Tables 2017

What are the 2017 tables?

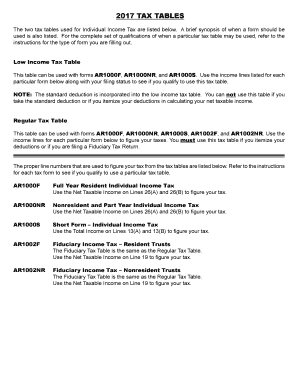

The 2017 tables refer to the tax tables used for calculating income tax liabilities for the tax year 2017 in the United States. These tables provide a structured format that helps taxpayers determine their tax obligations based on their income levels. The tables include various tax brackets, which categorize income ranges and their corresponding tax rates. Understanding these tables is essential for accurately completing the 2017 Arkansas tax form and ensuring compliance with state tax regulations.

How to use the 2017 tables

To effectively use the 2017 tables, taxpayers should first identify their filing status, such as single, married filing jointly, or head of household. Once the appropriate filing status is determined, taxpayers can locate their income level within the tables. By following the corresponding tax bracket, they can calculate their tax liability. It is important to consider any deductions or credits that may apply, as these can significantly affect the final tax amount owed.

Steps to complete the 2017 Arkansas tax form

Completing the 2017 Arkansas tax form involves several key steps:

- Gather all necessary documents, including W-2s and 1099s.

- Determine your filing status and total income.

- Refer to the 2017 tables to find your applicable tax rate.

- Calculate your taxable income by applying any deductions.

- Complete the tax form, ensuring all information is accurate.

- Review the form for any errors before submission.

Legal use of the 2017 tables

The 2017 tables are legally recognized tools for calculating tax liabilities in accordance with U.S. tax law. They must be used in compliance with the Internal Revenue Service (IRS) guidelines to ensure that taxpayers fulfill their legal obligations. Using these tables accurately helps avoid potential penalties and ensures that all tax calculations are legitimate and defensible in case of an audit.

Key elements of the 2017 tables

Key elements of the 2017 tables include:

- Tax brackets: These define the income ranges and corresponding tax rates.

- Filing statuses: Different rates apply depending on whether the taxpayer is single, married, or head of household.

- Deductions: Standard and itemized deductions can reduce taxable income.

- Credits: Tax credits can directly reduce the amount of tax owed.

Filing deadlines for the 2017 Arkansas tax form

Taxpayers must be aware of key filing deadlines to avoid penalties. The deadline for submitting the 2017 Arkansas tax form typically aligns with the federal tax deadline, which is usually April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule that may affect submission timelines.

Quick guide on how to complete 2014 arkansas tax 2017 form

Complete Tables effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Manage Tables across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to amend and eSign Tables with ease

- Obtain Tables and then click Get Form to begin.

- Use the resources we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Tables to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 arkansas tax 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 arkansas tax 2017 form

How to make an eSignature for your 2014 Arkansas Tax 2017 Form online

How to generate an eSignature for your 2014 Arkansas Tax 2017 Form in Google Chrome

How to generate an electronic signature for putting it on the 2014 Arkansas Tax 2017 Form in Gmail

How to generate an eSignature for the 2014 Arkansas Tax 2017 Form right from your smart phone

How to generate an electronic signature for the 2014 Arkansas Tax 2017 Form on iOS

How to make an eSignature for the 2014 Arkansas Tax 2017 Form on Android

People also ask

-

What are the key features of the 2017 tables in airSlate SignNow?

The 2017 tables in airSlate SignNow include advanced eSignature capabilities, customizable templates, and seamless workflow automation. These features are designed to enhance user productivity and ensure efficient document management, making your signing process smooth and reliable.

-

How does pricing work for the 2017 tables offered by airSlate SignNow?

airSlate SignNow offers competitive pricing plans for the 2017 tables, catering to various business needs and sizes. Each plan provides access to essential features, along with options for additional functionalities, ensuring you get the best value for your investment in eSigning solutions.

-

Can I integrate the 2017 tables with existing applications?

Yes, the 2017 tables in airSlate SignNow can be seamlessly integrated with various applications such as CRM systems, cloud storage services, and collaboration tools. This integration capability enhances your workflow, allowing you to manage documents more efficiently across different platforms.

-

What are the benefits of using the 2017 tables for document signing?

Using the 2017 tables in airSlate SignNow offers numerous benefits, including faster turnaround times for document approval and improved security for sensitive information. Additionally, the user-friendly interface ensures that any team member can quickly adapt to the eSigning process, further streamlining business operations.

-

Are there any security features associated with the 2017 tables?

Absolutely! The 2017 tables in airSlate SignNow incorporate robust security measures such as encryption, secure access controls, and compliance with industry standards. These features protect your documents and signatures, ensuring that your sensitive information remains confidential throughout the signing process.

-

How can I get support for the 2017 tables?

airSlate SignNow provides comprehensive support for the 2017 tables, including online resources such as FAQs, video tutorials, and personalized customer service. Whether you need help getting started or have specific questions, our support team is here to assist you every step of the way.

-

Can the 2017 tables be accessed on mobile devices?

Yes, the 2017 tables in airSlate SignNow are fully accessible on mobile devices, allowing you to send and eSign documents on the go. This mobile compatibility ensures that you can manage your document workflows anytime, anywhere, increasing your flexibility and productivity.

Get more for Tables

Find out other Tables

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple