405 Nc Formpdffillercom 2016

What is the 405 Nc Formpdffillercom

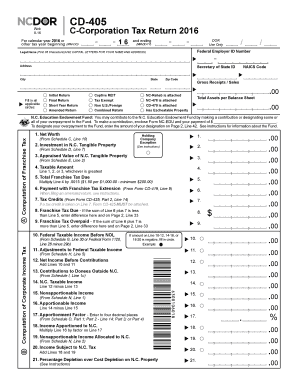

The 405 Nc Formpdffillercom is a specific form used for tax reporting purposes in the United States. It is designed to facilitate the accurate reporting of income and other financial information to the Internal Revenue Service (IRS). This form includes fillable fields that allow users to enter their relevant data directly online, ensuring compliance with federal regulations. The form is particularly important for taxpayers who need to report their earnings and claim deductions or credits accurately.

How to use the 405 Nc Formpdffillercom

Using the 405 Nc Formpdffillercom involves several straightforward steps. First, access the form through a reliable platform that supports digital completion. Once you have the form open, begin by filling in the required fields with your personal and financial information. Ensure that all entries are accurate and complete. After filling out the form, review it for any errors before proceeding to sign it electronically. This process streamlines your tax reporting and helps ensure timely submission to the IRS.

Steps to complete the 405 Nc Formpdffillercom

Completing the 405 Nc Formpdffillercom can be done efficiently by following these steps:

- Access the form from a trusted digital platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income, deductions, and any applicable credits.

- Review all entries for accuracy and completeness.

- Sign the form electronically using an eSignature solution.

- Submit the completed form to the IRS by the designated filing deadline.

Legal use of the 405 Nc Formpdffillercom

The legal use of the 405 Nc Formpdffillercom is essential for ensuring compliance with IRS regulations. This form must be completed accurately to avoid potential legal issues, such as penalties for incorrect reporting. The IRS allows the use of electronic signatures for this form, which enhances its validity and makes it easier for taxpayers to file their returns. It is crucial to adhere to the guidelines set forth by the IRS when using this form to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 405 Nc Formpdffillercom are critical for taxpayers to observe. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates and ensure that the form is submitted on time to avoid late fees or penalties. Marking these dates on your calendar can help you stay organized and compliant.

Form Submission Methods (Online / Mail / In-Person)

The 405 Nc Formpdffillercom can be submitted through various methods, providing flexibility for taxpayers. The primary method is online submission, which is often the quickest and most efficient way to file. Alternatively, taxpayers may choose to print the completed form and submit it via mail. In-person submissions are also possible at designated IRS offices, although this may require an appointment. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete 405 nc formpdffillercom 2016

Your assistance manual for preparing your 405 Nc Formpdffillercom

If you’re curious about how to finalize and send your 405 Nc Formpdffillercom, here are some brief instructions to simplify the tax filing process.

To begin, simply set up your airSlate SignNow account to revolutionize your handling of documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your tax paperwork with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revisit to change responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your 405 Nc Formpdffillercom in a matter of minutes:

- Create your account and start working on PDFs within moments.

- Refer to our directory to find any IRS tax form; browse through editions and schedules.

- Click Get form to open your 405 Nc Formpdffillercom in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Please remember that filing on paper may lead to increased errors and delayed refunds. Furthermore, prior to e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 405 nc formpdffillercom 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How many CUDA related jobs are expected to be filled by 2016?

According to sites like CareerBuilder about 13 job were posted that had some CUDA related and about 32 OpenCL jobs were posted on 2-6-2016. assuming this is an average rate of CUDA jobs and there are about 30 days per month the about 156 jobs per year would be posted on CareerBuilder. This is only an estimate not real figures of posting. Lets however assume about ninety percent of these job are real job and not re-posting recruiters the the number of jobs are about 140 per year. I would think most of the job would be in finance, graphic arts, or scientific computing. I would think the number is low because the limited uses of GPU hardware and CUDA is only for nVidia chipset. Also I am not including people who are not working on CUDA project right not but I think you could fine better data on the nVidia website for total CUDA chip sales to which industry.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

Create this form in 5 minutes!

How to create an eSignature for the 405 nc formpdffillercom 2016

How to make an electronic signature for your 405 Nc Formpdffillercom 2016 in the online mode

How to make an electronic signature for your 405 Nc Formpdffillercom 2016 in Google Chrome

How to make an eSignature for putting it on the 405 Nc Formpdffillercom 2016 in Gmail

How to create an eSignature for the 405 Nc Formpdffillercom 2016 straight from your smart phone

How to make an electronic signature for the 405 Nc Formpdffillercom 2016 on iOS

How to generate an eSignature for the 405 Nc Formpdffillercom 2016 on Android

People also ask

-

What is the 405 Nc FormsignNowcom and how can it help my business?

The 405 Nc FormsignNowcom is an essential tool for businesses looking to streamline their document signing process. With airSlate SignNow, you can easily fill out, send, and eSign the 405 Nc FormsignNowcom, making document management efficient and hassle-free. This feature not only saves time but also ensures compliance with legal standards.

-

How much does airSlate SignNow cost for using the 405 Nc FormsignNowcom?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including access to the 405 Nc FormsignNowcom. Our pricing is designed to be cost-effective, allowing businesses of all sizes to benefit from our eSigning solutions without breaking the bank. Check our website for detailed pricing information and special offers.

-

What features does airSlate SignNow provide for the 405 Nc FormsignNowcom?

When using the 405 Nc FormsignNowcom with airSlate SignNow, you'll enjoy features such as customizable templates, secure document storage, and real-time tracking of signatures. Additionally, our user-friendly interface makes it simple for anyone to manage their documents efficiently. This ensures that your business stays organized and productive.

-

Can I integrate the 405 Nc FormsignNowcom with other applications?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow when using the 405 Nc FormsignNowcom. Whether you use CRM systems, cloud storage, or productivity tools, our platform can connect with them, ensuring that your document management is as streamlined as possible. Check our integrations page for a complete list.

-

Is it secure to use airSlate SignNow for the 405 Nc FormsignNowcom?

Absolutely! airSlate SignNow takes security seriously, especially when handling sensitive documents like the 405 Nc FormsignNowcom. We use advanced encryption protocols and compliance with industry standards to ensure that your data remains safe and confidential throughout the signing process.

-

How can I get started with airSlate SignNow for the 405 Nc FormsignNowcom?

Getting started with airSlate SignNow for the 405 Nc FormsignNowcom is easy! Simply visit our website, sign up for an account, and explore our resources to learn how to fill out and eSign documents. Our user-friendly platform provides step-by-step guidance to help you maximize its features.

-

What are the benefits of using airSlate SignNow for the 405 Nc FormsignNowcom?

Using airSlate SignNow for the 405 Nc FormsignNowcom provides numerous benefits, including faster processing times, reduced paperwork, and enhanced collaboration. Businesses can enjoy a more efficient workflow, allowing teams to focus on what matters most while ensuring legal compliance and security.

Get more for 405 Nc Formpdffillercom

Find out other 405 Nc Formpdffillercom

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free