Company Tax Return CT600 Version 3 a Return Includes a Company Tax Return Form, Any Supplementary Pages, Accounts, Computations 2024-2026

Understanding the Company Tax Return CT600 Version 3 A

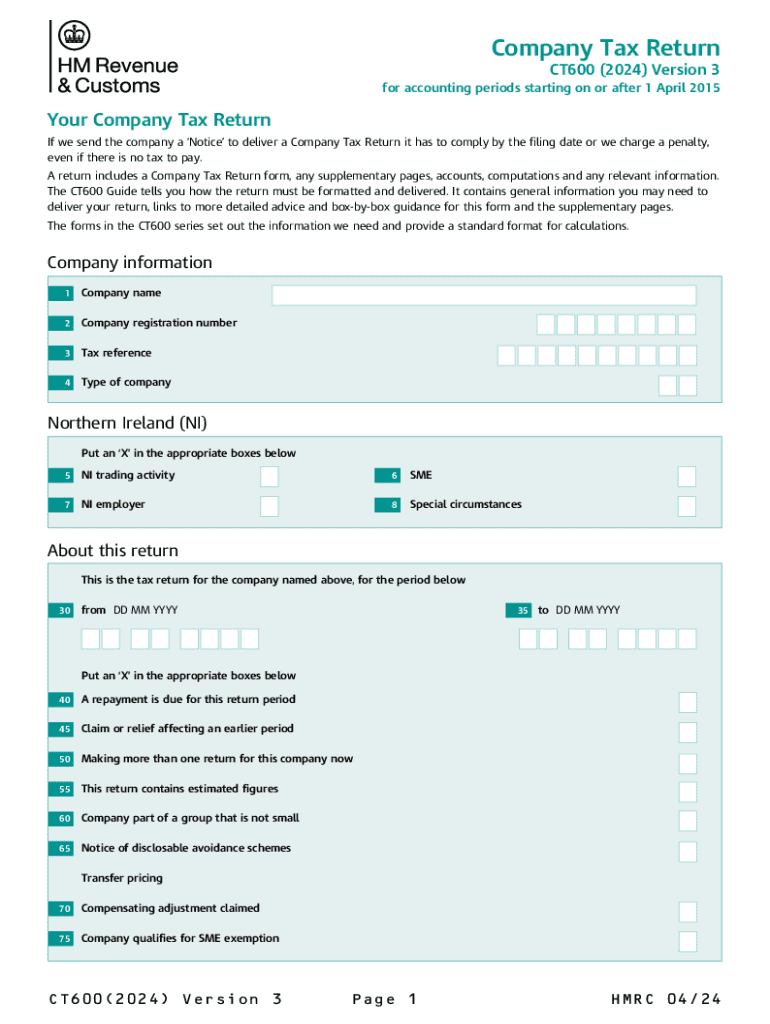

The Company Tax Return CT600 Version 3 A is a comprehensive document required by businesses in the United Kingdom for reporting their corporation tax liabilities. This form includes the main tax return form, any supplementary pages, financial accounts, computations, and other relevant information necessary for the tax assessment process. It is essential for companies to accurately complete this return to ensure compliance with tax regulations and to avoid potential penalties.

Steps to Complete the Company Tax Return CT600 Version 3 A

Completing the Company Tax Return CT600 Version 3 A involves several key steps:

- Gather all necessary financial records, including profit and loss statements, balance sheets, and any relevant supplementary pages.

- Fill out the main CT600 form, ensuring all sections are completed accurately, including company details and financial figures.

- Complete any required supplementary pages that pertain to specific tax reliefs or adjustments.

- Prepare the financial accounts and computations that support the figures reported in the return.

- Review the entire submission for accuracy and completeness before finalizing.

Legal Use of the Company Tax Return CT600 Version 3 A

The Company Tax Return CT600 Version 3 A serves a critical legal function for businesses in the UK. It is a formal declaration of a company’s income and expenses, which is used by the HM Revenue and Customs (HMRC) to calculate the corporation tax owed. Filing this return is not only a legal requirement but also a reflection of a company’s financial integrity. Failure to submit the CT600 can lead to legal repercussions, including fines and penalties.

Required Documents for Filing the Company Tax Return CT600 Version 3 A

To successfully file the Company Tax Return CT600 Version 3 A, certain documents are necessary:

- Financial accounts for the relevant accounting period.

- Detailed profit and loss statements.

- Balance sheets that reflect the company’s financial position.

- Any supplementary pages required for specific tax reliefs or adjustments.

- Computations that detail how the tax liability was calculated.

Filing Deadlines for the Company Tax Return CT600 Version 3 A

Timely submission of the Company Tax Return CT600 Version 3 A is crucial. The deadline for filing this return is typically twelve months after the end of the accounting period. Companies must ensure that their returns are submitted by this deadline to avoid penalties. Additionally, any tax owed must be paid within nine months of the end of the accounting period to prevent interest charges.

Form Submission Methods for the Company Tax Return CT600 Version 3 A

The Company Tax Return CT600 Version 3 A can be submitted through various methods:

- Online submission via the HMRC portal, which is the preferred method for many businesses.

- Paper submission by mailing the completed form to HMRC, though this method may take longer to process.

- In-person submission at designated HMRC offices, although this is less common.

Handy tips for filling out Company Tax Return CT600 Version 3 A Return Includes A Company Tax Return Form, Any Supplementary Pages, Accounts, Computations online

Quick steps to complete and e-sign Company Tax Return CT600 Version 3 A Return Includes A Company Tax Return Form, Any Supplementary Pages, Accounts, Computations online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant platform for maximum simplicity. Use signNow to electronically sign and share Company Tax Return CT600 Version 3 A Return Includes A Company Tax Return Form, Any Supplementary Pages, Accounts, Computations for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct company tax return ct600 version 3 a return includes a company tax return form any supplementary pages accounts computations

Create this form in 5 minutes!

How to create an eSignature for the company tax return ct600 version 3 a return includes a company tax return form any supplementary pages accounts computations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the Company Tax Return CT600 Version 3?

The Company Tax Return CT600 Version 3 includes a Company Tax Return Form, any supplementary pages, accounts, computations, and any relevant information necessary for filing. This comprehensive package ensures that all required documentation is submitted accurately and efficiently.

-

How can airSlate SignNow help with the Company Tax Return CT600 Version 3?

airSlate SignNow streamlines the process of preparing and submitting the Company Tax Return CT600 Version 3. Our platform allows you to easily eSign documents and manage all supplementary pages and computations in one place, making tax filing simpler and more organized.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures you can manage your Company Tax Return CT600 Version 3 without breaking the bank, providing excellent value for the features included.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and business software. This allows you to easily import data and manage your Company Tax Return CT600 Version 3 alongside your existing tools, enhancing your workflow and efficiency.

-

What benefits does airSlate SignNow provide for tax filing?

Using airSlate SignNow for your Company Tax Return CT600 Version 3 offers numerous benefits, including time savings, reduced errors, and enhanced document security. Our easy-to-use platform ensures that you can focus on your business while we handle the complexities of tax filing.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses managing their Company Tax Return CT600 Version 3. Our platform provides all the necessary tools to simplify tax filing without overwhelming users.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information related to your Company Tax Return CT600 Version 3, ensuring that your sensitive data remains confidential and secure.

Get more for Company Tax Return CT600 Version 3 A Return Includes A Company Tax Return Form, Any Supplementary Pages, Accounts, Computations

Find out other Company Tax Return CT600 Version 3 A Return Includes A Company Tax Return Form, Any Supplementary Pages, Accounts, Computations

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy