California Form 3843 Payment Voucher for Fiduciary E Filed Returns 2021

What is the California Form 3843 Payment Voucher for Fiduciary e-Filed Returns

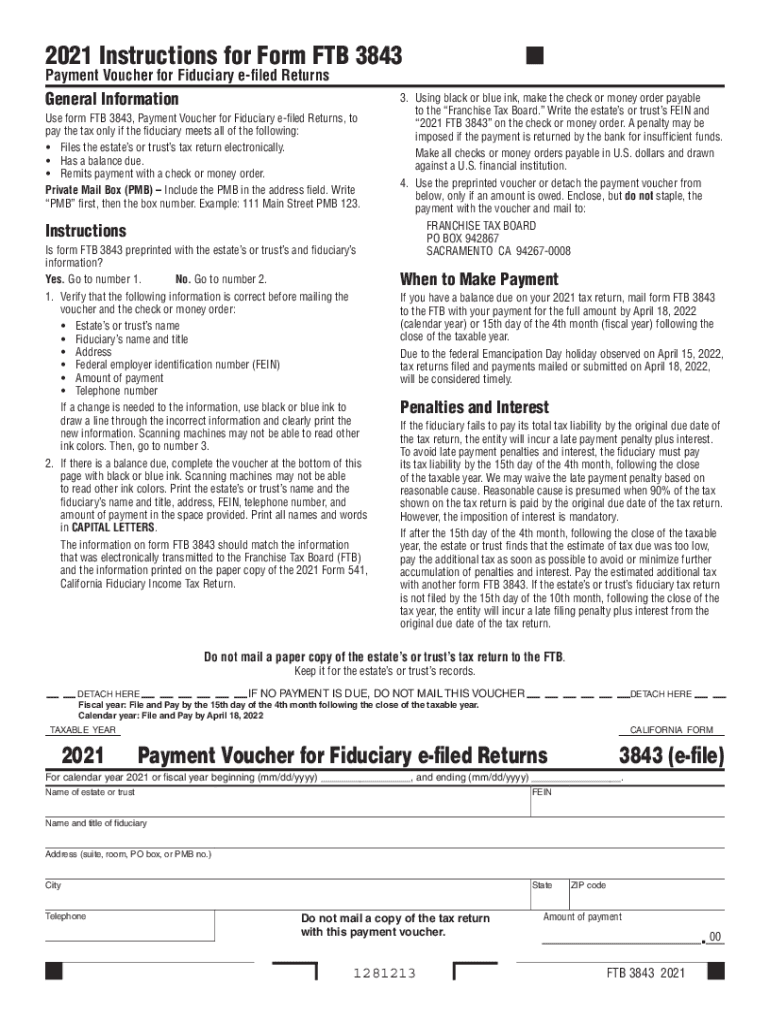

The California Form 3843, also known as the Payment Voucher for Fiduciary e-Filed Returns, is a crucial document for fiduciaries who need to submit payments related to taxes owed on behalf of estates or trusts. This form is designed to facilitate the payment process when filing fiduciary returns electronically. By using Form 3843, fiduciaries can ensure that their payments are properly credited to their accounts, helping to maintain compliance with California tax regulations.

How to Use the California Form 3843 Payment Voucher for Fiduciary e-Filed Returns

To effectively use the California Form 3843, fiduciaries should first complete their e-filed tax returns. Once the returns are filed, the form serves as a payment voucher for any taxes owed. It is essential to fill out the form accurately, including the taxpayer identification number, the amount being paid, and the tax year associated with the payment. After completing the form, it should be submitted along with the payment to ensure proper processing by the California Franchise Tax Board.

Steps to Complete the California Form 3843 Payment Voucher for Fiduciary e-Filed Returns

Completing the California Form 3843 involves several key steps:

- Gather necessary information, including the fiduciary's name, address, and taxpayer identification number.

- Determine the total amount owed for taxes based on the e-filed return.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form along with the payment to the appropriate address provided by the California Franchise Tax Board.

Legal Use of the California Form 3843 Payment Voucher for Fiduciary e-Filed Returns

The California Form 3843 is legally recognized as a valid payment voucher when submitted in conjunction with fiduciary tax returns. For the form to be considered legally binding, it must be completed accurately and submitted according to the guidelines established by the California Franchise Tax Board. Adhering to these guidelines ensures that the payment is processed correctly and that the fiduciary remains compliant with state tax laws.

Key Elements of the California Form 3843 Payment Voucher for Fiduciary e-Filed Returns

Several key elements are essential when completing the California Form 3843:

- Taxpayer Identification Number: This unique number identifies the fiduciary or entity responsible for the tax payment.

- Payment Amount: The total amount owed must be clearly stated on the form.

- Tax Year: Indication of the tax year for which the payment is being made is crucial for proper crediting.

- Signature: The form must be signed by the fiduciary or an authorized representative to validate the submission.

Form Submission Methods for the California Form 3843 Payment Voucher

The California Form 3843 can be submitted through various methods to ensure that payments are received by the California Franchise Tax Board. These methods include:

- Online Submission: Payment can be made electronically, ensuring immediate processing.

- Mail: The completed form can be mailed along with a check or money order to the designated address.

- In-Person: Fiduciaries may also choose to deliver the form and payment directly to a local Franchise Tax Board office.

Quick guide on how to complete california form 3843 payment voucher for fiduciary e filed returns

Prepare California Form 3843 Payment Voucher For Fiduciary E filed Returns effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage California Form 3843 Payment Voucher For Fiduciary E filed Returns on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign California Form 3843 Payment Voucher For Fiduciary E filed Returns effortlessly

- Obtain California Form 3843 Payment Voucher For Fiduciary E filed Returns and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional signature with ink.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign California Form 3843 Payment Voucher For Fiduciary E filed Returns and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3843 payment voucher for fiduciary e filed returns

Create this form in 5 minutes!

People also ask

-

What is FTB 3843 and why is it important for my business?

FTB 3843 refers to a specific tax form used by businesses in California to report certain tax credits. Understanding FTB 3843 is crucial as it can help ensure compliance and maximize potential tax savings. By utilizing airSlate SignNow, you can securely sign and send FTB 3843 documents electronically.

-

How can airSlate SignNow help me with FTB 3843?

AirSlate SignNow simplifies the process of managing and signing important documents like FTB 3843. With our easy-to-use interface, you can quickly send, sign, and track your FTB 3843 forms. This streamlines the submission process, ensuring timely filings and reducing paperwork hassles.

-

What are the features of airSlate SignNow that support FTB 3843 processing?

AirSlate SignNow offers a variety of features that enhance the management of FTB 3843 forms, including real-time tracking, secure cloud storage, and integration capabilities with other software. These features ensure that you can efficiently handle your documents and maintain compliance with regulatory requirements. Additionally, the platform supports multiple signing options, making it versatile for all user needs.

-

Is airSlate SignNow affordable for small businesses needing FTB 3843?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses, making it a cost-effective solution for handling FTB 3843 and other documents. You don't need to compromise on quality or features, as our plans provide excellent value. Start with a free trial to see how it fits your budget and needs.

-

Can I integrate airSlate SignNow with other applications for FTB 3843?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as CRMs, document storage solutions, and collaboration tools, enhancing your workflow when dealing with FTB 3843. These integrations automate processes and reduce manual efforts, allowing for a more efficient document management system.

-

What are the benefits of using airSlate SignNow for my FTB 3843 submissions?

Using airSlate SignNow for your FTB 3843 submissions offers numerous benefits, including expedited processing times, enhanced security for sensitive information, and ease of use for all stakeholders. The electronic signing features enable your team to work faster, reducing the turnaround time for important documents while ensuring compliance with tax regulations.

-

Is the signing process for FTB 3843 secure on airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform safeguards your FTB 3843 documents with industry-leading encryption and robust authentication measures. This ensures that your data remains confidential and protected throughout the signing process, giving you peace of mind.

Get more for California Form 3843 Payment Voucher For Fiduciary E filed Returns

- Warranty deed from individual to corporation oklahoma form

- Summary administration oklahoma form

- Oklahoma personal representative form

- Sec 514011 mn statutes form

- 19 printable acknowledgement of receipt of payment forms

- Ok llc company 497322988 form

- Warranty deed from individual to llc oklahoma form

- Do i have to sign a lien waiver to get paid on a construction form

Find out other California Form 3843 Payment Voucher For Fiduciary E filed Returns

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online