Tax Tables PDF 2022

What is the Tax Tables PDF?

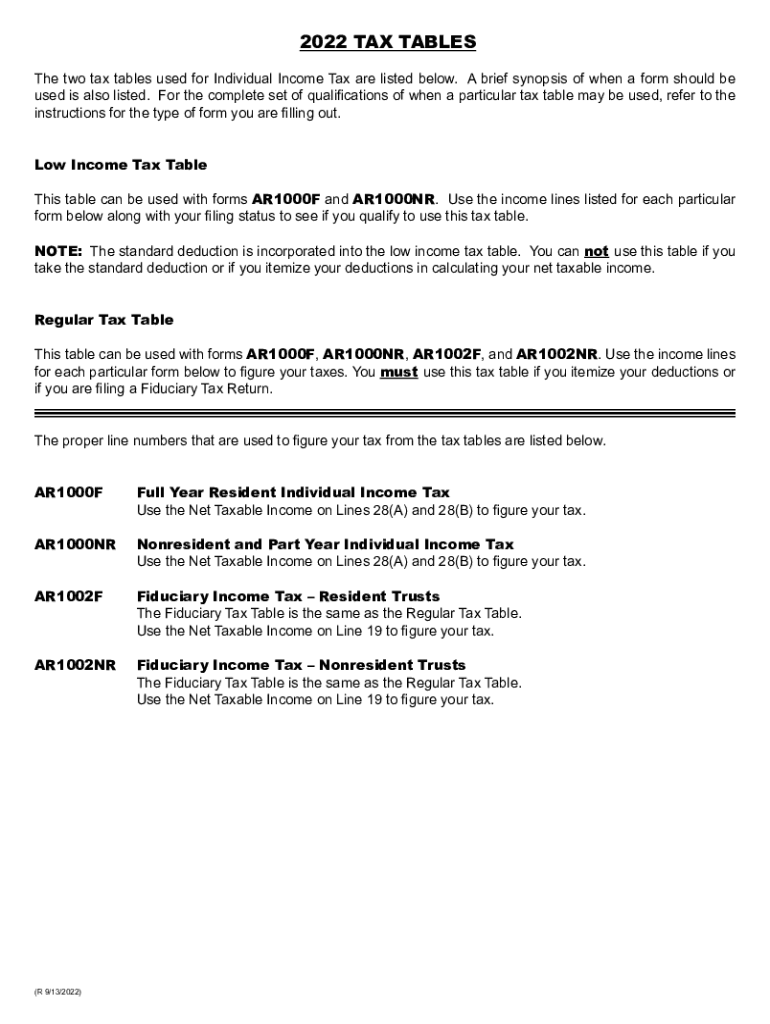

The Tax Tables PDF is a document that provides taxpayers with essential information regarding the tax rates applicable for a specific tax year, in this case, 2016. It includes various income brackets and the corresponding tax rates for individuals and businesses in Arkansas. This document serves as a reference for calculating state income tax obligations based on earned income. The 2016 Arkansas tax tables outline the necessary figures that help taxpayers determine their tax liabilities accurately.

How to Use the Tax Tables PDF

Using the Tax Tables PDF is straightforward. Taxpayers should first locate their taxable income within the provided ranges in the document. Once the appropriate income bracket is identified, taxpayers can refer to the corresponding tax rate. This rate will indicate the percentage of income that must be paid as state tax. It is important to ensure that the correct tables are used based on the tax year to avoid miscalculations.

Steps to Complete the Tax Tables PDF

Completing the Tax Tables PDF involves several steps:

- Gather all necessary financial documents to determine total taxable income.

- Access the 2016 Arkansas tax tables PDF and locate the income section.

- Identify your income bracket based on your total income.

- Find the corresponding tax rate for your income level.

- Calculate the tax owed by applying the tax rate to your taxable income.

Legal Use of the Tax Tables PDF

The Tax Tables PDF is legally recognized as a valid tool for determining tax liabilities in Arkansas. It is essential for taxpayers to use this document in compliance with state tax laws. The information contained within is derived from official state guidelines, making it a reliable resource for ensuring accurate tax reporting and compliance. Utilizing the tax tables correctly helps avoid potential penalties for underreporting income or miscalculating tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 2016 Arkansas tax returns are crucial for compliance. Typically, individual income tax returns must be filed by April 15 of the following year. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments. Staying informed about these dates helps ensure that all tax obligations are met in a timely manner, thus avoiding late fees or penalties.

Required Documents

To accurately complete the 2016 Arkansas tax tables, taxpayers need several key documents:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any additional income sources, such as freelance work.

- Receipts for deductible expenses, if applicable.

- Any other relevant financial documents that reflect income and deductions.

IRS Guidelines

While the Tax Tables PDF is specific to Arkansas, it is important to adhere to IRS guidelines when filing state taxes. The IRS provides overarching rules regarding income reporting, deductions, and credits that may affect state tax calculations. Taxpayers should ensure they are familiar with both state and federal tax regulations to maintain compliance and optimize their tax filings.

Quick guide on how to complete tax tables 2022 pdf

Complete Tax Tables Pdf easily on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow equips you with all the features you need to create, modify, and eSign your documents quickly without delays. Manage Tax Tables Pdf on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Tax Tables Pdf effortlessly

- Find Tax Tables Pdf and then select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Tables Pdf and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax tables 2022 pdf

Create this form in 5 minutes!

How to create an eSignature for the tax tables 2022 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the features of 2016 Arkansas tables?

The 2016 Arkansas tables provide a comprehensive solution for managing your documents. They include features such as electronic signatures, templates, and secure document storage, making it easier for businesses to streamline their processes. By using these tables, you can enhance your workflow and improve efficiency.

-

How can 2016 Arkansas tables benefit my business?

Implementing 2016 Arkansas tables in your organization can signNowly cut down on the time it takes to complete contracts and agreements. They also minimize paper usage, reducing environmental impact while providing a secure platform for signing documents. In addition, the ease of use can increase overall productivity among your team.

-

Are there integrations available with 2016 Arkansas tables?

Yes, 2016 Arkansas tables seamlessly integrate with various third-party applications, enhancing your existing workflows. This includes popular CRMs, document management systems, and collaboration tools. The flexibility of these tables allows for smoother transitions and an improved user experience.

-

What is the pricing structure for using 2016 Arkansas tables?

The pricing for 2016 Arkansas tables is designed to be cost-effective, providing excellent value for small to large businesses. Various tiers are available to cater to different needs, allowing users to choose a plan that fits their specific requirements. Additionally, you can start with a free trial to experience the benefits before committing.

-

Can I customize the 2016 Arkansas tables for my unique business needs?

Absolutely! The 2016 Arkansas tables offer a range of customization options that cater to various business environments. You can personalize templates, workflows, and branding elements, ensuring that the tables align perfectly with your organization’s needs and preferences.

-

What security measures are in place for 2016 Arkansas tables?

Security is a priority with 2016 Arkansas tables. The platform employs advanced encryption and secure cloud storage to protect your documents. You can also benefit from user access controls and audit trails, ensuring that all transactions are secure and compliant with industry standards.

-

Are there any mobile options for using 2016 Arkansas tables?

Yes, 2016 Arkansas tables are accessible on mobile devices, allowing you to manage documents on the go. This mobile functionality provides flexibility and convenience, enabling you to sign and send documents from anywhere. This is particularly beneficial for remote teams and busy professionals.

Get more for Tax Tables Pdf

- Legal last will and testament form for single person with adult and minor children missouri

- Legal last will and testament form for single person with adult children missouri

- Legal last will and testament for married person with minor children from prior marriage missouri form

- Legal last will and testament form for married person with adult children from prior marriage missouri

- Legal last will and testament form for divorced person not remarried with adult children missouri

- Legal last will and testament form for divorced person not remarried with no children missouri

- Legal last will and testament form for divorced person not remarried with minor children missouri

- Legal last will and testament form for divorced person not remarried with adult and minor children missouri

Find out other Tax Tables Pdf

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document