405 Nc Formpdffillercom 2015

What is the 405 Nc Formpdffillercom

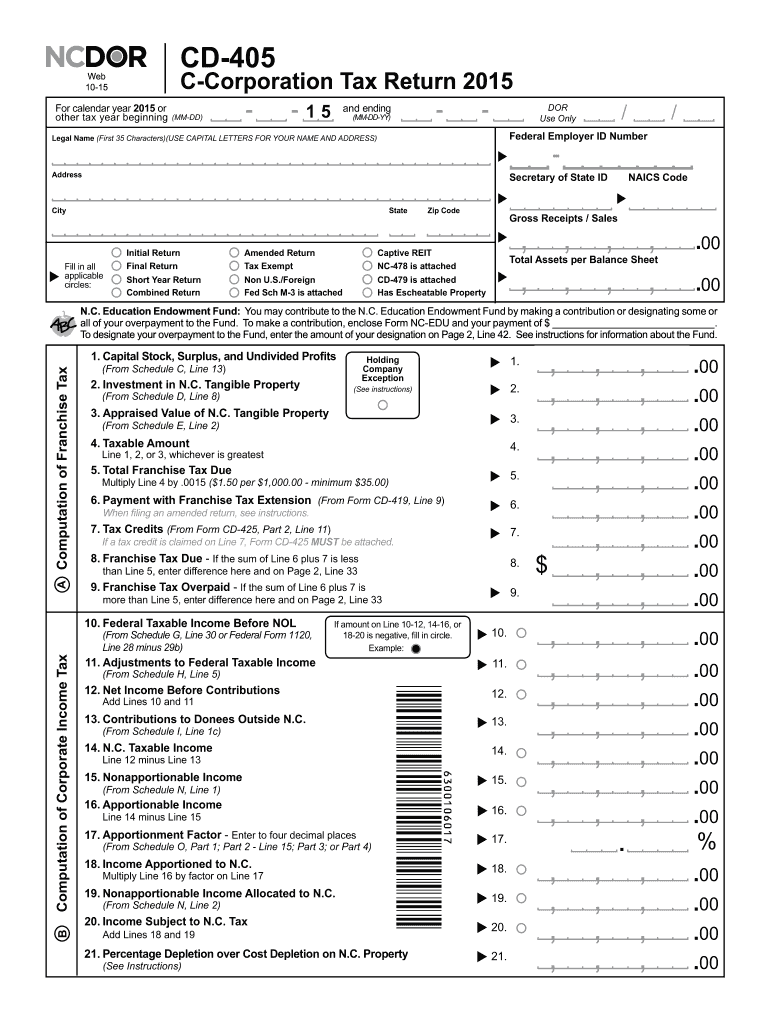

The 405 Nc Formpdffillercom is a specific document used primarily for tax reporting purposes in the United States. It is designed to facilitate the completion and submission of necessary tax information to the appropriate authorities. This form includes sections for personal and financial details, ensuring that taxpayers can accurately report their income and deductions. The digital format allows users to fill out the form online, enhancing accessibility and efficiency.

How to use the 405 Nc Formpdffillercom

Using the 405 Nc Formpdffillercom involves several straightforward steps. First, access the form through a secure online platform. Once opened, enter the required information in the designated fields. It is essential to review all entries for accuracy before proceeding. After completing the form, you can eSign it using a reliable eSignature solution. This process ensures that your submission is legally binding and compliant with IRS regulations.

Steps to complete the 405 Nc Formpdffillercom

Completing the 405 Nc Formpdffillercom can be broken down into clear steps:

- Access the form through a secure online platform.

- Fill in your personal details, including name, address, and Social Security number.

- Provide your financial information, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- eSign the document using a compliant eSignature solution.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the 405 Nc Formpdffillercom

The 405 Nc Formpdffillercom is legally recognized for tax reporting and compliance in the United States. When completed and signed, it serves as an official document that can be submitted to the IRS or relevant state authorities. The use of eSignatures on this form is supported under the ESIGN Act, which ensures that electronic signatures hold the same legal weight as traditional handwritten signatures. This legal recognition simplifies the filing process and enhances security.

Filing Deadlines / Important Dates

Filing deadlines for the 405 Nc Formpdffillercom vary based on individual circumstances, such as whether you are self-employed or filing jointly. Generally, the deadline for individual tax returns falls on April fifteenth each year. It is crucial to keep track of these dates to avoid penalties. Extensions may be available, but they require timely submission of the appropriate forms to the IRS.

Required Documents

To complete the 405 Nc Formpdffillercom, you will need several supporting documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process and ensure that all necessary information is accurately reported.

Quick guide on how to complete 405 nc formpdffillercom 2015

Your assistance manual on how to prepare your 405 Nc Formpdffillercom

If you’re interested in learning how to generate and submit your 405 Nc Formpdffillercom, here are some concise instructions on how to simplify tax reporting signNowly.

To start, you simply need to create your airSlate SignNow account to transform your online documentation handling. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to adjust, produce, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and revisit answers as required. Streamline your tax administration with superior PDF editing, eSigning, and simple sharing.

Adhere to the instructions below to complete your 405 Nc Formpdffillercom swiftly:

- Establish your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax document; browse through various versions and schedules.

- Click Obtain form to access your 405 Nc Formpdffillercom in our editor.

- Fill in the necessary fields with your details (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-recognized electronic signature (if required).

- Review your document and correct any mistakes.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in hard copy may increase return errors and delay refunds. Additionally, before e-filing your taxes, ensure to check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 405 nc formpdffillercom 2015

FAQs

-

How can I fill out an ITR for year 2015-16?

Try ClearTax, the easiest e-filing platform in India

-

Do we need the updated caste validity certificate of OBC-NC layer in filling out the application form of the NIACL AO 2018 or would the details of the certificate last updated in December 2015 go?

yes, you do need an updated caste certificate. Notification clearly indicates that the caste certificate should have been issued after 31–03–2018. (read page 11, subsection (b) ).

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I received Worker's Compensation in 2015, how could I find out how much I received in payments for filling out the FAFSA?

US workers compensation insurance carriers, third party claims administrators and self insureds all keep detailed records on how much they have paid on a given claim. It is broken down into medical payments and indemnity payments and claim expenses.For FAFSA's purposes , you want the indemnity payments which consists of lost time benefits and any settlement or award for your wage loss or disability.If you received a settlement or an award that was paid in a lump sum, it may have been a blend of medical and indemnity which makes it harder to break into accurate components. If there was a settlement, the document itself may recite how much was allocated to disability , disputed lost time, etc.Usually when a person has a lawyer, the carrier will not ( is ethically prohibited , actually) from talking directly to the claimant. However, for administrative things, the claim adjuster should be willing to give you the information needed. If the case is being litigated, your lawyers office needs to make the call. Regardless, it is simple and easy to retrieve on the carrier's end.There will not be a 1099 or W2. Also, worker's compensation benefits are not considered income under the Internal Revenue Code, so look carefully at the way FAFSA asks the question- you may not need this after all.

Create this form in 5 minutes!

How to create an eSignature for the 405 nc formpdffillercom 2015

How to create an eSignature for the 405 Nc Formpdffillercom 2015 in the online mode

How to create an electronic signature for the 405 Nc Formpdffillercom 2015 in Chrome

How to generate an eSignature for signing the 405 Nc Formpdffillercom 2015 in Gmail

How to create an electronic signature for the 405 Nc Formpdffillercom 2015 right from your mobile device

How to create an eSignature for the 405 Nc Formpdffillercom 2015 on iOS devices

How to create an eSignature for the 405 Nc Formpdffillercom 2015 on Android OS

People also ask

-

What is the 405 Nc FormsignNowcom and how can airSlate SignNow help?

The 405 Nc FormsignNowcom is a specific form used in North Carolina for various legal and administrative purposes. With airSlate SignNow, businesses can easily fill out and eSign this form online, streamlining the process and ensuring compliance. Our platform provides a user-friendly interface and robust features to enhance your document management.

-

How much does it cost to use airSlate SignNow for 405 Nc FormsignNowcom?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those who frequently work with the 405 Nc FormsignNowcom. You can choose from monthly or annual subscriptions, which provide access to our full suite of eSigning and document management features. Check our pricing page for the latest offers.

-

What features does airSlate SignNow offer for the 405 Nc FormsignNowcom?

airSlate SignNow provides a variety of features specifically designed to simplify the completion of the 405 Nc FormsignNowcom. These include customizable templates, collaboration tools, and secure eSignature capabilities. Our platform ensures that you can manage, sign, and store your documents efficiently.

-

Is airSlate SignNow secure for handling the 405 Nc FormsignNowcom?

Yes, airSlate SignNow prioritizes security and compliance when it comes to handling sensitive documents like the 405 Nc FormsignNowcom. We utilize advanced encryption and authentication measures to protect your data. Our platform is designed to meet industry standards, ensuring your information remains safe.

-

Can I integrate airSlate SignNow with other applications for the 405 Nc FormsignNowcom?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage the 405 Nc FormsignNowcom within your existing workflows. Whether you're using CRM software, cloud storage, or project management tools, our platform allows for smooth connectivity and enhanced productivity.

-

How can I get started with airSlate SignNow for the 405 Nc FormsignNowcom?

Getting started with airSlate SignNow for the 405 Nc FormsignNowcom is simple. You can sign up for a free trial on our website, which allows you to explore our features without any commitment. Once registered, you can start creating, filling out, and eSigning your documents right away.

-

What are the benefits of using airSlate SignNow for the 405 Nc FormsignNowcom?

Using airSlate SignNow for the 405 Nc FormsignNowcom offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform allows for quick document turnaround times and easy tracking of signatures, which can signNowly improve your business processes. Additionally, our cost-effective solution helps save time and resources.

Get more for 405 Nc Formpdffillercom

- Other state tax creditftbcagov state of california form

- 2020 ftb publication 1005 pension and annuity guidelines 2020 ftb publication 1005 pension and annuity guidelines form

- 2020 form 3526 investment interest expense deduction 2020 form 3526 investment interest expense deduction

- Printable 2020 california form 3800 tax computation for certain children with unearned income

- Printable 2020 california form 3581 tax deposit refund and transfer request

- Printable 2020 colorado form 104amt alternative minimum tax schedule

- Colorado form dr 0810 medical savings account employee

- Printable 2020 delaware form 200 02x non resident amended income tax return

Find out other 405 Nc Formpdffillercom

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter