Tax Form 8582 Instructions 2018

What is the Tax Form 8582 Instructions

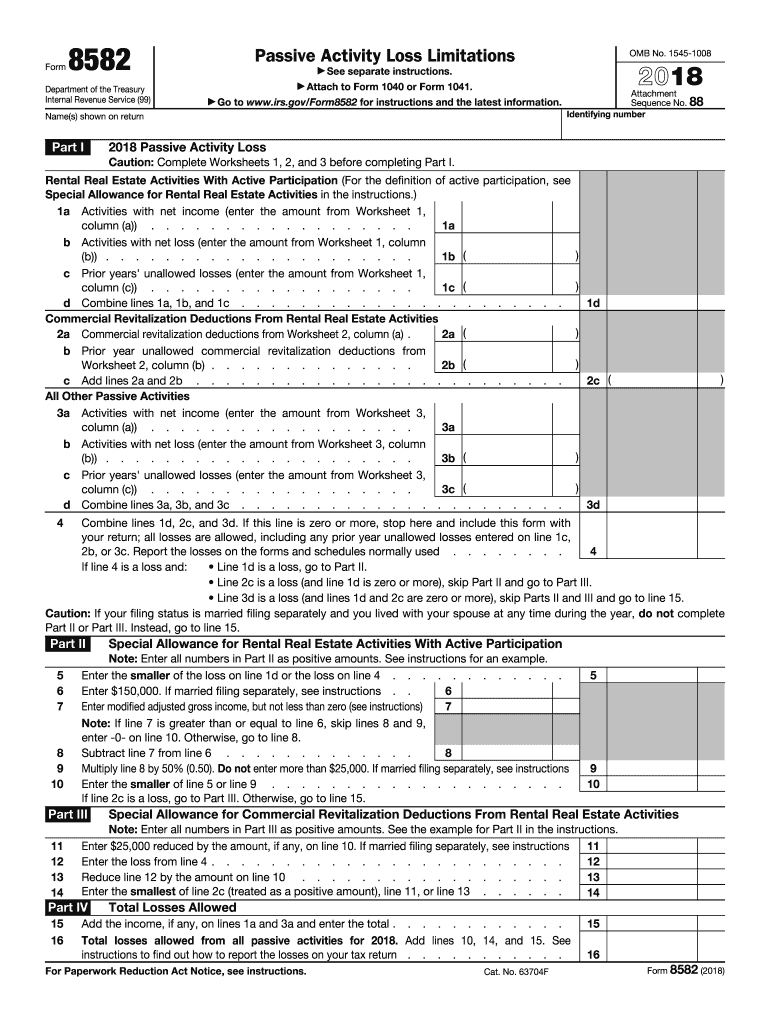

The IRS Tax Form 8582 is used to calculate passive activity loss limitations for individuals, estates, and trusts. This form is essential for taxpayers who have passive activities, such as rental properties or limited partnerships, and need to report losses from these activities. The instructions provide detailed guidance on how to fill out the form accurately, ensuring compliance with IRS regulations. Understanding these instructions is crucial for proper tax reporting and to avoid potential penalties.

Steps to complete the Tax Form 8582 Instructions

Completing the IRS Tax Form 8582 involves several key steps:

- Gather all relevant financial information regarding your passive activities, including income and losses.

- Review the instructions carefully to understand which sections apply to your situation.

- Fill out the form, ensuring all required fields are completed accurately.

- Attach any necessary documentation, such as schedules or worksheets that support your claims.

- Double-check your entries for accuracy before submission.

How to obtain the Tax Form 8582 Instructions

The instructions for IRS Tax Form 8582 can be obtained directly from the IRS website. They are available as a downloadable PDF, ensuring that you have the most current version. You can also find printed copies at local IRS offices or request them by mail. It is important to ensure you are using the latest instructions, as tax laws and forms can change from year to year.

Filing Deadlines / Important Dates

Filing deadlines for IRS Tax Form 8582 typically align with the general tax return deadlines. For most individuals, this means the form must be submitted by April 15 of the following tax year. If you are unable to meet this deadline, you may file for an extension, but it is crucial to pay any taxes owed by the original deadline to avoid penalties and interest.

Key elements of the Tax Form 8582 Instructions

The key elements of the IRS Tax Form 8582 instructions include:

- Definitions of passive activities and how they differ from non-passive activities.

- Guidance on how to calculate passive activity losses and credits.

- Instructions for reporting income from passive activities.

- Details on how to handle suspended losses and carryovers to future tax years.

Penalties for Non-Compliance

Failing to comply with the requirements of IRS Tax Form 8582 can lead to significant penalties. Taxpayers may face fines for incorrect reporting of passive activity losses or for failing to file the form altogether. Additionally, any unpaid taxes due to improper claims can accrue interest and penalties over time. It is essential to understand the implications of non-compliance to avoid unnecessary financial burdens.

Quick guide on how to complete 8582 2018 2019 form

Discover the easiest method to complete and endorse your Tax Form 8582 Instructions

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to finalize and endorse your Tax Form 8582 Instructions and similar forms for public services. Our advanced eSignature solution equips you with all the necessary tools to manage documents efficiently and in accordance with formal standards - robust PDF editing, managing, securing, signing, and sharing tools are all accessible within a user-friendly interface.

Only a few steps are needed to complete and endorse your Tax Form 8582 Instructions:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to include in your Tax Form 8582 Instructions.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using any method you prefer.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finished Tax Form 8582 Instructions in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our platform also offers adaptable form sharing options. There’s no need to print your templates when you need to submit them to the appropriate public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 8582 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the 8582 2018 2019 form

How to create an electronic signature for the 8582 2018 2019 Form in the online mode

How to create an electronic signature for the 8582 2018 2019 Form in Google Chrome

How to create an electronic signature for putting it on the 8582 2018 2019 Form in Gmail

How to make an eSignature for the 8582 2018 2019 Form straight from your mobile device

How to generate an eSignature for the 8582 2018 2019 Form on iOS

How to make an electronic signature for the 8582 2018 2019 Form on Android devices

People also ask

-

What are the Tax Form 8582 Instructions for eSigning with airSlate SignNow?

The Tax Form 8582 Instructions provide guidance on how to complete and submit your tax form effectively. With airSlate SignNow, you can digitally sign and send your Tax Form 8582 securely, ensuring compliance with IRS regulations. Our platform simplifies the process, making it easy to manage your tax documents.

-

How does airSlate SignNow enhance the process of completing Tax Form 8582 Instructions?

AirSlate SignNow streamlines the completion of Tax Form 8582 Instructions by allowing users to fill out and eSign documents from anywhere. Our intuitive interface reduces the time spent on paperwork, and you can track document status in real-time, ensuring you never miss a deadline.

-

What features does airSlate SignNow offer for managing Tax Form 8582 Instructions?

AirSlate SignNow offers features such as customizable templates, secure cloud storage, and automated reminders for Tax Form 8582 Instructions. These tools help you manage your tax documents efficiently and ensure all necessary fields are completed correctly before submission.

-

Is there a cost associated with using airSlate SignNow for Tax Form 8582 Instructions?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Whether you are a small business or a large enterprise, our cost-effective solutions for managing Tax Form 8582 Instructions are designed to provide great value without compromising on quality.

-

Can I integrate airSlate SignNow with other software for Tax Form 8582 Instructions?

Absolutely! AirSlate SignNow seamlessly integrates with popular software solutions, making it easy to incorporate Tax Form 8582 Instructions into your existing workflow. Connect with platforms like Google Drive, Dropbox, and more to streamline your document management.

-

What advantages does airSlate SignNow provide for completing Tax Form 8582 Instructions?

Using airSlate SignNow for your Tax Form 8582 Instructions offers numerous advantages, including enhanced security, reduced processing time, and improved accuracy. Our eSigning solution ensures that your documents are authenticated and legally binding, providing peace of mind during tax season.

-

How can I get assistance with my Tax Form 8582 Instructions using airSlate SignNow?

If you need assistance with your Tax Form 8582 Instructions, airSlate SignNow provides excellent customer support. You can access our help center, tutorials, and contact our support team for personalized guidance on using our platform effectively.

Get more for Tax Form 8582 Instructions

Find out other Tax Form 8582 Instructions

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document