Local Option Transient Rental Tax Rates Florida Department 2021

Understanding the Local Option Transient Rental Tax Rates

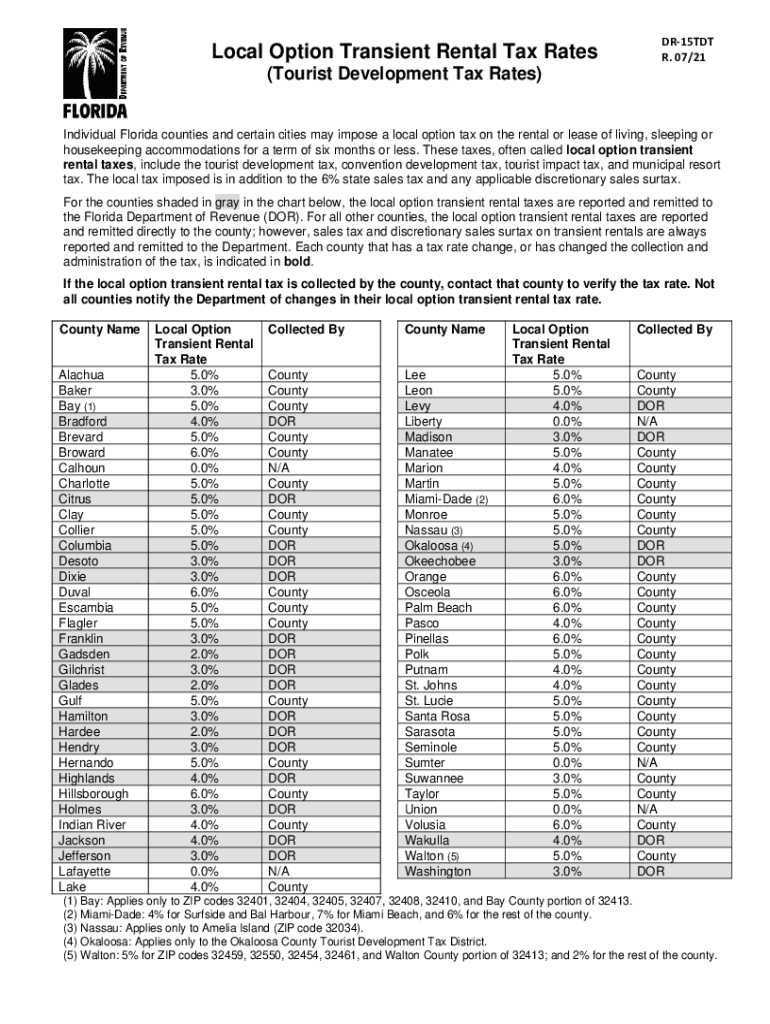

The Local Option Transient Rental Tax Rates in Florida are established by local governments to levy taxes on short-term rentals. These rates can vary significantly across different counties and municipalities. The tax is typically applied to the rental of accommodations for a period of six months or less, making it essential for property owners and managers to be aware of the specific rates applicable in their area. This tax is crucial for funding local services and infrastructure, and understanding it helps ensure compliance with state regulations.

Steps to Complete the Local Option Transient Rental Tax Rates

To successfully complete the Local Option Transient Rental Tax Rates, follow these steps:

- Identify the specific tax rate for your locality, as it can differ from one area to another.

- Gather necessary information about your rental property, including the address and rental duration.

- Calculate the total rental income and apply the local tax rate to determine the tax owed.

- Complete the required forms, ensuring all information is accurate and up to date.

- Submit the completed forms and payment by the designated deadline to avoid penalties.

Required Documents for Filing the Local Option Transient Rental Tax Rates

When filing the Local Option Transient Rental Tax Rates, several documents are required to ensure compliance. These typically include:

- A completed Florida Form DR-15TDT, which details your rental income and applicable tax.

- Proof of rental activity, such as rental agreements or booking confirmations.

- Any additional documentation requested by local tax authorities, which may vary by jurisdiction.

Legal Use of the Local Option Transient Rental Tax Rates

The legal use of the Local Option Transient Rental Tax Rates is governed by Florida state law. Property owners must comply with local regulations regarding the collection and remittance of these taxes. Failure to adhere to these laws can result in penalties, including fines and interest on unpaid taxes. It is essential for property owners to stay informed about changes in legislation and local tax rates to ensure compliance and avoid legal issues.

Filing Deadlines for the Local Option Transient Rental Tax Rates

Filing deadlines for the Local Option Transient Rental Tax Rates vary by locality but generally follow a quarterly schedule. Property owners should be aware of the following typical deadlines:

- First quarter: due by April 30 for rentals from January to March.

- Second quarter: due by July 31 for rentals from April to June.

- Third quarter: due by October 31 for rentals from July to September.

- Fourth quarter: due by January 31 for rentals from October to December.

Penalties for Non-Compliance with the Local Option Transient Rental Tax Rates

Non-compliance with the Local Option Transient Rental Tax Rates can lead to significant penalties. These may include:

- Fines that can accumulate based on the amount of tax owed.

- Interest charges on late payments, which can increase the total amount due.

- Potential legal action from local tax authorities, including liens on property.

Quick guide on how to complete local option transient rental tax rates florida department 577407376

Complete Local Option Transient Rental Tax Rates Florida Department effortlessly across any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents rapidly and without delays. Manage Local Option Transient Rental Tax Rates Florida Department using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and eSign Local Option Transient Rental Tax Rates Florida Department with ease

- Obtain Local Option Transient Rental Tax Rates Florida Department and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Local Option Transient Rental Tax Rates Florida Department while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct local option transient rental tax rates florida department 577407376

Create this form in 5 minutes!

How to create an eSignature for the local option transient rental tax rates florida department 577407376

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the dr 15tdt feature in airSlate SignNow?

The dr 15tdt feature in airSlate SignNow simplifies document management by offering efficient eSigning capabilities. This feature enables users to quickly send, receive, and sign documents electronically, which accelerates workflows and enhances productivity. Businesses can streamline their operations with dr 15tdt, making it easier to manage contracts and agreements.

-

How much does the dr 15tdt solution cost?

airSlate SignNow's pricing for the dr 15tdt solution is designed to be budget-friendly, with various plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual billing options, allowing for flexible budgeting. For detailed pricing information, visit our website to explore all available plans.

-

What features does dr 15tdt offer to enhance document workflows?

The dr 15tdt feature comes with a variety of functionality, including templates, automatic reminders, and customizable signing workflows. These features help to streamline document processing, reduce manual tasks, and minimize errors. By leveraging dr 15tdt, businesses can optimize their document workflows efficiently.

-

Can dr 15tdt integrate with other applications?

Yes, the dr 15tdt feature in airSlate SignNow supports seamless integrations with a wide range of applications such as Google Drive, Dropbox, and CRM platforms. These integrations ensure that your document signing process is interconnected with your existing software, enhancing overall productivity. This capability allows businesses to utilize dr 15tdt within their preferred ecosystem.

-

What are the benefits of using dr 15tdt for eSigning documents?

Using the dr 15tdt feature in airSlate SignNow provides signNow benefits, including faster turnaround times for document signings and improved security through encrypted transactions. Additionally, it helps to reduce paper usage and the costs associated with traditional signing methods. Ultimately, dr 15tdt enables businesses to operate more efficiently.

-

Is the dr 15tdt solution secure for sensitive documents?

Absolutely, airSlate SignNow takes security seriously, and the dr 15tdt feature includes robust security measures such as data encryption, secure cloud storage, and compliance with industry standards. This ensures that your sensitive documents are protected throughout the eSigning process. You can trust dr 15tdt to handle your important documents safely.

-

How can I get support for using dr 15tdt?

Should you need assistance with the dr 15tdt feature, airSlate SignNow offers comprehensive support through various channels. Users can access our support portal, live chat, or email for prompt help with any questions or technical issues. Our dedicated team is ready to ensure that you can make the most of the dr 15tdt solution.

Get more for Local Option Transient Rental Tax Rates Florida Department

Find out other Local Option Transient Rental Tax Rates Florida Department

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney