Arkansas Tax Form 2020

What is the Arkansas Tax Form

The Arkansas Tax Form is a document required by the state of Arkansas for individuals and businesses to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and is used to determine the amount of tax owed or the refund due. The form typically includes sections for personal information, income details, deductions, and credits applicable to the taxpayer.

Steps to complete the Arkansas Tax Form

Completing the Arkansas Tax Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim applicable deductions and credits to reduce your taxable income.

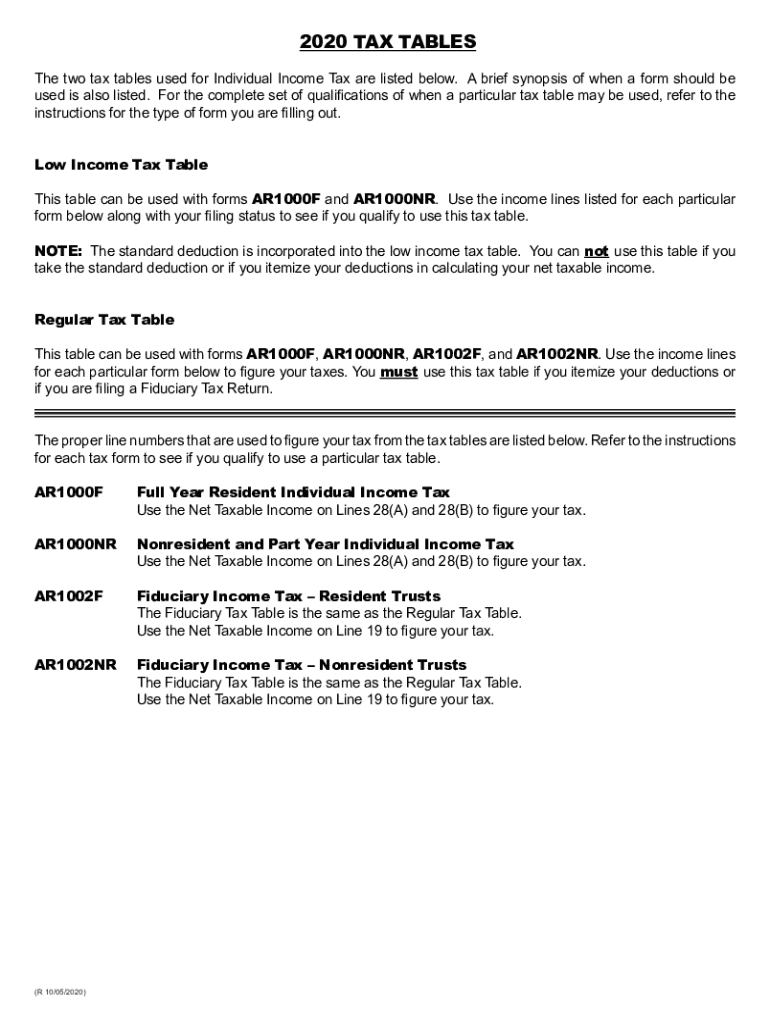

- Calculate your total tax liability using the provided tax tables.

- Sign and date the form to certify its accuracy.

How to obtain the Arkansas Tax Form

The Arkansas Tax Form can be obtained through several methods:

- Visit the official Arkansas Department of Finance and Administration website to download the form.

- Request a physical copy by contacting the local tax office or the state department.

- Access the form through authorized tax preparation software that includes state tax filing options.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Arkansas Tax Form to avoid penalties. Typically, the deadline for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, extensions may be available, but they must be filed before the original deadline.

Legal use of the Arkansas Tax Form

The Arkansas Tax Form is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer to affirm that the information provided is accurate and complete. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the form is valid and can be used for legal purposes.

Required Documents

To complete the Arkansas Tax Form accurately, several documents are required:

- W-2 forms from employers detailing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work performed.

- Records of other income, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Quick guide on how to complete arkansas tax form

Complete Arkansas Tax Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Arkansas Tax Form on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Arkansas Tax Form effortlessly

- Locate Arkansas Tax Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Adjust and eSign Arkansas Tax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas tax form

Create this form in 5 minutes!

How to create an eSignature for the arkansas tax form

The best way to make an e-signature for your PDF file in the online mode

The best way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the process for eSigning documents related to the 2020 Arkansas tax?

To eSign documents related to the 2020 Arkansas tax, simply upload your document to airSlate SignNow, then add the necessary fields for signatures, dates, and other information. Once your document is set up, you can send it to recipients for easy online signing. This process ensures compliance with Arkansas tax regulations while streamlining your workflow.

-

How does airSlate SignNow ensure the security of 2020 Arkansas tax documents?

airSlate SignNow employs state-of-the-art security measures including encryption, secure server protocols, and multi-factor authentication to protect your 2020 Arkansas tax documents. Our platform follows strict compliance with legal and regulatory requirements, ensuring that sensitive information remains confidential.

-

What are the pricing options for using airSlate SignNow for 2020 Arkansas tax filings?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it an economical choice for handling 2020 Arkansas tax filings. You can choose from various monthly or annual subscription models to best meet your business needs, with no hidden fees.

-

Can airSlate SignNow integrate with other tax software for 2020 Arkansas tax?

Yes, airSlate SignNow can easily integrate with various tax software and platforms to streamline your 2020 Arkansas tax process. This integration allows you to seamlessly transfer data, reduce manual entry, and enhance overall productivity when filing your taxes.

-

What features of airSlate SignNow can help with the 2020 Arkansas tax workflow?

airSlate SignNow offers features such as document templates, workflows, and tracking tools that streamline the 2020 Arkansas tax workflow. These functionalities help you create, send, and manage your tax documents efficiently, ensuring timely submissions and reducing errors.

-

Is there a mobile app available for managing 2020 Arkansas tax documents?

Yes, airSlate SignNow has a user-friendly mobile app that allows you to manage your 2020 Arkansas tax documents on the go. With the app, you can eSign documents, send requests, and track progress from anywhere, making it convenient for busy professionals.

-

What are the benefits of using airSlate SignNow for 2020 Arkansas tax?

Using airSlate SignNow for your 2020 Arkansas tax provides numerous benefits, including a quicker signing process, reduced paper usage, and improved document management. These advantages not only save time and resources but also enhance accuracy in your tax submissions.

Get more for Arkansas Tax Form

- District of columbia family form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure district form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497301560 form

- Dc letter landlord form

- Dc tenant form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497301563 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497301564 form

- Dc tenant in form

Find out other Arkansas Tax Form

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy