Local Option Transient Rental Tax Rates DR 15TDT R 2025-2026

Understanding the Local Option Transient Rental Tax Rates DR 15TDT R

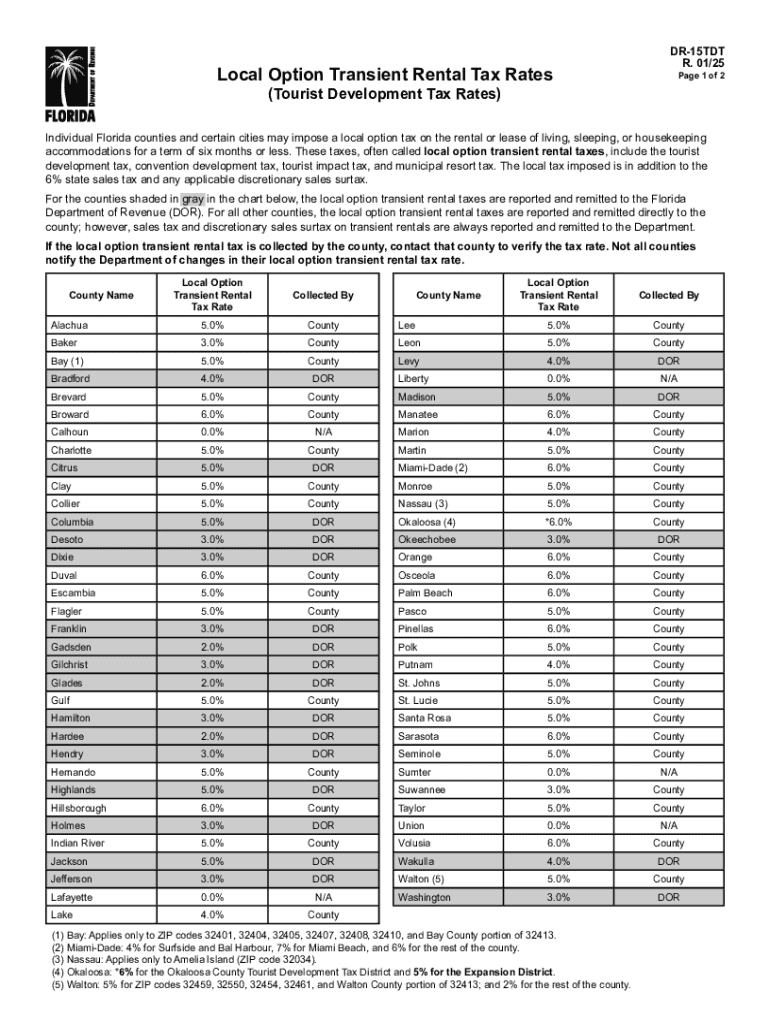

The Local Option Transient Rental Tax Rates DR 15TDT R is a form utilized in Florida for reporting and remitting transient rental taxes. This tax applies to short-term rentals, such as vacation homes and rental properties, and is essential for compliance with state and local tax regulations. The rates can vary by county, reflecting local government decisions on tourism and rental activities. Understanding these rates is crucial for property owners and managers to ensure accurate tax reporting and avoid penalties.

Steps to Complete the Local Option Transient Rental Tax Rates DR 15TDT R

Completing the Local Option Transient Rental Tax Rates DR 15TDT R involves several key steps:

- Gather necessary information: Collect details about your rental property, including the address, rental income, and the duration of rentals.

- Determine applicable tax rates: Research the specific transient rental tax rates for your county, as these can differ significantly.

- Fill out the form: Accurately input the required information, ensuring all fields are completed to avoid delays.

- Review for accuracy: Double-check all entries for correctness before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Local Option Transient Rental Tax Rates DR 15TDT R. Typically, these deadlines align with the end of each month, requiring property owners to submit their tax returns and payments by the 1st of the following month. Staying informed about these dates helps ensure timely compliance and avoids potential penalties.

Required Documents for Filing

When filing the Local Option Transient Rental Tax Rates DR 15TDT R, certain documents are necessary to support your submission. These may include:

- Rental income records: Documentation of all income received from transient rentals.

- Lease agreements: Copies of agreements that outline the terms of the rentals.

- Previous tax returns: If applicable, prior year filings can provide context for current submissions.

Having these documents ready can streamline the filing process and ensure that all information provided is accurate and complete.

Penalties for Non-Compliance

Failure to comply with the Local Option Transient Rental Tax requirements can result in significant penalties. These may include:

- Late fees: Additional charges for late submissions can accumulate quickly.

- Interest on unpaid taxes: Interest may accrue on any outstanding tax amounts, increasing the total owed.

- Legal action: In severe cases, continued non-compliance can lead to legal repercussions, including liens on property.

Understanding these penalties emphasizes the importance of timely and accurate tax reporting.

Who Issues the Form

The Local Option Transient Rental Tax Rates DR 15TDT R is issued by the Florida Department of Revenue. This agency oversees the collection of transient rental taxes and provides guidelines for property owners on how to comply with state laws. It is advisable to refer to their resources for the most current information regarding tax rates and filing procedures.

Create this form in 5 minutes or less

Find and fill out the correct local option transient rental tax rates dr 15tdt r

Create this form in 5 minutes!

How to create an eSignature for the local option transient rental tax rates dr 15tdt r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FL transient tax and how does it affect my business?

FL transient tax refers to the tax imposed on short-term rentals in Florida. Understanding this tax is crucial for businesses operating in the hospitality sector, as it directly impacts pricing and compliance. Utilizing airSlate SignNow can help streamline the documentation process related to FL transient tax, ensuring you stay compliant while focusing on your business.

-

How can airSlate SignNow help with FL transient tax documentation?

airSlate SignNow simplifies the process of managing FL transient tax documentation by allowing you to easily create, send, and eSign necessary forms. This ensures that all your tax-related documents are organized and accessible, reducing the risk of errors. With our platform, you can efficiently handle compliance requirements without the hassle.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with FL transient tax. Our plans are designed to be cost-effective, providing essential features without breaking the bank. You can choose a plan that fits your budget while ensuring you have the tools needed for efficient document management.

-

Are there any integrations available for managing FL transient tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and property management software to help you manage FL transient tax more effectively. These integrations allow for automatic updates and streamlined workflows, making it easier to handle tax calculations and submissions. This ensures that your business remains compliant with minimal effort.

-

What features does airSlate SignNow offer for FL transient tax compliance?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSigning to assist with FL transient tax compliance. These tools help ensure that all necessary documents are completed accurately and on time. By using our platform, you can minimize the risk of non-compliance and focus on growing your business.

-

How does airSlate SignNow enhance the eSigning process for FL transient tax documents?

With airSlate SignNow, the eSigning process for FL transient tax documents is quick and user-friendly. Our platform allows multiple parties to sign documents electronically, reducing turnaround time signNowly. This efficiency is crucial for businesses that need to manage tax-related documents promptly and accurately.

-

Can airSlate SignNow help me track FL transient tax submissions?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your FL transient tax submissions. You can easily see when documents are sent, viewed, and signed, ensuring that you stay on top of your compliance obligations. This transparency helps you manage your tax responsibilities more effectively.

Get more for Local Option Transient Rental Tax Rates DR 15TDT R

- Irs form 8898 ampquotstatement for individuals who begin or end

- Arizona form 600 d claim for unclaimed property azdor

- Form rev190 authorization to revenuestatemnus

- Instructions for form 720 rev june 2021 instructions for form 720 quarterly federal excise tax return

- Cover sheet request for elder or county of sacramento form

- 2021 form 1041 es

- 3 schedule h 990 form free to edit download ampamp print

- 2021 schedule g form 990 or 990 ez supplemental information regarding fundraising or gaming activities

Find out other Local Option Transient Rental Tax Rates DR 15TDT R

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online