Form 3893 Fill Out & Sign Online 2023

Understanding Form 3843

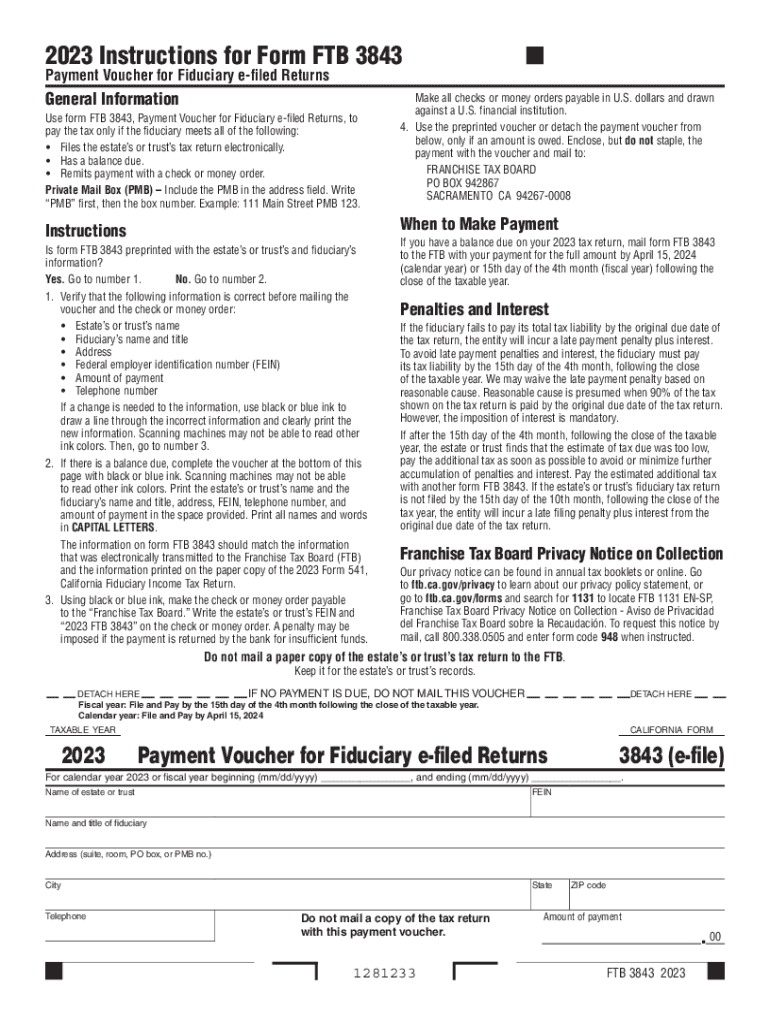

Form 3843, also known as the California payment fiduciary form, is a crucial document used in the state of California for fiduciaries managing payments on behalf of beneficiaries. This form is specifically designed for fiduciaries to report and remit payments due to the California Franchise Tax Board (FTB). It is essential for ensuring compliance with state tax obligations and facilitating the proper handling of funds.

Steps to Complete Form 3843

Completing Form 3843 involves several key steps to ensure accuracy and compliance:

- Gather all necessary information, including the fiduciary's details, beneficiary information, and payment amounts.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form to the California FTB by the specified deadline, either electronically or by mail.

Legal Use of Form 3843

The legal use of Form 3843 is paramount for fiduciaries in California. This form must be used when fiduciaries are responsible for making payments on behalf of individuals or entities. Proper use of the form helps to ensure that tax obligations are met and that fiduciaries fulfill their legal responsibilities. Failure to use the form correctly can result in penalties or legal complications.

Filing Deadlines for Form 3843

It is important to be aware of the filing deadlines associated with Form 3843. Typically, the form must be submitted by specific dates set by the California FTB, often aligning with tax payment deadlines. Keeping track of these dates is essential for fiduciaries to avoid late fees and ensure compliance with state regulations.

Form Submission Methods

Form 3843 can be submitted through various methods, providing flexibility for fiduciaries. The available submission methods include:

- Online Submission: Fiduciaries can complete and submit the form electronically through the California FTB's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate FTB address.

- In-Person Submission: Fiduciaries may also choose to submit the form in person at designated FTB offices.

Required Documents for Form 3843

When completing Form 3843, certain documents may be required to support the information provided. These documents typically include:

- Identification details of the fiduciary and beneficiaries.

- Records of payments made on behalf of the beneficiaries.

- Any relevant tax identification numbers.

Quick guide on how to complete form 3893 fill out ampamp sign online

Effortlessly Prepare Form 3893 Fill Out & Sign Online on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without hassles. Manage Form 3893 Fill Out & Sign Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Form 3893 Fill Out & Sign Online

- Locate Form 3893 Fill Out & Sign Online and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form, either by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your preferred device. Edit and electronically sign Form 3893 Fill Out & Sign Online to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3893 fill out ampamp sign online

Create this form in 5 minutes!

How to create an eSignature for the form 3893 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3843 used for?

The form 3843 is a crucial document for businesses looking to streamline their eSigning processes. It facilitates the signing and submission of important business documents, ensuring they are legally binding and secure. Utilizing form 3843 can help you keep track of document exchanges seamlessly.

-

How does airSlate SignNow support the use of form 3843?

airSlate SignNow provides a user-friendly platform that allows users to upload, send, and eSign documents like the form 3843 effortlessly. The software is designed to enhance the signing experience while complying with legal standards. You can also track the status of your form 3843 in real-time.

-

What are the pricing options for using airSlate SignNow with form 3843?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, even if you need to manage multiple form 3843 submissions. Pricing tiers fit small businesses to large enterprises, ensuring a cost-effective solution without sacrificing features. Sign up today for a free trial to explore the options.

-

Can I integrate form 3843 with other applications?

Yes, airSlate SignNow allows seamless integration of form 3843 with popular applications like Salesforce, G Suite, and more. This connectivity enhances workflow automation and ensures that your team can manage documents efficiently. Integrating tools around form 3843 maximizes productivity and collaboration.

-

Is form 3843 compliant with legal standards?

Absolutely! The form 3843 processed through airSlate SignNow meets industry-leading security and compliance standards, including ESIGN and UETA Acts. This means you can trust that your signed documents are legally valid and secure. Our platform prioritizes the confidentiality and integrity of your data.

-

What features can I expect when using airSlate SignNow for form 3843?

When using airSlate SignNow for the form 3843, you will enjoy features such as customizable templates, workflow automation, and audit trails. These tools simplify the signing process and provide valuable insights into your document handling. The robust functionality helps you manage form 3843 with ease.

-

How can I simplify my workflow with form 3843?

With airSlate SignNow, you can simplify your workflow associated with the form 3843 by utilizing automation tools that handle repetitive tasks. Customizable workflows ensure that each stage of your document processing is efficient. This approach not only saves time but also minimizes errors in your form 3843 submissions.

Get more for Form 3893 Fill Out & Sign Online

Find out other Form 3893 Fill Out & Sign Online

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple