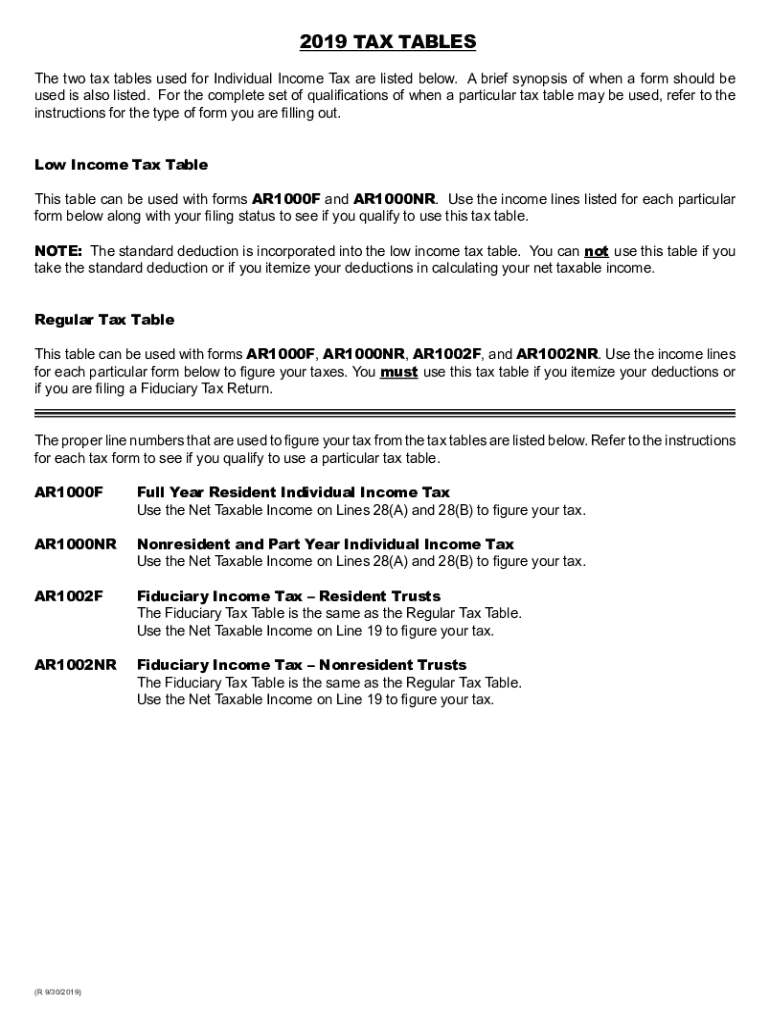

TAX TABLES 2019

What are the 2017 Arkansas tax tables?

The 2017 Arkansas tax tables provide a structured overview of the income tax rates applicable to residents and non-residents of Arkansas for the tax year 2017. These tables are essential for determining the amount of state income tax owed based on taxable income. The tables categorize income into various brackets, each associated with a specific tax rate, allowing taxpayers to calculate their liabilities accurately. Understanding these tables is crucial for anyone filing an Arkansas state tax return for 2017.

How to use the 2017 Arkansas tax tables

Using the 2017 Arkansas tax tables involves several straightforward steps. First, identify your filing status, which may include single, married filing jointly, married filing separately, or head of household. Next, determine your taxable income, which is your gross income minus any deductions or exemptions. Once you have your taxable income, locate the appropriate tax bracket in the tables. The corresponding tax rate will help you calculate the total tax owed. For example, if your taxable income falls within a specific range, apply the rate listed in that range to determine your tax liability.

Steps to complete the 2017 Arkansas tax tables

Completing the 2017 Arkansas tax tables requires careful attention to detail. Start by gathering all necessary financial documents, including W-2s, 1099s, and any records of deductions. Follow these steps:

- Determine your filing status.

- Calculate your total income from all sources.

- Subtract any applicable deductions to find your taxable income.

- Refer to the 2017 Arkansas tax tables to find your tax bracket.

- Multiply your taxable income by the applicable tax rate to calculate your tax owed.

Ensure that all calculations are double-checked for accuracy to avoid any issues during filing.

Legal use of the 2017 Arkansas tax tables

The 2017 Arkansas tax tables are legally recognized tools for calculating state income tax obligations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Arkansas Department of Finance and Administration. The tables must be used in conjunction with the appropriate tax forms, such as the 2017 Arkansas state tax form. Proper use of these tables helps avoid penalties for underreporting income or miscalculating tax liabilities.

Filing deadlines for the 2017 Arkansas tax tables

Filing deadlines are crucial for tax compliance. For the 2017 tax year, the deadline for submitting your Arkansas state tax return was April 15, 2018. If you filed for an extension, the extended deadline would typically be October 15, 2018. It is important to be aware of these dates to avoid late fees or penalties. Taxpayers should also keep in mind that any taxes owed must be paid by the original filing deadline to prevent interest and penalties from accruing.

Required documents for using the 2017 Arkansas tax tables

To effectively use the 2017 Arkansas tax tables, several documents are necessary. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any deductions, such as mortgage interest or charitable contributions.

- Previous year’s tax return for reference.

Gathering these documents ahead of time can streamline the process of filing your state tax return and ensure that you accurately use the tax tables.

Quick guide on how to complete 2019 tax tables

Effortlessly Prepare TAX TABLES on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage TAX TABLES on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign TAX TABLES with ease

- Obtain TAX TABLES and click on Get Form to begin.

- Utilize the provided tools to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically designed for those purposes by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your chosen device. Edit and eSign TAX TABLES to ensure excellent communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 tax tables

Create this form in 5 minutes!

How to create an eSignature for the 2019 tax tables

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are 2017 Arkansas tables and how do they benefit my business?

2017 Arkansas tables are structured data tables used in various business applications to streamline processes. By leveraging these tables, businesses can effectively manage their documents and data, leading to improved efficiency and reduced errors. Utilizing the 2017 Arkansas tables can enhance your workflow signNowly.

-

How can airSlate SignNow help with managing 2017 Arkansas tables?

AirSlate SignNow offers robust features that allow users to easily integrate and manage 2017 Arkansas tables within their document workflows. You can send, eSign, and store these tables securely, making it easy to collaborate with your team. This streamlines the entire document management process.

-

Are there any costs associated with using airSlate SignNow for 2017 Arkansas tables?

Yes, airSlate SignNow provides various pricing tiers to cater to different business needs when using 2017 Arkansas tables. The platform is designed to be cost-effective, enabling businesses of all sizes to efficiently manage their documents while remaining within budget. For detailed pricing information, visit our website.

-

What features does airSlate SignNow offer for 2017 Arkansas tables?

AirSlate SignNow offers a range of features specifically designed for effectively managing 2017 Arkansas tables. This includes eSignature integration, real-time collaboration, and secure document storage. These features make it easy for businesses to enhance their operations using 2017 Arkansas tables.

-

Can I integrate airSlate SignNow with other software when using 2017 Arkansas tables?

Absolutely! AirSlate SignNow seamlessly integrates with numerous applications, allowing you to connect your existing software to manage 2017 Arkansas tables effectively. This ensures that you can maintain your current workflows while benefiting from the powerful tools offered by airSlate SignNow.

-

What are the benefits of using airSlate SignNow for 2017 Arkansas tables?

Utilizing airSlate SignNow for 2017 Arkansas tables offers numerous advantages, including increased efficiency, reduced paperwork, and simplified document handling. These benefits translate into time savings and improved accuracy for your business. By adopting airSlate SignNow, you can better manage your 2017 Arkansas tables effortlessly.

-

Is training available for using airSlate SignNow with 2017 Arkansas tables?

Yes, airSlate SignNow provides comprehensive training resources and support for users looking to manage 2017 Arkansas tables effectively. Whether through online tutorials, webinars, or dedicated customer support, we ensure users have the guidance needed to maximize their experience with our platform.

Get more for TAX TABLES

- Sample letter reference college scholarship form

- Letter continuance form

- Notice exercise option form

- Employee dating form

- Acknowledgment of modified terms 497331915 form

- Acknowledgment of obligations with regard to personally identifiable information

- Agreement obligations form

- Lost stock certificate form

Find out other TAX TABLES

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself