Arizona Form 322

What is the Arizona Form 322

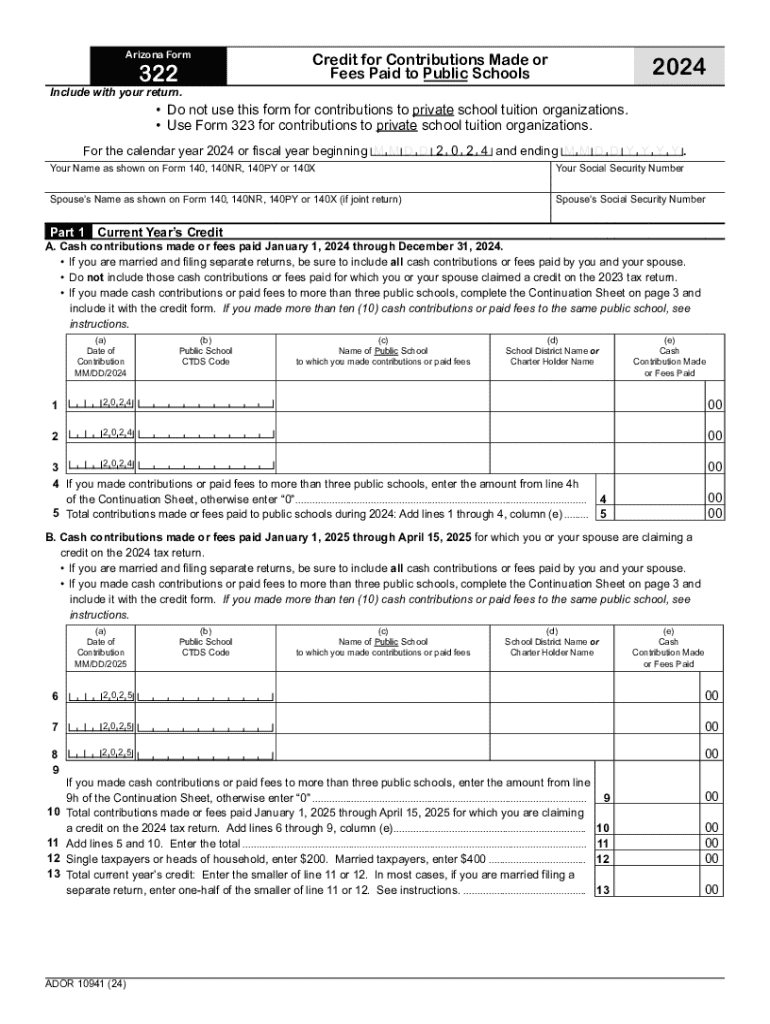

The Arizona Form 322 is a state-specific tax form used primarily for reporting various tax credits and deductions available to taxpayers in Arizona. This form is essential for individuals and businesses seeking to claim tax benefits related to specific activities or expenditures. Understanding the purpose and function of this form is crucial for accurate tax reporting and compliance with state regulations.

How to use the Arizona Form 322

Using the Arizona Form 322 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary information and documentation related to the credits they intend to claim. This may include receipts, identification numbers, and prior tax returns. Once the form is filled out, it can be submitted electronically or via mail, depending on the taxpayer's preference and the specific instructions provided for the form.

Steps to complete the Arizona Form 322

Completing the Arizona Form 322 requires careful attention to detail. Here are the key steps:

- Begin by downloading the latest version of the form from the Arizona Department of Revenue website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Identify and list the specific tax credits you are claiming, ensuring you meet all eligibility criteria for each credit.

- Provide any required documentation to support your claims, such as proof of expenses or eligibility.

- Review the completed form for accuracy before submission.

Legal use of the Arizona Form 322

The Arizona Form 322 must be used in accordance with state tax laws and regulations. It is legally binding, and any false information or misrepresentation can lead to penalties. Taxpayers should ensure they are familiar with the legal requirements surrounding the form, including eligibility criteria for the credits they are claiming. Consulting a tax professional may be beneficial for those unsure about the legal implications of their claims.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 322 align with the general tax filing deadlines established by the Arizona Department of Revenue. Typically, individual taxpayers must submit their forms by April fifteenth of each year, while businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates to avoid late penalties.

Form Submission Methods

The Arizona Form 322 can be submitted through various methods, including:

- Online submission via the Arizona Department of Revenue's e-filing system, which is often the fastest and most efficient method.

- Mailing a paper copy of the form to the appropriate address specified in the form instructions.

- In-person submission at designated tax offices, which may be beneficial for those needing assistance or clarification on their filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 322 771921264

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 322 and how is it used?

The Arizona Form 322 is a document used for specific legal and administrative purposes in the state of Arizona. It is essential for businesses and individuals who need to comply with state regulations. Using airSlate SignNow, you can easily fill out and eSign the Arizona Form 322, streamlining your document management process.

-

How can airSlate SignNow help with the Arizona Form 322?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign the Arizona Form 322 efficiently. With its intuitive interface, you can ensure that all necessary fields are completed accurately. This not only saves time but also reduces the risk of errors in your documentation.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 322?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary based on features and usage, allowing you to choose the best option for your needs. Investing in airSlate SignNow can ultimately save you time and resources when handling the Arizona Form 322.

-

What features does airSlate SignNow offer for managing the Arizona Form 322?

airSlate SignNow offers a range of features for managing the Arizona Form 322, including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance your workflow and ensure that your documents are processed efficiently. Additionally, you can integrate with other tools to further streamline your operations.

-

Can I integrate airSlate SignNow with other applications for the Arizona Form 322?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to connect your workflow seamlessly. Whether you use CRM systems, cloud storage, or other document management tools, you can easily incorporate the Arizona Form 322 into your existing processes. This integration enhances productivity and simplifies document handling.

-

What are the benefits of using airSlate SignNow for the Arizona Form 322?

Using airSlate SignNow for the Arizona Form 322 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can signNowly speed up your processes. Additionally, you can maintain compliance with state regulations while ensuring your documents are securely stored.

-

Is airSlate SignNow secure for handling the Arizona Form 322?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Arizona Form 322. The platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently manage your documents, knowing that they are secure and compliant with legal standards.

Get more for Arizona Form 322

- For undeclared students applying for first major only form

- In compliance with the family educational rights and privacy act ferpa of 1974 as amended the university form

- Financial aid document submission cover sheet form

- Welcome to civilian employment civilian human resources form

- Standard affiliation agreement template updated april 8 2020 form

- Major form

- Cba internship learning agreement form

- Low income verification form

Find out other Arizona Form 322

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney