Resident Personal Income Tax Return 2020

What is the Resident Personal Income Tax Return

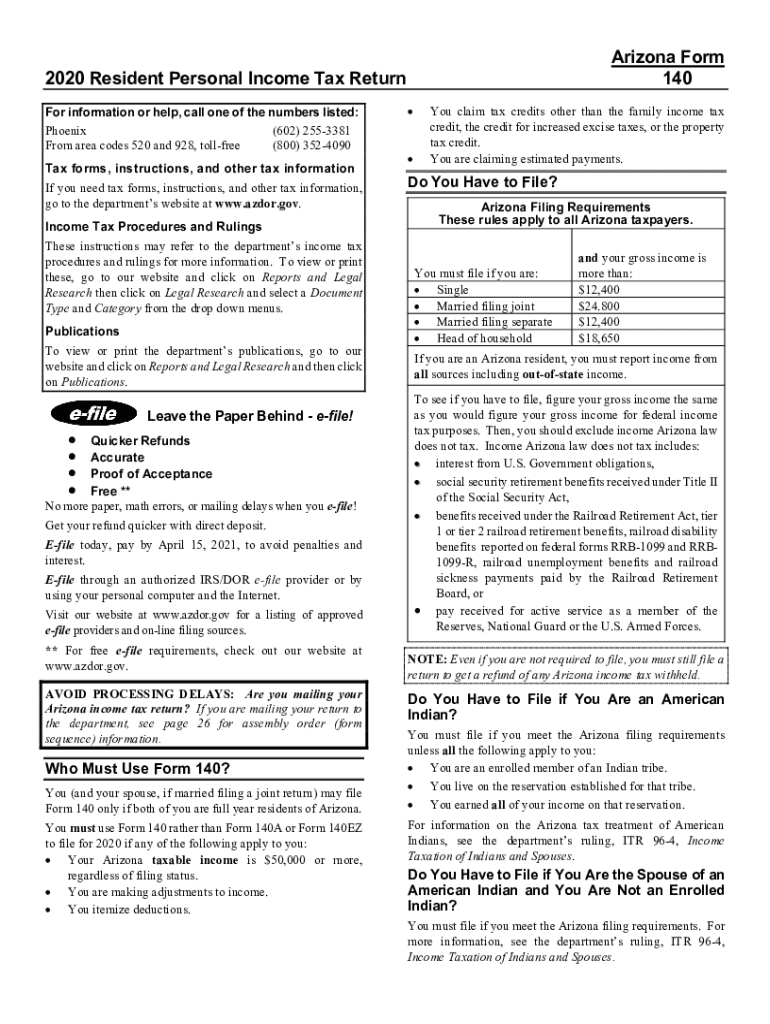

The Resident Personal Income Tax Return, commonly referred to as the 2020 Arizona 140 instructions form, is a crucial document for individuals residing in Arizona who need to report their income to the state. This form is essential for calculating the amount of state tax owed based on the taxpayer's income, deductions, and credits. It is designed to ensure compliance with Arizona tax laws and to facilitate the accurate assessment of state income tax obligations.

Steps to complete the Resident Personal Income Tax Return

Completing the 2020 Arizona 140 instructions form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Determine your filing status (e.g., single, married filing jointly).

- Calculate your total income by adding all sources of income reported on your documents.

- Identify applicable deductions and credits that you may qualify for, which can reduce your taxable income.

- Fill out the 2020 Arizona 140 instructions form accurately, ensuring all information is complete.

- Review your form for accuracy and completeness before submission.

- Submit the form either electronically or by mail, following the guidelines provided.

Legal use of the Resident Personal Income Tax Return

The 2020 Arizona 140 instructions form is legally recognized as a valid document for reporting income to the state. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. Electronic signatures are acceptable under U.S. law, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. This legal framework ensures that electronically signed documents hold the same weight as traditional handwritten signatures.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for taxpayers. For the 2020 tax year, the typical deadline for submitting the Resident Personal Income Tax Return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as extensions granted by the state or federal government.

Required Documents

To accurately complete the 2020 Arizona 140 instructions form, taxpayers must gather several essential documents:

- W-2 forms from employers reporting wages and salary.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or receipts for charitable contributions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the 2020 Arizona 140 instructions form. The form can be filed electronically through the Arizona Department of Revenue's online portal, which often provides a faster processing time. Alternatively, taxpayers may choose to print the form and submit it by mail to the appropriate address. In-person submissions are also possible at designated tax offices, although this method is less common. Each submission method has its own set of guidelines and processing times, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete 2020 resident personal income tax return

Complete Resident Personal Income Tax Return effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the needed form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without any holdups. Handle Resident Personal Income Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Resident Personal Income Tax Return with ease

- Obtain Resident Personal Income Tax Return and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Alter and eSign Resident Personal Income Tax Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 resident personal income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 resident personal income tax return

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the 2020 Arizona instructions form printable used for?

The 2020 Arizona instructions form printable is designed to guide taxpayers in completing their Arizona tax forms accurately. It provides step-by-step instructions necessary for ensuring compliance with state tax regulations. Utilizing this printable form can simplify the filing process and help avoid common mistakes.

-

How can I obtain the 2020 Arizona instructions form printable?

You can easily obtain the 2020 Arizona instructions form printable by visiting the Arizona Department of Revenue website or through authorized online tax preparation services. Additionally, airSlate SignNow offers features that allow users to access and eSign these documents conveniently. This ensures a seamless process for those who need to file their taxes on time.

-

Is the 2020 Arizona instructions form printable available in multiple formats?

Yes, the 2020 Arizona instructions form printable is available in various formats including PDF and Word. This flexibility allows users to choose the format that best fits their workflow, whether for printing or electronic use. airSlate SignNow also supports multiple file formats, enhancing accessibility for users.

-

Are there any costs associated with using the 2020 Arizona instructions form printable?

The 2020 Arizona instructions form printable itself is typically free to obtain from official sources. However, if you choose to use additional services such as those provided by airSlate SignNow for eSigning or document management, there may be associated costs. It is advisable to review pricing plans based on your needs.

-

Can I fill out the 2020 Arizona instructions form printable electronically?

Absolutely! With airSlate SignNow, you can fill out the 2020 Arizona instructions form printable electronically and eSign it right from your device. This feature streamlines the process and saves time, making tax filing more efficient and organized. You don’t need to print unless you want a physical copy.

-

What are the benefits of using airSlate SignNow for the 2020 Arizona instructions form printable?

Using airSlate SignNow for the 2020 Arizona instructions form printable enhances efficiency through easy eSigning and document management capabilities. The solution is cost-effective and user-friendly, enabling quicker turnaround times for important tax documents. Additionally, it ensures that your documents are securely stored and easily retrievable.

-

Can I integrate the 2020 Arizona instructions form printable with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, making it easy to manage the 2020 Arizona instructions form printable alongside other tools you may use. This flexibility helps streamline your workflow and improve productivity by keeping everything in one accessible location.

Get more for Resident Personal Income Tax Return

- Chapter test form a answers

- University of papua new guinea application form

- Hsmv 77096 1048382 form

- Maine dot driveway permit form

- Duty resumption form 477204229

- International marketing test bank pdf form

- Form i 929 petition for qualifying familymember of a u 1 nonimmigrant 518861377

- 62a500p personal property tax forms and instructions excel

Find out other Resident Personal Income Tax Return

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF