Local Option Transient Rental Tax Rates DR 15TDT Tourist 2020

What is the Local Option Transient Rental Tax Rates DR 15TDT Tourist

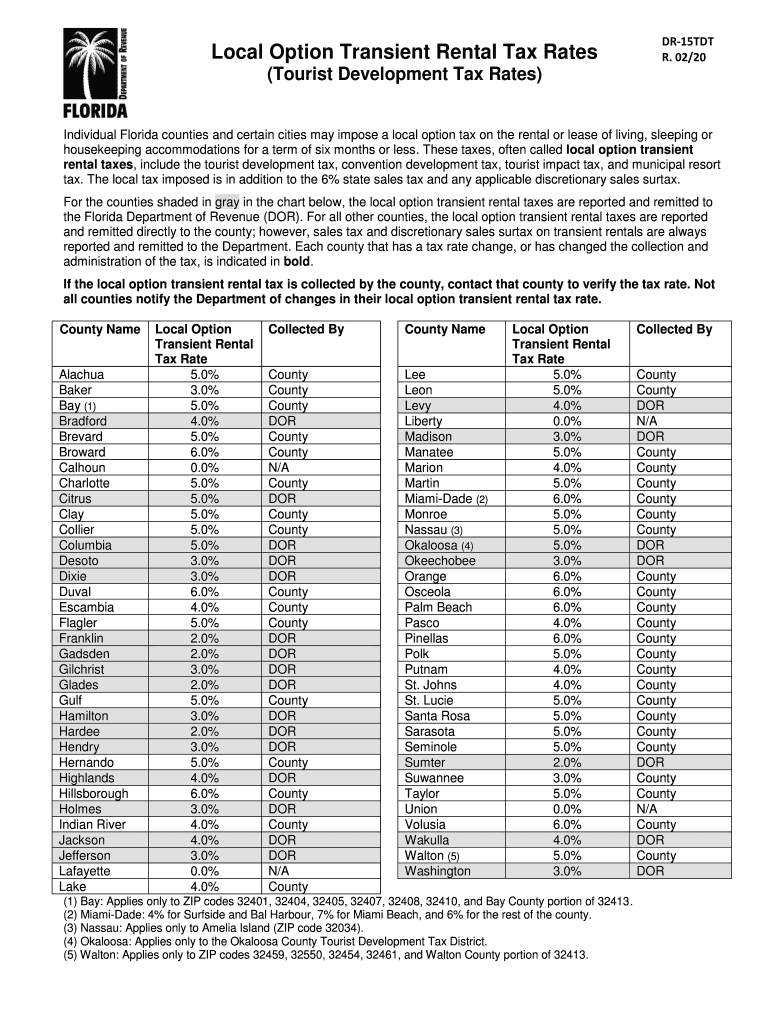

The Local Option Transient Rental Tax Rates DR 15TDT Tourist is a tax form used in Florida for reporting and remitting taxes on short-term rentals. This tax applies to rentals that are typically for six months or less, including vacation homes, condos, and apartments. The rates can vary by county, as local governments have the authority to impose their own transient rental taxes in addition to the state tax. Understanding these rates is crucial for property owners and managers to ensure compliance and avoid penalties.

Steps to complete the Local Option Transient Rental Tax Rates DR 15TDT Tourist

Completing the Local Option Transient Rental Tax Rates DR 15TDT Tourist involves several key steps:

- Gather rental income information: Collect all relevant data regarding the rental income earned during the reporting period.

- Determine applicable tax rates: Check the local tax rates that apply to your specific location, as they can differ by county.

- Fill out the form: Accurately input your rental income and calculate the tax owed based on the applicable rates.

- Review for accuracy: Ensure all information is correct to avoid issues during submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Local Option Transient Rental Tax Rates DR 15TDT Tourist

Utilizing the Local Option Transient Rental Tax Rates DR 15TDT Tourist form is essential for legal compliance in Florida. It ensures that property owners pay the correct amount of transient rental tax, which is required by state and local laws. Failing to file or pay these taxes can lead to penalties, fines, and potential legal issues. It is important to keep records of all transactions and filings for future reference and audits.

Required Documents

When preparing to fill out the Local Option Transient Rental Tax Rates DR 15TDT Tourist form, certain documents are necessary:

- Income statements showing total rental income for the reporting period.

- Records of any exemptions or deductions that may apply.

- Previous tax returns or forms, if applicable, for reference.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines for the Local Option Transient Rental Tax Rates DR 15TDT Tourist. Typically, these forms are due quarterly, with specific dates depending on the county. Missing a deadline can result in late fees and interest charges. Keeping a calendar of these dates can help ensure timely submissions and compliance.

Who Issues the Form

The Local Option Transient Rental Tax Rates DR 15TDT Tourist form is issued by the Florida Department of Revenue. This department oversees the collection of taxes and ensures compliance with state tax laws. Property owners should refer to the Department of Revenue for the most current forms and guidance on completing them accurately.

Quick guide on how to complete local option transient rental tax rates dr 15tdt tourist

Complete Local Option Transient Rental Tax Rates DR 15TDT Tourist effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Local Option Transient Rental Tax Rates DR 15TDT Tourist on any platform with airSlate SignNow's Android or iOS applications and upgrade any document-driven process today.

How to modify and eSign Local Option Transient Rental Tax Rates DR 15TDT Tourist with ease

- Find Local Option Transient Rental Tax Rates DR 15TDT Tourist and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and eSign Local Option Transient Rental Tax Rates DR 15TDT Tourist and ensure outstanding communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct local option transient rental tax rates dr 15tdt tourist

Create this form in 5 minutes!

How to create an eSignature for the local option transient rental tax rates dr 15tdt tourist

How to make an eSignature for your Local Option Transient Rental Tax Rates Dr 15tdt Tourist online

How to create an electronic signature for the Local Option Transient Rental Tax Rates Dr 15tdt Tourist in Chrome

How to make an electronic signature for signing the Local Option Transient Rental Tax Rates Dr 15tdt Tourist in Gmail

How to make an eSignature for the Local Option Transient Rental Tax Rates Dr 15tdt Tourist straight from your mobile device

How to generate an electronic signature for the Local Option Transient Rental Tax Rates Dr 15tdt Tourist on iOS

How to generate an electronic signature for the Local Option Transient Rental Tax Rates Dr 15tdt Tourist on Android OS

People also ask

-

What is a Florida transient rental sample?

A Florida transient rental sample is a template that outlines the essential terms and conditions for renting a property on a short-term basis in Florida. This document helps both property owners and renters navigate the specific legal requirements and responsibilities involved in transient rentals in the state. Utilizing a well-structured Florida transient rental sample can save time and ensure compliance.

-

How can airSlate SignNow help with Florida transient rental agreements?

airSlate SignNow simplifies the process of creating, sending, and signing Florida transient rental agreements. With our platform, you can easily customize your Florida transient rental sample and send it to tenants for eSignature. This not only speeds up the rental process but also ensures that all agreements are legally binding and securely stored.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing tiers to suit different business needs, including options that are particularly beneficial for property owners managing transient rentals. Our plans start with a cost-effective solution that includes access to templates like the Florida transient rental sample. This flexibility helps businesses budget their document management efficiently.

-

What features does airSlate SignNow offer for managing rental agreements?

airSlate SignNow provides several features tailored for managing rental agreements, including document templates, eSigning, and automated workflows. With our platform, users can easily create a Florida transient rental sample and customize it as needed. These features enhance efficiency, reduce errors, and ensure a smooth signing process.

-

Is airSlate SignNow compliant with Florida rental regulations?

Yes, airSlate SignNow is designed to support compliance with Florida rental regulations, including those specific to transient rentals. By using a Florida transient rental sample from our platform, users can ensure that their agreements meet state requirements. Our user-friendly interface makes it easy to include all necessary legal elements in your documents.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers integrations with various popular software tools that can enhance your workflow, such as property management systems and email applications. This means you can seamlessly incorporate your Florida transient rental sample into your existing systems, streamlining processes from document creation to management.

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, featuring encryption and robust authentication methods to protect your rental agreements. When you utilize a Florida transient rental sample, you can trust that all signed documents are securely stored and easily accessible. This security is vital for maintaining the integrity of your business transactions.

Get more for Local Option Transient Rental Tax Rates DR 15TDT Tourist

Find out other Local Option Transient Rental Tax Rates DR 15TDT Tourist

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document