify any unrelated business activities that your organization is engaged in.

- Fill out the form by providing accurate and complete information in the designated sections.

- Review the completed form for accuracy and ensure all required attachments are included.

- Attach the Schedule R to your Form 990 before submission.

Key elements of the Form 990 Schedule R

The IRS 990 Schedule R form contains several key elements that organizations must pay attention to:

- Identification of related organizations: This section requires details about any entities that are related to the filing organization.

- Unrelated business income: Organizations must report any income generated from activities unrelated to their exempt purpose.

- Ownership interests: The form requires disclosure of any ownership interests in related organizations.

- Financial transactions: Organizations must report significant financial transactions with related entities.

Legal use of the Form 990 Schedule R

The legal use of the IRS 990 Schedule R form is essential for maintaining compliance with federal tax regulations. Organizations must accurately report related organizations and unrelated business activities to avoid legal repercussions. Failure to provide complete and truthful information can result in penalties, including fines or loss of tax-exempt status. It is important for organizations to understand the legal implications of their disclosures on this form and ensure they adhere to IRS guidelines.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the IRS 990 Schedule R form to ensure timely compliance. Generally, the Form 990, including all schedules, is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations following a calendar year, this typically falls on May fifteenth. If additional time is needed, organizations can request an extension, but they must still file the Schedule R by the extended deadline to avoid penalties.

Quick guide on how to complete form 990 schedule r

Effortlessly Prepare Form 990 Schedule R on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form 990 Schedule R on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Simplest Way to Edit and Electronically Sign Form 990 Schedule R Without Effort

- Find Form 990 Schedule R and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or conceal private information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 990 Schedule R to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 schedule r

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule r

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the IRS 990 Schedule R form?

The IRS 990 Schedule R form is an essential document that tax-exempt organizations must file to report their relationships with related organizations and report certain activities. Understanding how to properly complete the IRS 990 Schedule R form can help ensure compliance with IRS regulations and avoid penalties. Utilizing eSignature solutions like airSlate SignNow can streamline the signing process for these critical documents.

-

How can airSlate SignNow assist with filling out the IRS 990 Schedule R form?

airSlate SignNow provides an easy-to-use platform that allows you to fill out and eSign the IRS 990 Schedule R form efficiently. Its user-friendly interface ensures that you can complete forms quickly and securely, reducing the risk of errors. Plus, with cloud storage integration, you can easily access your documents whenever you need them.

-

Is there a cost associated with using airSlate SignNow for IRS 990 Schedule R form?

airSlate SignNow offers a cost-effective solution that caters to various budgets, with flexible pricing plans tailored to different organizational needs. While the basic features come with a free trial, more advanced tools for the IRS 990 Schedule R form require a subscription. This investment can save you time and reduce paperwork in the long run.

-

What are the benefits of using airSlate SignNow for IRS 990 Schedule R form submissions?

Using airSlate SignNow for IRS 990 Schedule R form submissions enhances efficiency by facilitating quick eSignatures and document management. The platform simplifies the entire process, ensuring your forms are signed and submitted on time. Additionally, it enhances security by providing encrypted signing options so sensitive information remains protected.

-

Can airSlate SignNow integrate with other software for IRS 990 Schedule R forms?

Yes, airSlate SignNow seamlessly integrates with various software and tools to enhance your workflow for managing the IRS 990 Schedule R form. Whether you use CRM systems, storage solutions, or accounting software, SignNow can connect to these platforms, making it easier to access your documents and streamline your processes.

-

What should I do if I encounter difficulties while completing the IRS 990 Schedule R form?

If you face challenges while completing the IRS 990 Schedule R form, airSlate SignNow offers comprehensive support and resources. You can access helpful guides, tutorials, and customer service for assistance. This support can greatly ease the process of filling out and signing key documents, ensuring you stay compliant.

-

Is airSlate SignNow secure for signing IRS 990 Schedule R forms?

Absolutely, airSlate SignNow is designed with security as a priority for signing IRS 990 Schedule R forms. The platform employs advanced encryption and compliance with industry standards to protect your data and documents during the signing process. You can trust that your sensitive information is safe and secure.

Get more for Form 990 Schedule R

- Demand to produce copy of will from heir to executor or person in possession of will west virginia form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497432049 form

- Bill of sale of automobile and odometer statement wyoming form

- Bill of sale for automobile or vehicle including odometer statement and promissory note wyoming form

- Promissory note in connection with sale of vehicle or automobile wyoming form

- Bill of sale for watercraft or boat wyoming form

- Bill of sale of automobile and odometer statement for as is sale wyoming form

- Construction contract cost plus or fixed fee wyoming form

Find out other Form 990 Schedule R

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter