CD 405 Web 7 24 for Calendar Year or Other T 2024-2026

Understanding the CD 405 Form

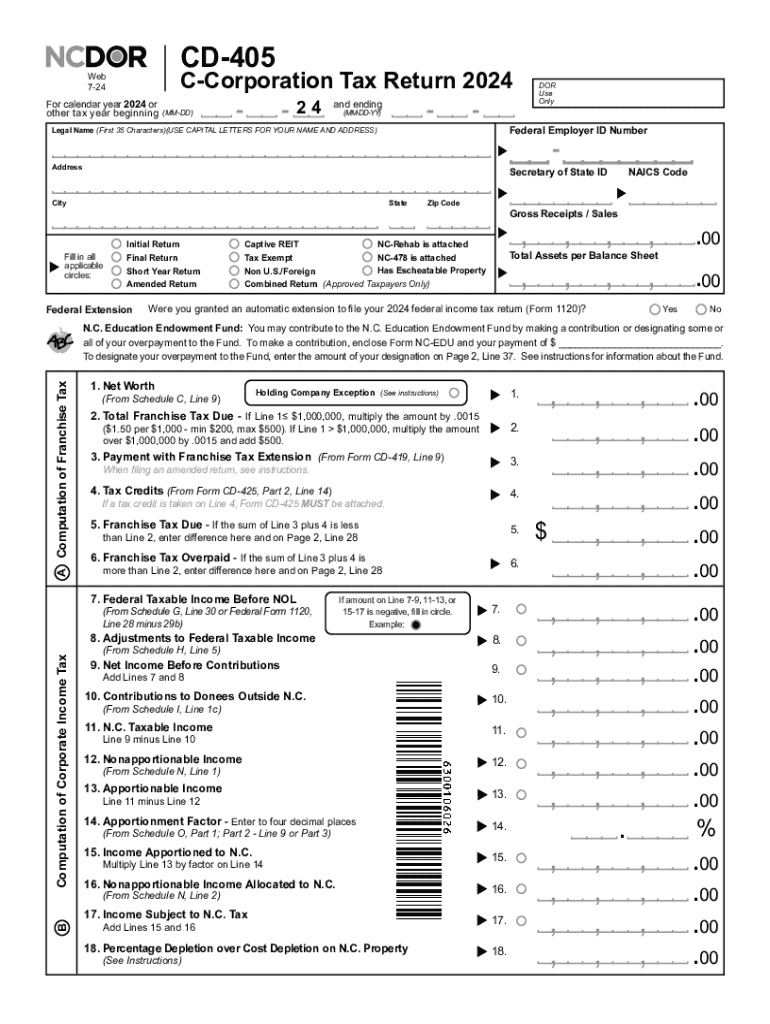

The CD 405 form, officially known as the North Carolina Corporate Tax Return, is a crucial document for corporations operating in North Carolina. This form is utilized to report the corporation's income, deductions, and credits to the North Carolina Department of Revenue (NCDOR). Filing this form accurately is essential for compliance with state tax laws.

Steps to Complete the CD 405 Form

Completing the CD 405 form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate financial information, ensuring all income and deductions are reported.

- Review the form for accuracy, checking for any mathematical errors or missing information.

- Sign and date the form before submission, as an unsigned form may be considered invalid.

Filing Deadlines for the CD 405 Form

Corporations must be aware of the filing deadlines for the CD 405 form to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but must be requested prior to the original deadline.

Legal Use of the CD 405 Form

The CD 405 form serves a legal purpose in ensuring that corporations comply with North Carolina tax regulations. It is essential for corporations to file this form accurately to avoid legal repercussions, such as fines or audits. Understanding the legal implications of the information provided on the form is crucial for corporate compliance.

Required Documents for the CD 405 Form

When preparing to file the CD 405 form, several documents are required:

- Financial statements, including profit and loss statements.

- Documentation of any tax credits or deductions claimed.

- Previous year’s tax return for reference.

Who Issues the CD 405 Form

The North Carolina Department of Revenue is the issuing authority for the CD 405 form. This department oversees the collection of state taxes and ensures compliance with tax laws. Corporations should refer to the NCDOR for any updates or changes to the form or filing requirements.

Examples of Using the CD 405 Form

Corporations of various types, including limited liability companies (LLCs) and C-corporations, must use the CD 405 form to report their income and pay state taxes. For instance, a manufacturing company must report its sales revenue, while a service-based business will report its service income. Each corporation must tailor its filing to accurately reflect its unique financial situation.

Create this form in 5 minutes or less

Find and fill out the correct cd 405 web 7 24 for calendar year or other t

Create this form in 5 minutes!

How to create an eSignature for the cd 405 web 7 24 for calendar year or other t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cd 405 feature in airSlate SignNow?

The cd 405 feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, making it easier for businesses to manage their workflows efficiently.

-

How does pricing work for the cd 405 feature?

Pricing for the cd 405 feature in airSlate SignNow is designed to be cost-effective for businesses of all sizes. You can choose from various subscription plans that cater to your specific needs, ensuring you only pay for what you use.

-

What are the key benefits of using cd 405?

Using the cd 405 feature enhances productivity by reducing the time spent on document management. It also improves security with encrypted signatures, ensuring that your documents are safe and compliant with legal standards.

-

Can cd 405 integrate with other software?

Yes, the cd 405 feature in airSlate SignNow seamlessly integrates with various software applications. This allows businesses to connect their existing tools and automate workflows, enhancing overall efficiency.

-

Is the cd 405 feature suitable for small businesses?

Absolutely! The cd 405 feature is designed to be user-friendly and cost-effective, making it ideal for small businesses. It helps them manage their document signing needs without the complexity of traditional solutions.

-

What types of documents can I send using cd 405?

With the cd 405 feature, you can send a wide range of documents for eSigning, including contracts, agreements, and forms. This versatility makes it a valuable tool for various industries and business needs.

-

How secure is the cd 405 feature?

The cd 405 feature in airSlate SignNow prioritizes security with advanced encryption and authentication measures. This ensures that all documents are protected and that the signing process meets industry standards for security.

Get more for CD 405 Web 7 24 For Calendar Year Or Other T

- Mn form instructions 2018 2019

- 2019 mwr reciprocity exemptionaffidavit of residency form

- Personal income tax employee business expense affidavit rev 775 form

- Credit for military service in a combat zone form

- 2017 nj 1065 instructions for njpartnership return 2017 nj 1065 instructions for njpartnership return form

- 2015 nj 2017 2019 form

- Submitter form nj efw2 s 2018 2019

- Tax compliance certification oregon form

Find out other CD 405 Web 7 24 For Calendar Year Or Other T

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document