Get the Fl Rental Tax Rates Form pdfFiller 2022

Understanding the Florida transient rental tax

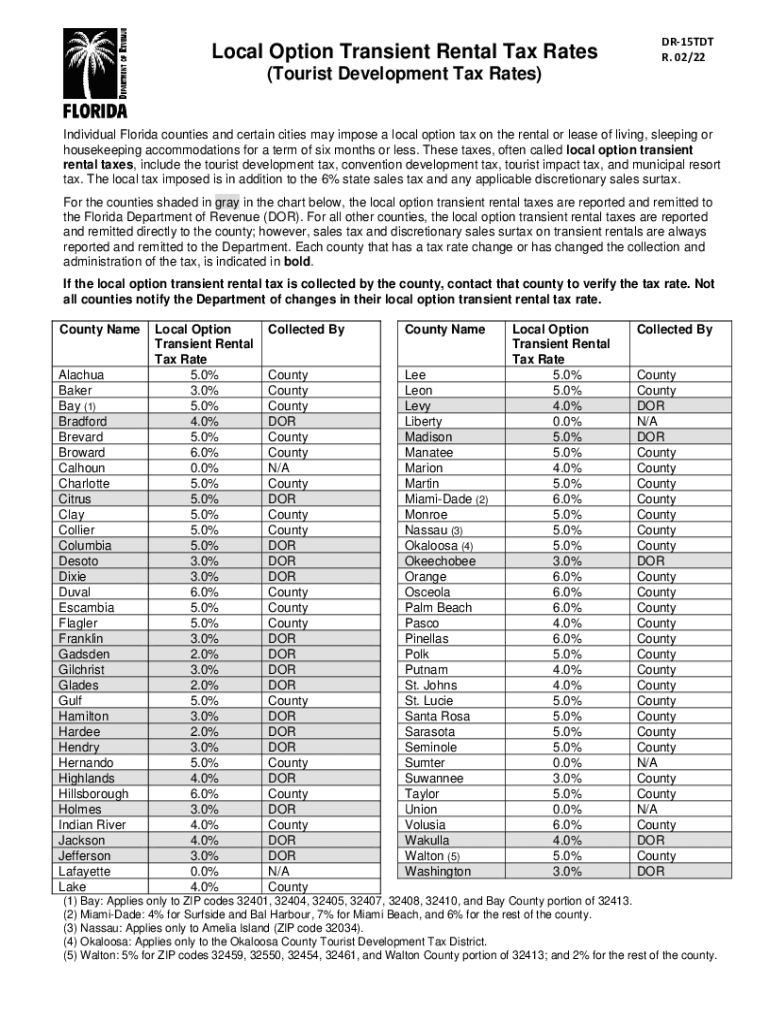

The Florida transient rental tax applies to short-term rentals, including vacation homes, apartments, and other lodging options rented for six months or less. This tax is collected by the state to generate revenue for local governments and is typically charged at a rate of six percent, though local jurisdictions may impose additional taxes, resulting in varying total rates across the state. Property owners and managers must be aware of these tax obligations to ensure compliance and avoid potential penalties.

Key elements of the Florida transient rental tax

When dealing with the Florida transient rental tax, several key elements must be understood:

- Tax Rates: The base state rate is six percent, but local option taxes can increase this rate significantly, depending on the county or municipality.

- Registration: Property owners must register with the Florida Department of Revenue to collect and remit the transient rental tax.

- Filing Frequency: Depending on the amount of tax collected, owners may need to file returns monthly, quarterly, or annually.

- Exemptions: Certain exemptions may apply, such as rentals to government entities or specific non-profit organizations.

Steps to complete the Florida transient rental tax form

Completing the Florida transient rental tax form involves several important steps:

- Gather Information: Collect all necessary information, including rental income, rental periods, and any applicable exemptions.

- Access the Form: Obtain the appropriate form, typically Form DR-15TDT, from the Florida Department of Revenue's website.

- Fill Out the Form: Accurately complete the form with the required details, ensuring all calculations are correct.

- Submit the Form: File the completed form either online, by mail, or in person, depending on your preference and the local regulations.

Filing deadlines and important dates

Staying aware of filing deadlines is crucial for compliance. Generally, the Florida transient rental tax returns are due on the first day of the month following the end of the reporting period. For example, if you collect taxes in January, the return is due by February 1. Late submissions may incur penalties and interest, so it is essential to mark these dates on your calendar.

Penalties for non-compliance

Failure to comply with the Florida transient rental tax regulations can lead to significant penalties. These may include:

- Late Fees: A percentage of the unpaid tax may be charged for each month the tax remains unpaid.

- Interest: Interest accrues on unpaid taxes from the due date until payment is made.

- Legal Action: In severe cases, the state may pursue legal action to collect unpaid taxes, which can result in additional costs.

Legal use of the Florida transient rental tax form

The Florida transient rental tax form is legally binding when completed correctly and submitted on time. To ensure its legality, property owners must adhere to all relevant laws and regulations, including maintaining accurate records of rental transactions and tax payments. Utilizing a reliable electronic signature solution can further enhance the legal standing of the submitted documents, ensuring compliance with eSignature laws.

Quick guide on how to complete get the free fl rental tax rates 2020 form pdffiller

Easily Prepare Get The Fl Rental Tax Rates Form PdfFiller on Any Device

Managing documents online has gained signNow traction among companies and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Get The Fl Rental Tax Rates Form PdfFiller on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The Easiest Method to Alter and eSign Get The Fl Rental Tax Rates Form PdfFiller Effortlessly

- Locate Get The Fl Rental Tax Rates Form PdfFiller and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Get The Fl Rental Tax Rates Form PdfFiller to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free fl rental tax rates 2020 form pdffiller

Create this form in 5 minutes!

How to create an eSignature for the get the free fl rental tax rates 2020 form pdffiller

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the Florida transient rental tax?

The Florida transient rental tax is a tax levied on short-term rentals, typically on properties rented for six months or less. This tax can vary by county and is often collected by property owners or management companies. Understanding this tax is crucial for compliance and ensuring the profitability of your rental business.

-

How can airSlate SignNow help with Florida transient rental tax compliance?

airSlate SignNow simplifies document management by allowing property owners to easily send, sign, and store documents related to Florida transient rental tax compliance. By streamlining contract management and tax-related forms, users can ensure that all necessary paperwork is completed accurately and on time.

-

What features does airSlate SignNow offer for managing rental agreements?

airSlate SignNow offers features like eSigning, customizable templates, and secure storage for rental agreements, making it easier for landlords to manage their properties. These features are particularly helpful for ensuring compliance with Florida transient rental tax regulations, as they allow for quick updates and collaborations on necessary documents.

-

Is airSlate SignNow cost-effective for small property owners in Florida?

Yes, airSlate SignNow provides an affordable solution for small property owners in Florida. With competitive pricing plans, users can manage their rental documents without incurring signNow costs, ensuring they can meet Florida transient rental tax obligations efficiently.

-

Can I integrate airSlate SignNow with other software systems for my rental business?

Absolutely! airSlate SignNow offers integrations with various property management software systems, allowing you to streamline your workflow. This seamless integration enhances your ability to manage documents efficiently, including those related to Florida transient rental tax.

-

What benefits does eSigning provide for Florida rental agreements?

ESigning through airSlate SignNow accelerates the contract signing process, making it more convenient for both property owners and tenants. This is especially beneficial in Florida, where adhering to transient rental tax regulations requires timely execution of rental agreements.

-

Are there any training resources available for using airSlate SignNow?

Yes, airSlate SignNow provides various training resources, including tutorials and webinars, to help users maximize their experience. These resources can guide property owners through managing documents related to Florida transient rental tax effectively and efficiently.

Get more for Get The Fl Rental Tax Rates Form PdfFiller

Find out other Get The Fl Rental Tax Rates Form PdfFiller

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself