Florida Sales and Use Tax Florida Dept of Revenue 2020

What is the Florida Sales and Use Tax Florida Dept of Revenue?

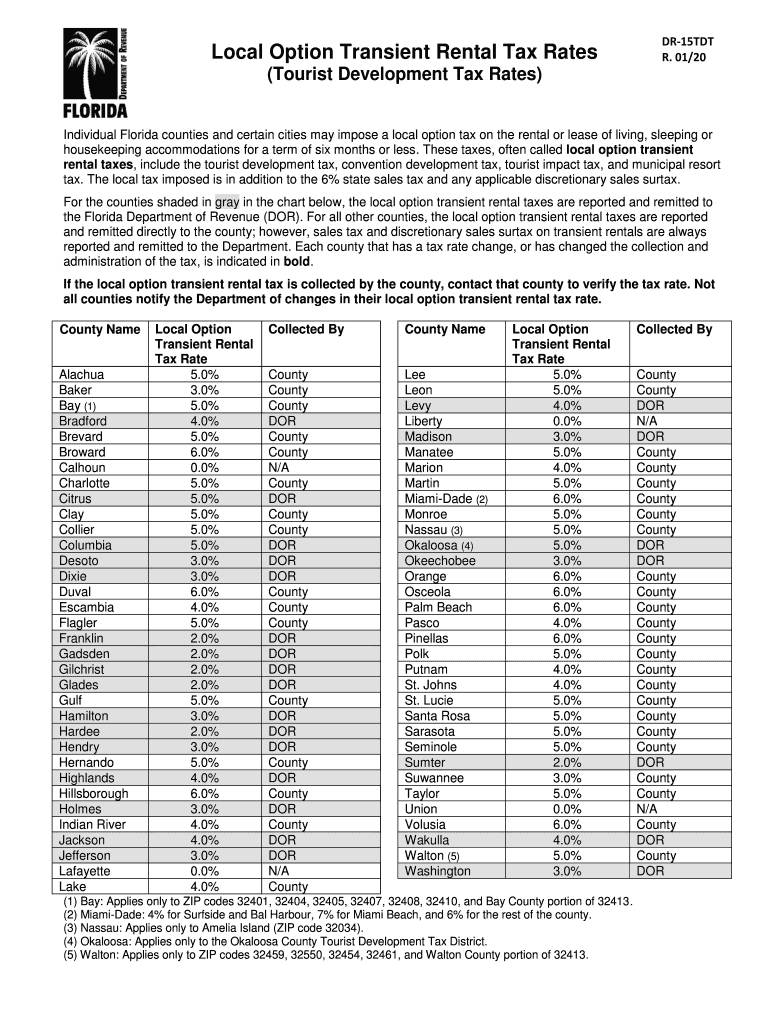

The Florida Sales and Use Tax is a tax imposed on the sale of goods and certain services within the state of Florida. Managed by the Florida Department of Revenue, this tax applies to both in-state and out-of-state sales of tangible personal property, as well as specific services. The tax rate varies depending on the type of goods or services sold, with the general state rate being six percent. Local jurisdictions may impose additional sales taxes, leading to varying total rates across different areas.

How to use the Florida Sales and Use Tax Florida Dept of Revenue

Utilizing the Florida Sales and Use Tax involves understanding the tax obligations for your business or personal purchases. Businesses must register with the Florida Department of Revenue to collect sales tax from customers. When making purchases, consumers should be aware of the tax rate applicable to their transactions. This ensures compliance and accurate reporting during tax filing periods. Businesses can also use the tax to determine their eligibility for exemptions on certain purchases, such as raw materials or items for resale.

Steps to complete the Florida Sales and Use Tax Florida Dept of Revenue

Completing the Florida Sales and Use Tax form involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Determine the applicable sales tax rate based on the location of the sale and the type of goods or services.

- Calculate the total sales tax due by applying the tax rate to the sale amount.

- Complete the Florida Sales and Use Tax form accurately, ensuring all required fields are filled out.

- Submit the form online, by mail, or in person to the Florida Department of Revenue, adhering to the specified deadlines.

Legal use of the Florida Sales and Use Tax Florida Dept of Revenue

The legal use of the Florida Sales and Use Tax form is crucial for ensuring compliance with state tax laws. Proper documentation and accurate reporting are necessary to avoid penalties. Businesses must maintain records of all sales transactions and tax collected. This not only supports compliance but also provides necessary documentation in case of audits. Understanding the legal implications of the sales tax helps businesses operate within the law and fosters trust with customers.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Sales and Use Tax are critical for businesses to avoid late fees and penalties. Generally, businesses must file their sales tax returns monthly or quarterly, depending on their sales volume. The Florida Department of Revenue provides a calendar of important dates, including the due dates for filing and payment. Staying informed about these deadlines ensures timely compliance and helps maintain good standing with tax authorities.

Required Documents

To complete the Florida Sales and Use Tax form, certain documents are required. These typically include:

- Your Florida sales tax registration number.

- Records of sales transactions, including invoices and receipts.

- Documentation supporting any claimed exemptions.

- Previous sales tax returns, if applicable.

Having these documents organized and readily available simplifies the completion of the form and supports accurate reporting.

Quick guide on how to complete florida sales and use tax florida dept of revenue

Complete Florida Sales And Use Tax Florida Dept Of Revenue smoothly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly. Manage Florida Sales And Use Tax Florida Dept Of Revenue on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and electronically sign Florida Sales And Use Tax Florida Dept Of Revenue effortlessly

- Obtain Florida Sales And Use Tax Florida Dept Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Florida Sales And Use Tax Florida Dept Of Revenue and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida sales and use tax florida dept of revenue

Create this form in 5 minutes!

How to create an eSignature for the florida sales and use tax florida dept of revenue

How to create an electronic signature for your Florida Sales And Use Tax Florida Dept Of Revenue online

How to generate an eSignature for the Florida Sales And Use Tax Florida Dept Of Revenue in Chrome

How to generate an eSignature for signing the Florida Sales And Use Tax Florida Dept Of Revenue in Gmail

How to make an electronic signature for the Florida Sales And Use Tax Florida Dept Of Revenue straight from your smart phone

How to generate an electronic signature for the Florida Sales And Use Tax Florida Dept Of Revenue on iOS devices

How to generate an electronic signature for the Florida Sales And Use Tax Florida Dept Of Revenue on Android OS

People also ask

-

What is the Florida Sales And Use Tax handled by the Florida Dept Of Revenue?

The Florida Sales And Use Tax is a tax imposed on the sale of tangible personal property and certain services in Florida. The Florida Dept Of Revenue is responsible for administering this tax, ensuring compliance among businesses operating in the state.

-

How can airSlate SignNow help businesses manage Florida Sales And Use Tax documents?

airSlate SignNow streamlines the process of sending and eSigning documents related to the Florida Sales And Use Tax. With our platform, businesses can quickly prepare necessary tax documentation, allowing for faster compliance and submission to the Florida Dept Of Revenue.

-

Are there costs associated with using airSlate SignNow for Florida Sales And Use Tax documents?

Yes, airSlate SignNow offers a variety of pricing plans designed to fit different business needs. Our cost-effective solution ensures that managing documentation for Florida Sales And Use Tax through the Florida Dept Of Revenue is budget-friendly and efficient.

-

What features does airSlate SignNow offer for handling tax-related documents?

airSlate SignNow includes features like document templates, automated workflows, and advanced eSignature capabilities. These features simplify the management of documents tied to the Florida Sales And Use Tax and enhance your interactions with the Florida Dept Of Revenue.

-

How does using airSlate SignNow improve compliance with the Florida Dept Of Revenue?

By using airSlate SignNow, businesses can ensure that their documents are prepared accurately and signed promptly. This minimizes the risk of errors and helps maintain compliance with the Florida Sales And Use Tax regulations set forth by the Florida Dept Of Revenue.

-

Can airSlate SignNow integrate with accounting software for Florida Sales And Use Tax management?

Yes, airSlate SignNow can seamlessly integrate with various accounting software. This integration supports businesses in efficiently managing the financial aspects of the Florida Sales And Use Tax and facilitates easy reporting to the Florida Dept Of Revenue.

-

Is airSlate SignNow easy to use for new users unfamiliar with Florida Sales And Use Tax?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for those unfamiliar with Florida Sales And Use Tax requirements. Our intuitive interface allows new users to quickly learn how to manage their documentation effectively.

Get more for Florida Sales And Use Tax Florida Dept Of Revenue

- Interim change reporting procedures post lease up form

- New hirerehire employee form royal tire

- Bapplicationb for base fee elec middle district of north bb ncmb uscourts form

- Questionnaire legalshield form

- Legal will questionnaire form

- Mississippi licensing information legalshield

- Patriot federal credit union form

- Application for instructor form

Find out other Florida Sales And Use Tax Florida Dept Of Revenue

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure