Form 990 Instructions PDF 2018

What is the Form 990 Instructions PDF

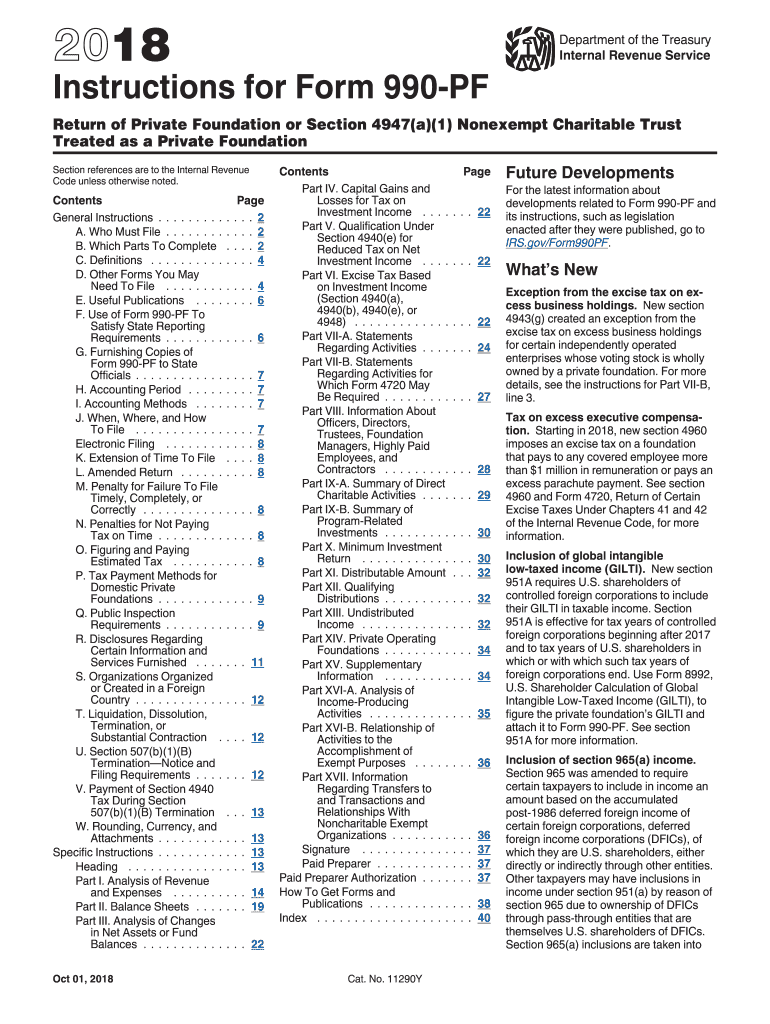

The Form 990 Instructions PDF provides detailed guidance for organizations required to file the IRS Form 990-PF, which is specifically designed for private foundations. This document outlines the necessary steps and information needed to complete the form accurately, ensuring compliance with IRS regulations. It includes definitions of key terms, explanations of various sections of the form, and specific instructions for reporting financial activities, grants, and other relevant information.

Steps to Complete the Form 990 Instructions PDF

Completing the Form 990-PF requires careful attention to detail. Here are the essential steps:

- Review the instructions thoroughly to understand the requirements.

- Gather all necessary financial documents, including balance sheets and income statements.

- Fill out the form section by section, ensuring all required fields are completed.

- Double-check calculations and ensure that all figures are accurate and consistent.

- Compile any required attachments, such as schedules or additional documentation.

- Submit the completed form by the deadline, either electronically or by mail.

Legal Use of the Form 990 Instructions PDF

The Form 990 Instructions PDF serves as an official guideline for private foundations to comply with IRS requirements. Using the instructions correctly is crucial, as failure to adhere to the guidelines can lead to penalties or issues with tax-exempt status. Organizations must ensure that they use the most current version of the instructions to avoid any legal complications.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 990-PF is vital for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the foundation's accounting period. For organizations operating on a calendar year, this means the form is typically due by May fifteenth. Extensions may be available, but they must be requested in advance and submitted properly.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Form 990-PF. The form can be filed electronically through the IRS e-file system, which offers a faster processing time and confirmation of receipt. Alternatively, organizations may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not accepted for this form. It is essential to follow the specific submission guidelines outlined in the instructions to ensure proper processing.

Required Documents

When completing the Form 990-PF, several documents are necessary to support the information provided. These may include:

- Financial statements, such as balance sheets and income statements.

- Records of grants made during the year.

- Documentation of any changes in the organization's structure or operations.

- Attachments for specific schedules as required by the IRS.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990-PF, which are essential for compliance. These guidelines cover various aspects, including the types of income that must be reported, allowable deductions, and the requirements for maintaining tax-exempt status. Organizations should familiarize themselves with these guidelines to avoid common pitfalls and ensure that their filings meet all necessary standards.

Quick guide on how to complete irs 990 pf instructions 2018 2019 form

Uncover the easiest method to complete and sign your Form 990 Instructions Pdf

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior way to finalize and sign your Form 990 Instructions Pdf and related forms for public services. Our intelligent eSignature platform equips you with everything needed to handle documents swiftly and in compliance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools all available in a user-friendly layout.

Only a few steps are necessary to complete and sign your Form 990 Instructions Pdf:

- Upload the fillable template to the editor using the Get Form button.

- Check what information you need to enter in your Form 990 Instructions Pdf.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Refine the content with Text boxes or Images from the top menu.

- Emphasize what’s important or Blackout fields that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any method you choose.

- Insert the Date next to your signature and finalize your task with the Done button.

Store your completed Form 990 Instructions Pdf in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our platform also supports versatile file sharing. There’s no need to print your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct irs 990 pf instructions 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the irs 990 pf instructions 2018 2019 form

How to generate an electronic signature for the Irs 990 Pf Instructions 2018 2019 Form online

How to make an eSignature for your Irs 990 Pf Instructions 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the Irs 990 Pf Instructions 2018 2019 Form in Gmail

How to create an electronic signature for the Irs 990 Pf Instructions 2018 2019 Form straight from your smartphone

How to create an electronic signature for the Irs 990 Pf Instructions 2018 2019 Form on iOS

How to generate an eSignature for the Irs 990 Pf Instructions 2018 2019 Form on Android

People also ask

-

What are the key features of airSlate SignNow relevant to the 2017 IRS 990 PF instructions?

airSlate SignNow offers robust features like eSignature, document management, and workflow automation, which can facilitate compliance with the 2017 IRS 990 PF instructions. With these features, users can ensure that their forms are signed, tracked, and stored securely, making it easier to adhere to IRS requirements.

-

How can airSlate SignNow help me understand the 2017 IRS 990 PF instructions?

While airSlate SignNow doesn't provide official tax guidance, it simplifies the process of filling out and submitting documents required by the 2017 IRS 990 PF instructions. Users can create templates, gather necessary signatures, and manage documents efficiently to ensure compliance.

-

Is airSlate SignNow a cost-effective solution for managing 2017 IRS 990 PF documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing all types of documents, including those related to 2017 IRS 990 PF instructions. With flexible pricing plans, businesses can choose an option that suits their budget while gaining access to essential eSignature and document management features.

-

Can I integrate airSlate SignNow with other software I use for the 2017 IRS 990 PF instructions?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for managing documents associated with the 2017 IRS 990 PF instructions. This ensures you can connect with tools you already use, maintaining efficiency and organization.

-

What are the benefits of using airSlate SignNow for the 2017 IRS 990 PF instructions?

Using airSlate SignNow to manage your documentation for the 2017 IRS 990 PF instructions provides numerous benefits, including enhanced efficiency and reduced processing time. With easy-to-use features, you can gather signatures quickly, making the submission process smoother and more reliable.

-

How does airSlate SignNow ensure the security of documents related to the 2017 IRS 990 PF instructions?

Security is a top priority for airSlate SignNow. All documents related to the 2017 IRS 990 PF instructions are encrypted and stored securely, ensuring that sensitive information is protected during the signing and submission process.

-

What support does airSlate SignNow offer for questions about the 2017 IRS 990 PF instructions?

airSlate SignNow provides excellent customer support to help users navigate any questions regarding the 2017 IRS 990 PF instructions. Our dedicated support team is available via chat, email, and phone to ensure you receive timely assistance.

Get more for Form 990 Instructions Pdf

- Sanlam besonderhede van afhanklikes aftree pensioenfondse in english downloud the form in english please

- U s air force form af60 download

- Copyright transfer form pdf spie spie

- Cube that is fillable form

- Certificate of real estate value sdcl 7 9 74 minnehahacounty form

- Form ct 245 iinstructions for form ct 245 maintenance fee tax ny

- Mvms physical education department monthly exercise log form

- 5001en calculation of withholding tax on dividend form

Find out other Form 990 Instructions Pdf

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later