CT600 Company Tax Return Forms HMRC 2023

What is the CT600 Company Tax Return?

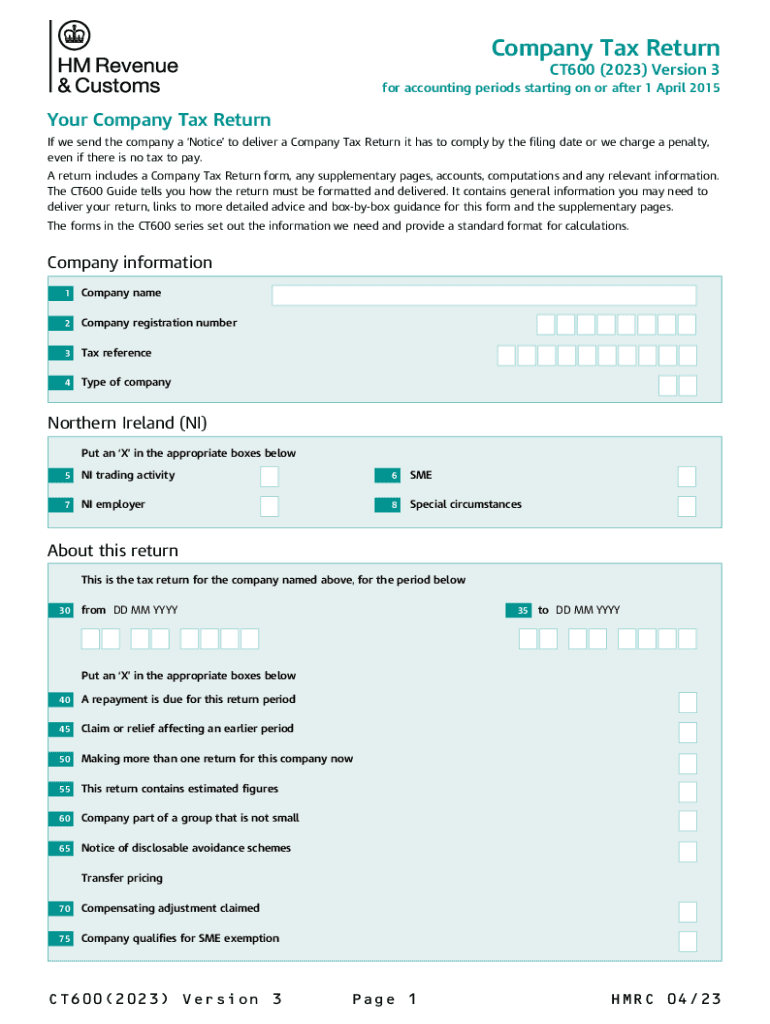

The CT600 Company Tax Return is a crucial document required by HM Revenue and Customs (HMRC) for all companies operating in the United Kingdom. This form is used to report a company's profits, calculate the tax owed, and ensure compliance with UK tax laws. Companies must submit this form annually, detailing their income, expenses, and any applicable tax reliefs. The editable CT600 form allows businesses to fill out and submit their tax returns efficiently and accurately, streamlining the process of tax compliance.

Steps to Complete the CT600 Company Tax Return

Completing the CT600 Company Tax Return involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather Financial Records: Collect all necessary financial documents, including profit and loss statements, balance sheets, and receipts for expenses.

- Fill Out the Form: Use the editable CT600 form to input your company’s financial information. This includes income, allowable expenses, and any tax reliefs.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: File the completed form electronically or by mail, ensuring it reaches HMRC by the deadline.

Legal Use of the CT600 Company Tax Return

The CT600 form is legally binding and must be completed in accordance with UK tax regulations. Companies are required to submit accurate information to avoid legal repercussions, including fines or penalties. The editable CT600 form provides a reliable means of ensuring that all necessary information is captured correctly, thus safeguarding against potential legal issues. Compliance with the relevant laws, including the Companies Act and tax legislation, is essential for maintaining good standing with HMRC.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for companies to avoid penalties. The CT600 must be submitted within twelve months of the end of the accounting period. For example, if your accounting period ends on December 31, the form must be filed by December 31 of the following year. Additionally, companies must pay any tax owed within nine months of the accounting period's end. Keeping track of these dates helps ensure timely compliance and avoids unnecessary financial penalties.

Form Submission Methods

Companies have several options for submitting the CT600 Company Tax Return. The most efficient method is electronic submission through HMRC's online services, which allows for immediate processing and confirmation of receipt. Alternatively, companies can submit the form by mail; however, this method may result in longer processing times. It is important to choose a submission method that aligns with your company’s needs and ensures compliance with HMRC requirements.

Key Elements of the CT600 Company Tax Return

The CT600 form consists of several key elements that must be accurately completed. These include:

- Company Information: Basic details about the company, including name, registration number, and accounting period.

- Financial Statements: Sections for reporting income, expenses, and profits.

- Tax Calculation: A calculation of the corporation tax owed based on reported profits.

- Signature: A declaration that the information provided is accurate and complete, requiring a signature from an authorized company representative.

How to Obtain the CT600 Company Tax Return

The editable CT600 form can be obtained directly from the HMRC website or through authorized tax software that supports the completion of tax returns. Companies can download the form in PDF format for offline use or access it through online platforms for digital completion. Ensuring you have the latest version of the form is essential for compliance, as tax regulations may change annually.

Quick guide on how to complete ct600 company tax return forms hmrc

Complete CT600 Company Tax Return Forms HMRC with ease on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without delays. Handle CT600 Company Tax Return Forms HMRC on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The simplest way to edit and eSign CT600 Company Tax Return Forms HMRC effortlessly

- Find CT600 Company Tax Return Forms HMRC and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiresome form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign CT600 Company Tax Return Forms HMRC and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct600 company tax return forms hmrc

Create this form in 5 minutes!

How to create an eSignature for the ct600 company tax return forms hmrc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an editable ct600 form?

An editable ct600 form is a digital document that allows users to fill out and modify their tax returns efficiently. With airSlate SignNow, you can easily edit and sign your ct600 forms online, ensuring that they are always accurate and up to date.

-

How can I create an editable ct600 form using airSlate SignNow?

Creating an editable ct600 form with airSlate SignNow is simple. You can upload your existing template, and our platform will convert it into an editable format that you can customize as needed, which streamlines your tax filing process.

-

Is there a free trial for the editable ct600 form feature?

Yes, airSlate SignNow offers a free trial that allows you to explore the editable ct600 form feature. This trial enables prospective customers to test all functionalities, making it easier to understand the benefits of using our solution for tax documents.

-

What are the key benefits of using an editable ct600 form?

Using an editable ct600 form with airSlate SignNow offers numerous benefits, including increased accuracy, time savings, and improved compliance. The ability to edit and eSign documents digitally reduces the risk of errors and enhances workflow efficiency.

-

Does airSlate SignNow support integrations for the editable ct600 form?

Yes, airSlate SignNow supports various integrations that make managing your editable ct600 form easier. You can connect with popular applications and services to streamline your workflow and access all necessary tools from one platform.

-

What pricing options are available for using editable ct600 forms?

airSlate SignNow offers various pricing plans that cater to different business needs when using editable ct600 forms. Our competitive rates ensure you get the best value, making our solution both cost-effective and efficient for your organization.

-

Can I collaborate with others on an editable ct600 form?

Absolutely! With airSlate SignNow, you can easily collaborate with team members on an editable ct600 form. The platform allows multiple users to edit, comment, and sign documents in real-time, streamlining the collaboration process.

Get more for CT600 Company Tax Return Forms HMRC

- Axis bank challan form

- Complaints policy template form

- 910b form medicaid sc

- Wisconsin state fairquilt entry formofficiale

- Reset forminstructions oregon ohio indivi

- Non disclosure between two companies agreement template form

- Non disclosure confidentiality agreement template form

- Non disclosure email agreement template form

Find out other CT600 Company Tax Return Forms HMRC

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors