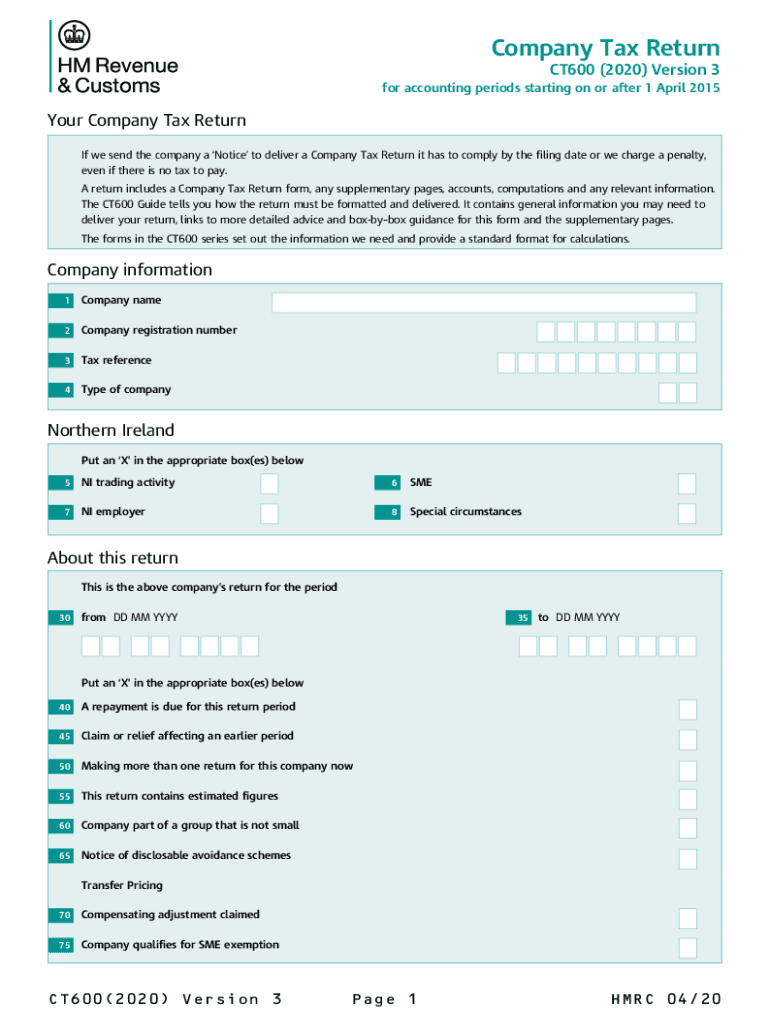

Company Tax Return CT600 Version 3 Use for Accounting Periods Starting on or After 1 April 2020

Understanding the Company Tax Return CT600

The Company Tax Return CT600 is a crucial document for businesses in the United States, specifically designed for reporting corporate tax obligations. This form is essential for companies to declare their profits and calculate the tax they owe to the Internal Revenue Service (IRS). It is a requirement for all corporate entities, including limited liability companies (LLCs), corporations, and partnerships, ensuring compliance with federal tax regulations.

Steps to Complete the Company Tax Return CT600

Filling out the CT600 form requires careful attention to detail. Here are the essential steps to complete the process:

- Gather all necessary financial documents, including income statements, balance sheets, and receipts.

- Begin by entering your company's legal name, address, and Employer Identification Number (EIN) at the top of the form.

- Report your total income, including sales revenue and other earnings, in the appropriate sections.

- Deduct allowable expenses, such as operating costs and salaries, to determine your taxable profit.

- Calculate your tax liability based on the current corporate tax rate.

- Review the completed form for accuracy, ensuring all figures are correct and all required sections are filled out.

- Submit the form electronically or by mail, depending on your preference and the IRS guidelines.

Legal Use of the Company Tax Return CT600

The CT600 form serves as a legal document that must be filed with the IRS to fulfill corporate tax obligations. It is essential to ensure that the information provided is accurate and complete, as discrepancies can lead to penalties or audits. Utilizing a reliable platform for e-signing and submitting the CT600 can enhance the legal validity of the document, ensuring compliance with federal regulations.

Filing Deadlines for the Company Tax Return CT600

Timely submission of the CT600 form is critical to avoid penalties. The standard deadline for filing is typically the 15th day of the fourth month following the end of your corporation's accounting period. For example, if your fiscal year ends on December 31, the CT600 would be due by April 15 of the following year. It is advisable to check for any specific extensions or changes in deadlines that may apply to your business.

Required Documents for the Company Tax Return CT600

To successfully complete the CT600 form, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Records of all income and expenses incurred during the accounting period.

- Previous tax returns, if applicable, to provide context for current filings.

- Any supporting documentation for deductions claimed, such as receipts and invoices.

Examples of Using the Company Tax Return CT600

Businesses of various types utilize the CT600 form to report their tax obligations. For instance, a small LLC may use the form to declare its profits and expenses, while a larger corporation may need to provide detailed financial statements and complex calculations. Understanding how different entities approach the CT600 can provide valuable insights into best practices for tax reporting.

Form Submission Methods for the Company Tax Return CT600

Submitting the CT600 form can be done through various methods, depending on your preference and the requirements set forth by the IRS. Businesses can choose to file electronically using approved e-filing systems, which often streamline the process and reduce errors. Alternatively, the form can be mailed directly to the IRS, ensuring that it is sent to the correct address for processing. It is important to retain copies of the submitted form and any correspondence for your records.

Quick guide on how to complete company tax return ct600 2020 version 3 use for accounting periods starting on or after 1 april 2015

Accomplish Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April with ease

- Locate Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct company tax return ct600 2020 version 3 use for accounting periods starting on or after 1 april 2015

Create this form in 5 minutes!

How to create an eSignature for the company tax return ct600 2020 version 3 use for accounting periods starting on or after 1 april 2015

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the ct600, and how can airSlate SignNow help with it?

The ct600 is a corporation tax return in the UK, essential for businesses to report their income and tax liabilities. airSlate SignNow simplifies this process by allowing users to create, send, and eSign their ct600 documents easily, ensuring compliance and accuracy in submissions.

-

How much does airSlate SignNow cost for managing ct600 documents?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. For managing ct600 documents, you can choose a plan that fits your budget while providing features tailored for efficient document handling and eSigning.

-

What features does airSlate SignNow offer for ct600 document management?

airSlate SignNow provides robust features such as template creation, document tracking, and secure eSigning specifically for ct600 documents. These features help streamline the tax submission process and enhance collaboration within teams.

-

Are there any benefits of using airSlate SignNow for submitting ct600?

Yes, using airSlate SignNow for submitting your ct600 offers numerous benefits, including time savings, reduced errors, and improved security. The platform's intuitive interface makes the process efficient, helping businesses focus on their core activities.

-

Can airSlate SignNow integrate with other accounting software for ct600 processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, streamlining the entire ct600 processing workflow. This integration ensures that your documents are consistently up-to-date and accessible whenever needed.

-

Is airSlate SignNow secure for handling sensitive ct600 information?

Yes, airSlate SignNow prioritizes security and compliance, using encryption and secure servers to protect your ct600 information. This ensures that your financial data remains confidential and safeguarded against unauthorized access.

-

How does airSlate SignNow improve collaboration on ct600 submissions?

With features like real-time document editing and status tracking, airSlate SignNow enhances collaboration on ct600 submissions. Teams can work together effectively, reducing the time taken to prepare and submit important tax documents.

Get more for Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April

- Revenuenebraskagovtax forms2021form 12n nebraska nonresident income tax agreement 2021

- Dmvcoloradogov motor vehicle requestor release affidavit of intended use form

- Nebraska forms nebraska department of revenuenebraska form 13 nebraska resale or exempt sale certificate for sanebraska form 13

- Azdorgovformspoa and disclosure formspower of attorney poa disclosure formsarizona

- Qasfloridarevenuecomformslibrarycurrentgeneral information and instructions for the display of dr

- Taxpayer bill of rightsinternal revenue service irs tax forms

- Colliertaxcollectorcomtourist development taxtourist development taxcollier county tax collector form

- Bmv 4856 form

Find out other Company Tax Return CT600 Version 3 Use For Accounting Periods Starting On Or After 1 April

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form