1099b 2018

What is the 1099-B?

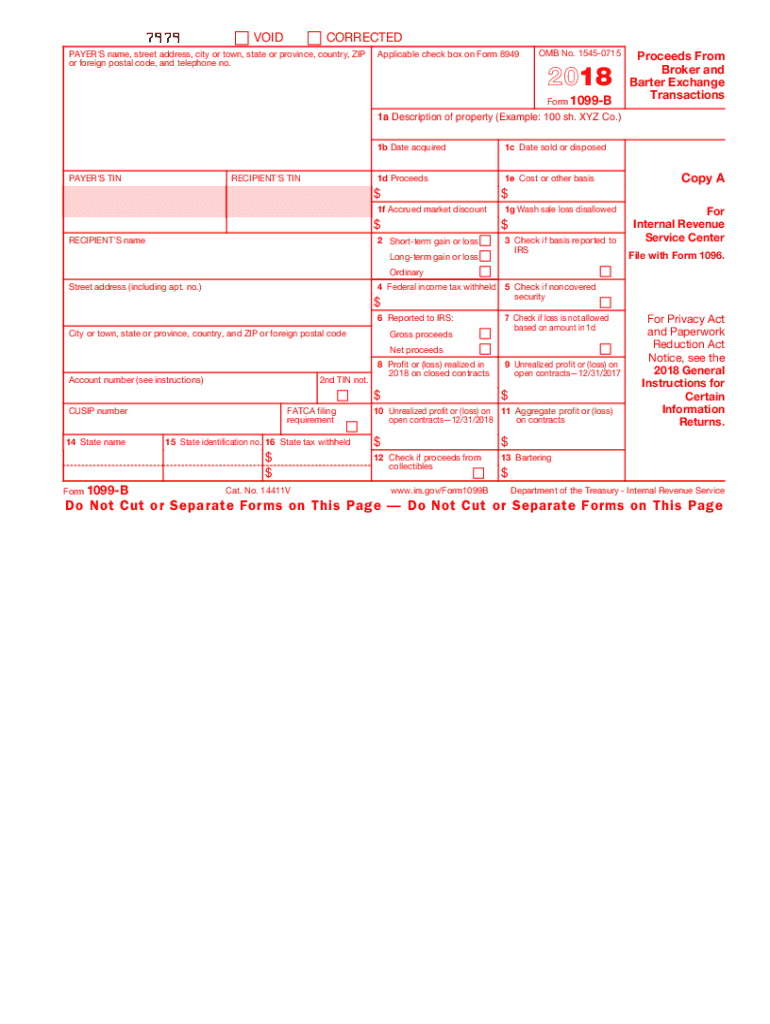

The IRS Form 1099-B is a tax document used to report proceeds from broker and barter exchange transactions. This form is essential for taxpayers who have sold stocks, bonds, or other securities during the tax year. It provides detailed information about the transactions, including the date of sale, the amount realized, and any related costs or adjustments. Understanding the 1099-B is crucial for accurately reporting capital gains and losses on your tax return.

How to Obtain the 1099-B

To obtain the IRS Form 1099-B, individuals typically receive it from their brokerage firm or financial institution. These organizations are required to issue the form to clients who engaged in transactions that necessitate reporting. If you have not received your 1099-B by mid-February, it is advisable to contact your broker directly. Additionally, you can access your transaction history through your brokerage account online, which may provide the necessary information to complete your tax filings.

Steps to Complete the 1099-B

Completing the 1099-B involves several important steps. First, gather all relevant transaction records, including purchase dates, sale dates, and amounts. Next, accurately fill out the form by entering the required information in the designated fields. Ensure that you report each transaction separately, detailing the proceeds and any adjustments for commissions or fees. Finally, review the completed form for accuracy before submitting it along with your tax return.

Filing Deadlines / Important Dates

The IRS has specific deadlines for filing Form 1099-B. Generally, brokers must provide the form to taxpayers by January thirty-first of the year following the tax year in which the transactions occurred. Additionally, the deadline for submitting the 1099-B to the IRS is typically February twenty-eighth if filed by paper, or March thirty-first if filed electronically. It is essential to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal Use of the 1099-B

The legal use of the IRS Form 1099-B is to ensure that taxpayers accurately report their capital gains and losses to the IRS. This form is legally required for any transactions involving the sale of securities or barter exchanges. Using the 1099-B correctly helps maintain transparency in financial reporting and compliance with tax laws. Failure to report the information accurately can result in penalties or audits from the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1099-B. Taxpayers must ensure that all information reported on the form is accurate and complete. The IRS emphasizes the importance of reporting capital gains and losses correctly, as this impacts tax liabilities. Additionally, taxpayers should refer to IRS Publication 550 for detailed instructions on how to report investment income and capital gains, which includes guidance on using the 1099-B effectively.

Penalties for Non-Compliance

Failure to comply with the reporting requirements associated with Form 1099-B can lead to significant penalties. The IRS may impose fines for late filings, inaccurate information, or failure to file altogether. These penalties can vary based on the severity of the non-compliance and the length of the delay. It is crucial for taxpayers to understand these potential consequences and ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete 1099 b 2018 2019 form

Uncover the easiest method to complete and endorse your 1099b

Are you still spending time preparing your official documents on paper instead of utilizing online methods? airSlate SignNow offers a superior approach to complete and endorse your 1099b and related forms for public services. Our intelligent electronic signature platform equips you with all you need to manage documents swiftly and according to official standards - robust PDF editing, administration, protection, signing, and sharing features all available within a user-friendly interface.

Only a few simple steps are necessary to complete and endorse your 1099b:

- Upload the fillable template to the editor using the Get Form button.

- Review what information you must provide in your 1099b.

- Navigate between fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Blackout fields that are no longer relevant.

- Select Sign to generate a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and finalize your task with the Done button.

Store your completed 1099b in the Documents directory within your profile, download it, or export it to your preferred cloud storage service. Our solution also provides flexible form sharing. There’s no requirement to print your forms when needing to submit them to the relevant public office - simply do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 b 2018 2019 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 1099 b 2018 2019 form

How to generate an eSignature for your 1099 B 2018 2019 Form in the online mode

How to make an electronic signature for the 1099 B 2018 2019 Form in Chrome

How to make an electronic signature for signing the 1099 B 2018 2019 Form in Gmail

How to generate an electronic signature for the 1099 B 2018 2019 Form from your smartphone

How to generate an electronic signature for the 1099 B 2018 2019 Form on iOS

How to make an eSignature for the 1099 B 2018 2019 Form on Android devices

People also ask

-

What is a 1099b form and how does it relate to airSlate SignNow?

The 1099b form is used to report the sale of securities and other income to the IRS. With airSlate SignNow, you can easily create, send, and eSign your 1099b documents. This streamlines the process of filing and ensures that all necessary signatures are obtained swiftly and securely.

-

How can airSlate SignNow help me manage my 1099b forms efficiently?

airSlate SignNow provides a user-friendly platform for managing all your 1099b forms. You can automate document workflows, set reminders for important deadlines, and ensure compliance with IRS requirements, making the entire process more efficient.

-

Is airSlate SignNow cost-effective for handling multiple 1099b forms?

Yes, airSlate SignNow offers competitive pricing plans that are perfect for businesses handling multiple 1099b forms. Our subscription models cater to various needs, ensuring that you get a cost-effective solution for your eSigning and document management requirements.

-

Can I integrate airSlate SignNow with my accounting software for 1099b processing?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage your 1099b forms. This integration allows for automatic population of necessary data, reducing manual entry and minimizing errors.

-

What features does airSlate SignNow offer for 1099b document management?

airSlate SignNow offers a range of features for 1099b document management, including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance your workflow and ensure that your 1099b forms are processed smoothly.

-

Is it safe to use airSlate SignNow for sensitive 1099b information?

Yes, airSlate SignNow prioritizes your data security. Our platform employs advanced encryption and complies with industry standards to protect sensitive 1099b information, ensuring that your documents remain confidential and secure.

-

How can airSlate SignNow improve the speed of processing my 1099b forms?

With airSlate SignNow, you can signNowly speed up the processing of your 1099b forms by utilizing automated workflows and electronic signatures. This eliminates the need for physical signatures and reduces turnaround time, allowing you to meet your filing deadlines promptly.

Get more for 1099b

- Atlanta public schools registration form

- Nevada modified business tax return form 100092536

- U s fish and wildlife service form 3 2392 operatorauthorization test heavy equipment fws

- Irs publication 505 tax withholding and estimated tax form

- Title i claim for loss instructions hud form

- Date ordered w marketing proposals s form

- Storage license agreement template form

- Storage space agreement template form

Find out other 1099b

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free