Ct600 2015

What is the CT600?

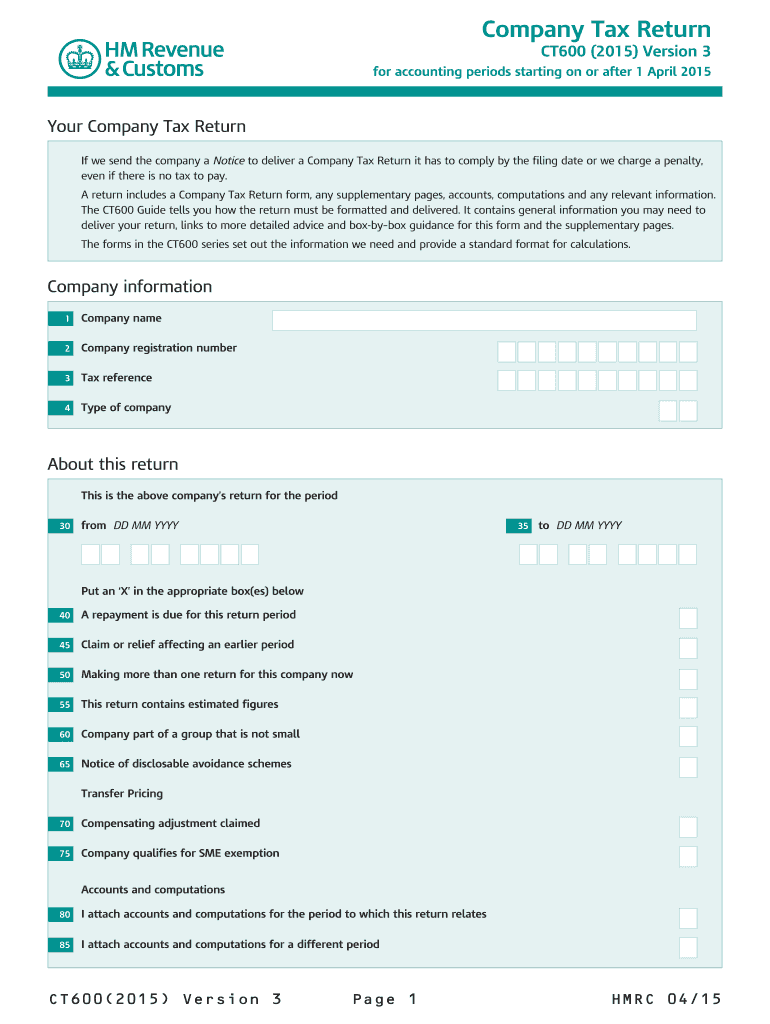

The CT600 is the official company tax return form used in the United Kingdom for reporting corporate income and calculating the amount of Corporation Tax owed. This form is essential for limited companies, including those registered in the United States that have business operations in the UK. The CT600 requires detailed financial information, including profits, losses, and any tax reliefs or allowances applicable to the company. Understanding the CT600 is crucial for compliance with UK tax regulations.

How to use the CT600

Using the CT600 involves several steps to ensure accurate completion. First, gather all necessary financial records, including profit and loss statements, balance sheets, and any relevant tax documents. Next, access the CT600 form online through official HMRC channels or authorized platforms. Fill in the required sections, ensuring that all financial details are accurate and complete. Once completed, review the form for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the submission method you choose.

Steps to complete the CT600

Completing the CT600 requires careful attention to detail. Follow these steps:

- Gather documentation: Collect all relevant financial records, including income statements and expenses.

- Access the form: Obtain the CT600 from the HMRC website or an approved provider.

- Fill out the form: Enter your company's financial information accurately in the designated fields.

- Review: Double-check all entries for accuracy and completeness.

- Submit: Send the completed form to HMRC electronically or by mail.

Legal use of the CT600

The CT600 must be completed in accordance with UK tax laws to ensure its legal validity. Companies are required to file this form annually, and failure to do so can result in penalties. It is important to adhere to the guidelines set forth by HMRC, including accurate reporting of income, expenses, and tax liabilities. Companies should also keep records of their submissions and any correspondence with HMRC to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the CT600 are critical for compliance. Generally, the CT600 must be submitted within twelve months of the end of the accounting period. Companies should also be aware of any specific deadlines for payments of Corporation Tax, which typically fall due nine months after the end of the accounting period. Keeping track of these dates is essential to avoid late filing penalties and interest on unpaid taxes.

Required Documents

To complete the CT600, several documents are required. These include:

- Profit and loss accounts

- Balance sheet

- Tax computation

- Any supporting documents for tax reliefs or allowances claimed

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete ct600 tax return 2015 2019 form

A concise guide on how to prepare your Ct600

Locating the suitable template can be difficult when formal international documentation is needed. Even if you possess the required form, it might be cumbersome to swiftly prepare it according to all the specifications if you utilize printed versions instead of handling everything digitally. airSlate SignNow is the online electronic signature solution that assists you in overcoming these challenges. It allows you to get your Ct600 and promptly fill it out and sign it on the spot without the need for reprinting documents if you make an error.

Follow these steps to prepare your Ct600 with airSlate SignNow:

- Click the Get Form button to quickly upload your document to our editor.

- Begin with the first empty field, enter the necessary details, and proceed with the Next tool.

- Complete the empty fields using the Cross and Check tools from the top pane.

- Choose the Highlight or Line options to emphasize the most important information.

- Select Image and upload one if your Ct600 necessitates it.

- Utilize the right-side pane to add additional fields for you or others to fill out if needed.

- Review your inputs and approve the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

Once your Ct600 is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders to your liking. Don’t spend time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct ct600 tax return 2015 2019 form

FAQs

-

Which ITR (Income Tax Return) form should I fill for AY 2015-16?

If you have not redeemed your SIP till April 2015 and Salary is the only source of your Income then you have to file ITR-1.Let me recommend you to use http://mytaxcafe.com for filing your Income Tax Return as it automatically selects the type of ITR applicable on you. Further tax filing is free at http://mytaxcafe.comIf you have any doubts then please mail us at support@mytaxcafe.com

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

Do I need a tax lawyer if I received a CP2000 letter for my state tax return, and will I need to fill out a 1040X for my federal as I used TaxAct during 2015?

Whether you need a tax attorney or not depends on the content of the CP2000 letter. Most of the time, the reason for the letter is for failure to report an income form on your return (W-2, 1099, etc.) or something similar, usually not something severe enough to pay an attorney. If you filed the return yourself online, you may want to contact a CPA firm or other tax prep firm that has Enrolled Agents (EAs) who are qualified and certified to practice and represent clients before the IRS in the event the letter ends up being severe enough that you’ll be audited by the IRS. However, most tax professionals in these types of firms will have seen these types of letters before, will be able to understand them and know what you need to do to respond. Depending on the company, they may or may not charge you for this advice, so I would call ahead to be sure.Generally, with a CP2000 letter the IRS generally does not want you to file a 1040X form to amend your return for that year.Here’s a link to help you with understanding the letter you received:Understanding Your CP2000 Notice

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

Create this form in 5 minutes!

How to create an eSignature for the ct600 tax return 2015 2019 form

How to generate an electronic signature for your Ct600 Tax Return 2015 2019 Form in the online mode

How to make an electronic signature for the Ct600 Tax Return 2015 2019 Form in Google Chrome

How to make an electronic signature for putting it on the Ct600 Tax Return 2015 2019 Form in Gmail

How to generate an electronic signature for the Ct600 Tax Return 2015 2019 Form straight from your mobile device

How to create an eSignature for the Ct600 Tax Return 2015 2019 Form on iOS

How to create an electronic signature for the Ct600 Tax Return 2015 2019 Form on Android OS

People also ask

-

What is Ct600 and how can airSlate SignNow help with it?

Ct600 is a crucial form for Corporation Tax in the UK, and airSlate SignNow simplifies the process of signing and managing these documents. With our platform, businesses can easily eSign Ct600 forms, ensuring compliance and reducing the time spent on paperwork.

-

How much does airSlate SignNow cost for managing Ct600 documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who frequently manage Ct600 forms. Our affordable plans ensure that you can efficiently handle your eSignature needs without breaking the bank.

-

What features does airSlate SignNow offer for signing Ct600 forms?

Our platform provides features like customizable templates, real-time tracking, and secure cloud storage specifically designed for managing Ct600 forms. This ensures a smooth signing process, enhancing your productivity and compliance.

-

Can I integrate airSlate SignNow with my existing tools for handling Ct600?

Yes, airSlate SignNow easily integrates with various business applications, allowing you to streamline your workflow for managing Ct600 documents. Whether it's CRM systems or accounting software, our integrations enhance your efficiency.

-

Is airSlate SignNow secure for signing sensitive Ct600 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry regulations to protect your Ct600 forms. You can trust that your sensitive data is safe while eSigning.

-

How does airSlate SignNow improve the efficiency of filing Ct600?

By using airSlate SignNow, businesses can signNowly reduce the time it takes to prepare and file Ct600 forms. Our intuitive eSignature process allows for quick approvals, leading to faster submission and compliance.

-

Can I track the status of my Ct600 documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your Ct600 documents, allowing you to monitor the signing process. This feature helps ensure that all necessary signatures are collected promptly.

Get more for Ct600

Find out other Ct600

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online