CD 405 C Corporation Tax Return Web 7 23 for 2023

What is the CD 405 C Corporation Tax Return?

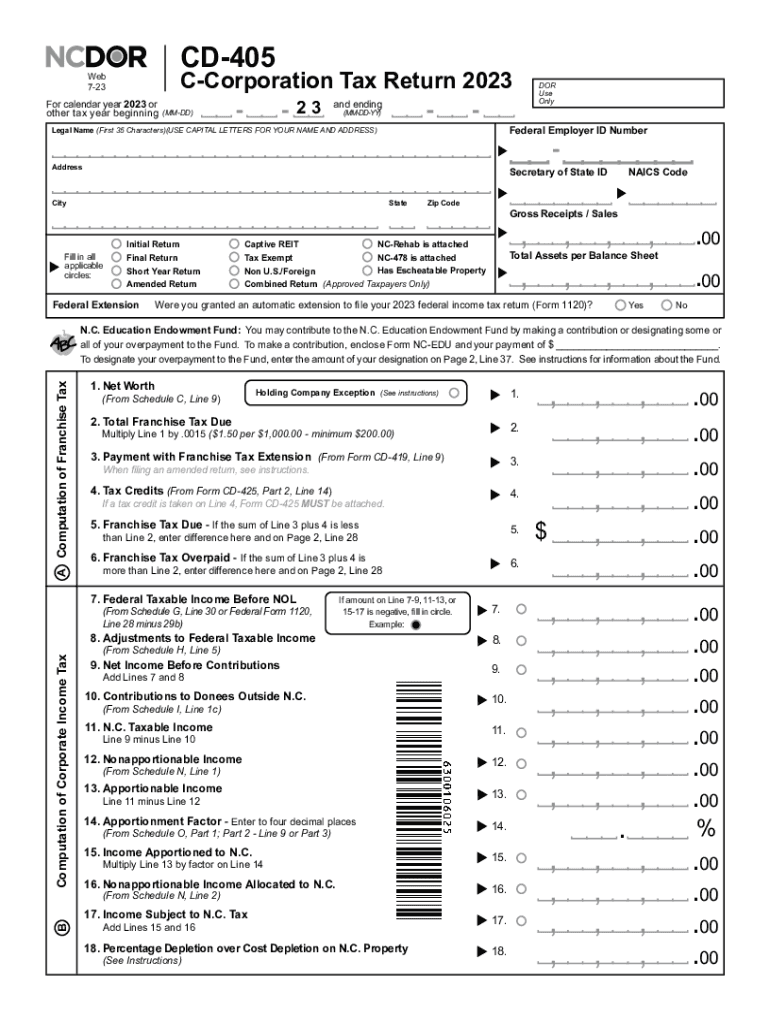

The CD 405 C Corporation Tax Return is a specific form used by corporations operating in North Carolina to report their income, deductions, and tax liability to the state. This form is essential for compliance with North Carolina's corporate tax laws. It captures various financial details, including gross income, deductions, and credits, allowing the state to assess the corporation's tax obligations accurately. Understanding the purpose of the CD 405 is crucial for businesses to ensure they meet their tax responsibilities effectively.

Steps to Complete the CD 405 C Corporation Tax Return

Completing the CD 405 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering your corporation's gross income, allowable deductions, and any applicable tax credits. Be sure to review the instructions for the CD 405 to understand specific line items and calculations. After completing the form, double-check for any errors or omissions before submission. Finally, ensure that you file the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the CD 405 are critical for corporations to avoid late fees and penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as state regulations may adjust them. Marking these dates on your calendar can help ensure timely compliance.

Required Documents for the CD 405

When preparing to file the CD 405, certain documents are required to support the information reported on the form. Key documents include financial statements, such as profit and loss statements, balance sheets, and any relevant tax documentation. Additionally, corporations should have records of deductions and credits claimed, as well as any supporting documentation for these items. Having these documents organized and ready will facilitate a smoother filing process.

Key Elements of the CD 405 C Corporation Tax Return

The CD 405 includes several key elements that are essential for accurate tax reporting. This includes sections for reporting gross income, which encompasses all revenue generated by the corporation. Deductions are also a significant component, allowing corporations to reduce their taxable income by reporting business expenses. Additionally, the form requires information on tax credits that may apply, which can further decrease the overall tax liability. Understanding these elements is vital for effective tax planning and compliance.

State-Specific Rules for the CD 405

North Carolina has specific rules and regulations that govern the completion and submission of the CD 405. These include unique tax rates, allowable deductions, and credits that differ from federal tax guidelines. Corporations must be aware of these state-specific rules to ensure compliance and optimize their tax position. Regularly reviewing the North Carolina Department of Revenue's updates can provide valuable information on any changes to these regulations.

Quick guide on how to complete cd 405 c corporation tax return web 7 23 for

Complete CD 405 C Corporation Tax Return Web 7 23 For effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without interruptions. Handle CD 405 C Corporation Tax Return Web 7 23 For on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign CD 405 C Corporation Tax Return Web 7 23 For without hassle

- Find CD 405 C Corporation Tax Return Web 7 23 For and click on Get Form to begin.

- Utilize the tools we supply to complete your form.

- Emphasize pertinent sections of your documents or obscure private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form quests, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign CD 405 C Corporation Tax Return Web 7 23 For and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cd 405 c corporation tax return web 7 23 for

Create this form in 5 minutes!

How to create an eSignature for the cd 405 c corporation tax return web 7 23 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NC corporation tax?

NC corporation tax is a tax imposed on the income of corporations registered in North Carolina. It is important for businesses to understand this tax to ensure compliance and avoid penalties. Familiarizing yourself with the NC corporation tax will help you manage your financial responsibilities effectively.

-

How does airSlate SignNow help with NC corporation tax documentation?

airSlate SignNow streamlines the process of signing and managing documents necessary for NC corporation tax returns. By using our easy-to-use eSigning solution, businesses can ensure that their tax documents are completed accurately and submitted on time. This saves valuable time and helps maintain compliance.

-

Is airSlate SignNow cost-effective for small businesses dealing with NC corporation tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing NC corporation tax. Our pricing plans are designed to accommodate various business sizes, ensuring that even small businesses can afford an efficient eSigning solution. Lower document management costs can lead to signNow savings during tax season.

-

What features does airSlate SignNow offer to assist with NC corporation tax filings?

airSlate SignNow offers features like customizable templates, secure document storage, and real-time collaboration to assist with NC corporation tax filings. These features enable businesses to create structured documents quickly while ensuring all necessary information is included for tax compliance. Additionally, automated reminders help keep track of important tax dates.

-

Can airSlate SignNow integrate with accounting software for NC corporation tax?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, making the process of managing NC corporation tax more efficient. These integrations allow for easy data transfer and document sharing, ensuring your financial records are consistent and up to date.

-

What are the benefits of using airSlate SignNow for NC corporation tax documents?

By using airSlate SignNow for NC corporation tax documents, businesses benefit from enhanced efficiency and reduced errors due to the electronic signing process. Our solution also provides a secure platform for document management, ensuring your sensitive information is protected. Moreover, faster turnaround times can lead to timely tax submissions and compliance.

-

How can I ensure compliance with NC corporation tax using airSlate SignNow?

To ensure compliance with NC corporation tax, airSlate SignNow provides tools for tracking document statuses and access to comprehensive templates. By using these features, businesses can ensure that all required forms are properly completed and submitted in accordance with state guidelines. This proactive approach can help prevent any potential issues.

Get more for CD 405 C Corporation Tax Return Web 7 23 For

- Transcript request students atlanta metro college form

- College admission appeal letter form

- Respiratory protection program102009final hampshire form

- Hanover county public schools volunteer form

- Checklist eyewash station form

- Gwinnett county high school transcripts form

- On site supervisor evaluation form school of education soe unc

- Ngintod form

Find out other CD 405 C Corporation Tax Return Web 7 23 For

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter