Arizona Instructions Tax Form 2018

What is the Arizona Instructions Tax Form

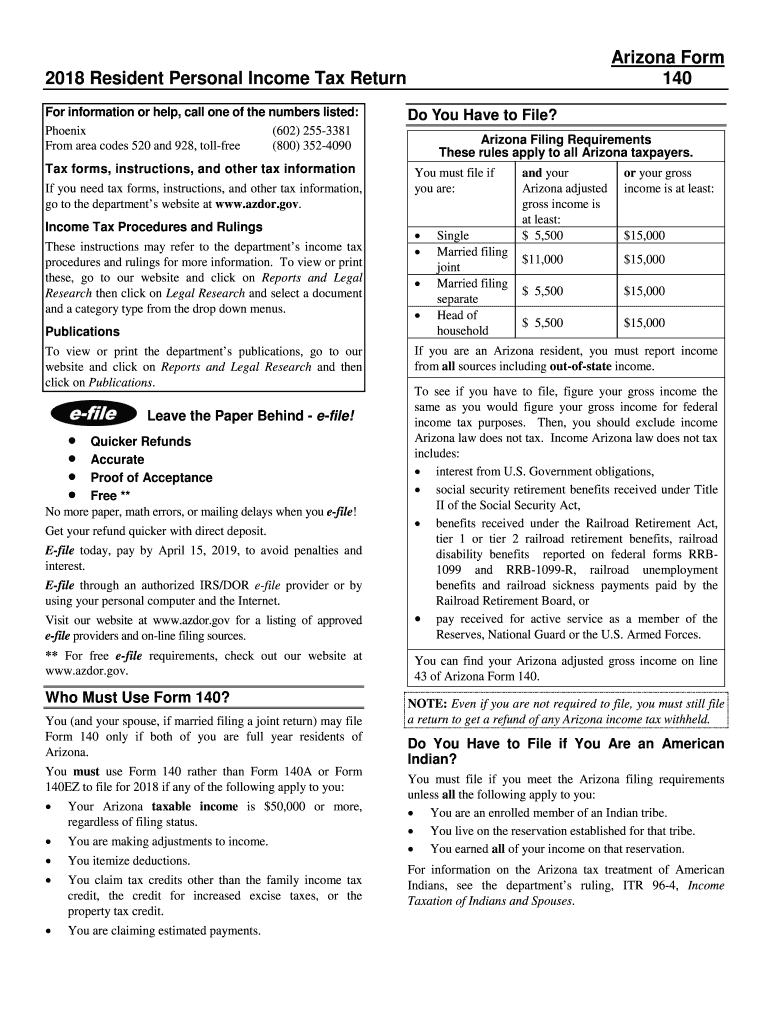

The Arizona Instructions Tax Form provides essential guidance for individuals and businesses filing their state income tax returns. This form outlines the necessary steps to complete the Arizona income tax forms accurately, ensuring compliance with state tax regulations. It includes detailed explanations of various sections of the tax forms, including income reporting, deductions, and credits available to taxpayers.

Steps to complete the Arizona Instructions Tax Form

Completing the Arizona Instructions Tax Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand what information is required for each section of the form.

- Fill out the form accurately, providing all requested information, including personal details and income sources.

- Double-check your entries for accuracy to avoid errors that could lead to delays or penalties.

- Submit the completed form according to the specified submission methods, either online or via mail.

Legal use of the Arizona Instructions Tax Form

The Arizona Instructions Tax Form is legally binding when completed and submitted according to state regulations. It is crucial to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing a reliable electronic signature tool can enhance the legal standing of your submission, ensuring compliance with eSignature laws.

Required Documents

When completing the Arizona Instructions Tax Form, certain documents are required to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Documentation for any tax credits claimed

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Arizona Instructions Tax Form to avoid penalties. Typically, the deadline for filing state income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions that may apply to their specific situations.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Instructions Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Arizona Department of Revenue website

- Mailing a paper form to the appropriate address

- In-person submission at designated state tax offices

Key elements of the Arizona Instructions Tax Form

The Arizona Instructions Tax Form includes several key elements that are crucial for accurate completion. These elements typically consist of:

- Personal identification information

- Income details, including wages, interest, and dividends

- Deductions and credits applicable to the taxpayer

- Signature lines for verification of information

Quick guide on how to complete arizona instructions tax form

Complete Arizona Instructions Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a sustainable alternative to traditional printed and signed papers, enabling you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Arizona Instructions Tax Form on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Arizona Instructions Tax Form effortlessly

- Locate Arizona Instructions Tax Form and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Alter and eSign Arizona Instructions Tax Form and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona instructions tax form

Create this form in 5 minutes!

How to create an eSignature for the arizona instructions tax form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What are AZ income tax forms and instructions?

AZ income tax forms and instructions are necessary documents required by the Arizona Department of Revenue for filing state taxes. These forms guide taxpayers on how to correctly report their income, claim deductions, and determine their tax liability. Utilizing airSlate SignNow, you can easily access and complete these forms online.

-

How can airSlate SignNow help with AZ income tax forms and instructions?

airSlate SignNow simplifies the process of filling out AZ income tax forms and instructions by providing a user-friendly electronic signing platform. You can quickly upload, sign, and send tax documents without the hassle of printing and mailing. This not only saves time but also ensures compliance with state regulations.

-

Are there any costs associated with using airSlate SignNow for AZ income tax forms and instructions?

Yes, while airSlate SignNow offers a cost-effective solution for managing AZ income tax forms and instructions, there are subscription plans to choose from. These plans are designed to fit various business needs, whether you're an individual taxpayer or a larger organization. Check our pricing page for more details on subscription options.

-

What features does airSlate SignNow offer for AZ income tax forms and instructions?

airSlate SignNow offers various features to enhance your experience with AZ income tax forms and instructions. These include customizable templates, real-time collaboration, secure storage, and advanced tracking options. With these features, completing and managing your tax documents becomes much more efficient.

-

Can I integrate airSlate SignNow with other software for AZ income tax forms and instructions?

Absolutely! airSlate SignNow provides seamless integrations with various platforms, allowing you to streamline your process for AZ income tax forms and instructions. Whether you use CRM systems, document management software, or financial tools, our integrations enhance your workflow and improve productivity.

-

Is it easy to access AZ income tax forms and instructions using airSlate SignNow?

Yes, accessing AZ income tax forms and instructions with airSlate SignNow is straightforward. Once you create an account, you can easily search for and download the forms you need. Our platform is designed to make your tax preparation process as simple and accessible as possible.

-

What benefits does airSlate SignNow offer for preparing AZ income tax forms and instructions?

Using airSlate SignNow for your AZ income tax forms and instructions offers several benefits, such as increased efficiency, reduced paperwork, and enhanced security. You can complete your forms faster and ensure they are signed and submitted securely. This ultimately allows for a stress-free tax season.

Get more for Arizona Instructions Tax Form

- Job safety analysis example form

- Birds job application form

- Mat 1 form

- Snap benefits application pdf form

- Bank guarantee renewal request letter format word

- Printable information sheet

- List of questions asked by daca form i 821d 1docx

- The body project script peer leader universal 2 session version bodyprojectsupport form

Find out other Arizona Instructions Tax Form

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple