Www Taxformfinder Orgcaliforniaform 3843California Form 3843 Payment Voucher for Fiduciary E Filed 2020

Understanding the California Form 3843 Payment Voucher for Fiduciaries

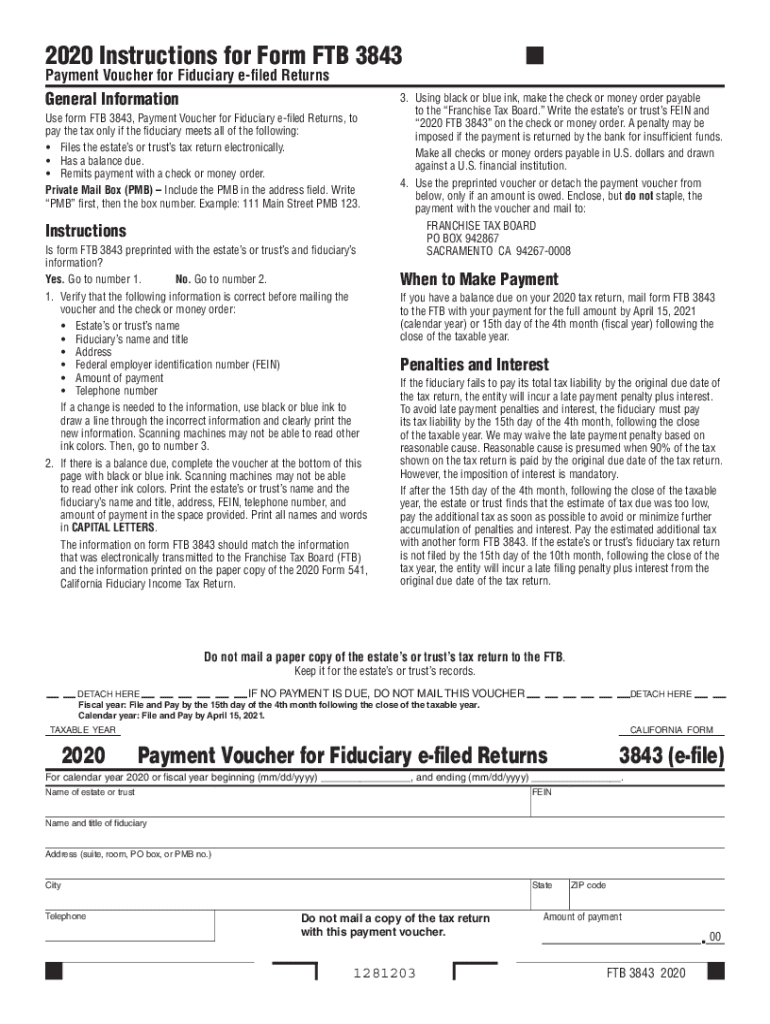

The California Form 3843, commonly referred to as the 3843 payment voucher, is specifically designed for fiduciaries to report and remit tax payments on behalf of estates or trusts. This form is essential for ensuring compliance with California tax laws and helps facilitate the proper handling of fiduciary responsibilities. It serves as a payment voucher, allowing fiduciaries to submit payments to the California Franchise Tax Board (FTB) for taxes owed by the estate or trust.

Steps to Complete the California Form 3843

Completing the California Form 3843 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to the estate or trust. This includes income, deductions, and any applicable tax credits. Next, accurately fill out the form, ensuring that all required fields are completed. Double-check the calculations to avoid errors that could lead to penalties. Finally, submit the form along with the payment to the appropriate address provided by the California FTB.

Legal Use of the California Form 3843 Payment Voucher

The legal use of the California Form 3843 is critical for fiduciaries managing estates or trusts. This form must be used in accordance with California tax regulations to ensure that tax payments are processed correctly. The completed form serves as proof of payment and compliance, which can be essential in the event of an audit or inquiry by the California FTB. Using this form properly helps fiduciaries fulfill their legal obligations and protects them from potential liabilities.

Filing Deadlines for the California Form 3843

Filing deadlines for the California Form 3843 are crucial for fiduciaries to remember. Typically, the payment voucher is due on or before the tax return due date for the estate or trust. It is important to check the specific deadlines each tax year, as they may vary based on the estate's or trust's fiscal year and any extensions that may apply. Timely submission of the form and payment helps avoid penalties and interest charges.

Form Submission Methods for the California Form 3843

The California Form 3843 can be submitted through various methods, providing flexibility for fiduciaries. The form can be filed online through the California FTB's e-file system, which offers a convenient and efficient way to submit payments. Alternatively, fiduciaries may choose to mail the completed form along with the payment to the address specified by the FTB. In-person submissions may also be possible at designated FTB offices, depending on local regulations and availability.

Key Elements of the California Form 3843

Key elements of the California Form 3843 include essential information that fiduciaries must provide. This includes the name and address of the fiduciary, details about the estate or trust, and the amount of tax payment being submitted. Additionally, the form requires the fiduciary's signature, affirming the accuracy of the information provided. Understanding these elements is vital for ensuring that the form is filled out correctly and complies with California tax laws.

Quick guide on how to complete wwwtaxformfinderorgcaliforniaform 3843california form 3843 payment voucher for fiduciary e filed

Effortlessly prepare Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed on any device

Digital document management has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your papers quickly without delays. Manage Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed easily

- Find Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgcaliforniaform 3843california form 3843 payment voucher for fiduciary e filed

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgcaliforniaform 3843california form 3843 payment voucher for fiduciary e filed

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF on Android devices

People also ask

-

What is FTB 3843 and how does it relate to airSlate SignNow?

FTB 3843 is a form used in California for tax purposes, and airSlate SignNow can help businesses complete and eSign this document efficiently. Our platform simplifies the process of filling out, submitting, and tracking FTB 3843 forms, ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for handling FTB 3843?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including those needing to manage FTB 3843 forms. You can start with a free trial, after which the plans are designed to be cost-effective, allowing unlimited eSignatures for all your important documents.

-

What features make airSlate SignNow ideal for handling FTB 3843?

airSlate SignNow provides essential features like customizable templates, automatic reminders, and secure cloud storage, making it perfect for managing FTB 3843. These features enhance your workflow efficiency and ensure that your documents are handled seamlessly and securely.

-

Can I integrate airSlate SignNow with other software for FTB 3843 processing?

Yes, airSlate SignNow offers seamless integrations with various platforms like CRM systems and productivity tools that enhance the management of FTB 3843 forms. These integrations allow for streamlined data entry and improved document workflows, saving you time and effort.

-

What benefits does airSlate SignNow provide when using FTB 3843?

Using airSlate SignNow for your FTB 3843 documents brings numerous benefits, including increased speed and accuracy in document management. Moreover, our platform ensures that your submissions are legally binding and secure, allowing you to focus on your business growth.

-

Is airSlate SignNow user-friendly for filling out FTB 3843?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to fill out and eSign FTB 3843 forms. Our intuitive interface guides you through the process, ensuring you can complete your documents without any hassles.

-

How does airSlate SignNow ensure the security of my FTB 3843 documents?

airSlate SignNow prioritizes the security of your documents, employing industry-leading encryption and compliance measures. When using our platform for FTB 3843, you can trust that your sensitive information is protected against unauthorized access.

Get more for Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed

Find out other Www taxformfinder orgcaliforniaform 3843California Form 3843 Payment Voucher For Fiduciary E filed

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free