Irs Form 1040 Schedule B 2010

What is the IRS Form 1040 Schedule B

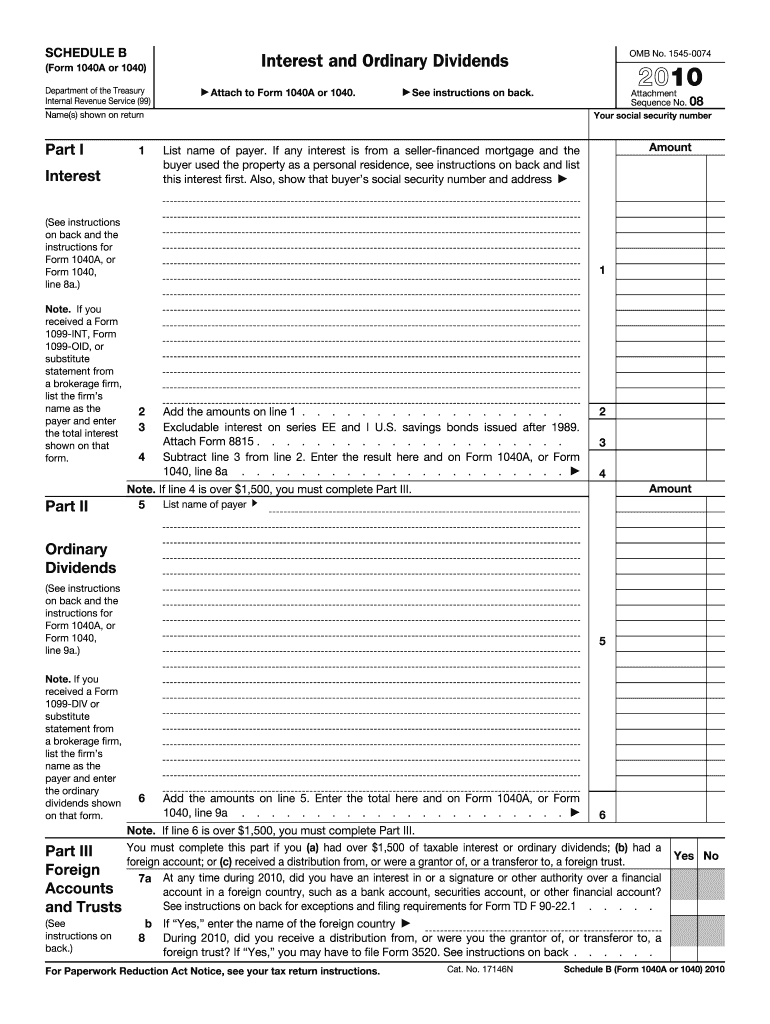

The IRS Form 1040 Schedule B is a supplementary form used by individual taxpayers in the United States to report interest and ordinary dividends. This form is crucial for those who receive more than $1,500 in taxable interest or dividends during the tax year. It helps the IRS ensure that all income is accurately reported and taxed accordingly. The information provided on Schedule B is then transferred to the main Form 1040, which is the standard individual income tax return.

How to use the IRS Form 1040 Schedule B

Using the IRS Form 1040 Schedule B involves several steps. First, gather all relevant financial documents that detail your interest and dividend income. This may include bank statements, brokerage statements, and any other documentation that reflects your earnings. Next, complete the form by entering the total amounts of interest and dividends in the appropriate sections. Ensure that you accurately report any foreign accounts if applicable, as this may have additional reporting requirements. Finally, attach Schedule B to your Form 1040 when filing your tax return, whether electronically or by mail.

Steps to complete the IRS Form 1040 Schedule B

Completing the IRS Form 1040 Schedule B requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including statements showing interest and dividend income.

- Fill out Part I of Schedule B, which covers interest income. List each source of interest income and the amount received.

- Complete Part II for dividend income, detailing each source and the corresponding amount.

- If you have foreign accounts, answer the questions regarding foreign financial accounts in the designated section.

- Review the completed form for accuracy before attaching it to your Form 1040.

Legal use of the IRS Form 1040 Schedule B

The IRS Form 1040 Schedule B is legally binding when accurately filled out and submitted as part of your tax return. It is essential to provide truthful and complete information, as discrepancies can lead to penalties or audits. The form must be signed and dated, affirming that the information is correct to the best of your knowledge. Understanding the legal implications of reporting income accurately is crucial for compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1040 and its accompanying Schedule B typically align with the annual tax filing deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may file for additional time, but must ensure that any taxes owed are paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 1040 Schedule B can be submitted through various methods. Taxpayers can file their returns electronically using approved tax software, which often simplifies the process by automatically generating the necessary forms. Alternatively, individuals may choose to mail their completed forms to the appropriate IRS address based on their state of residence. In-person submissions are generally not available, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 2010 irs form 1040 schedule b

Effortlessly Prepare Irs Form 1040 Schedule B on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents rapidly without any delays. Handle Irs Form 1040 Schedule B on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Irs Form 1040 Schedule B with Ease

- Locate Irs Form 1040 Schedule B and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information meticulously and click on the Done button to save your changes.

- Decide how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and electronically sign Irs Form 1040 Schedule B to ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 irs form 1040 schedule b

Create this form in 5 minutes!

How to create an eSignature for the 2010 irs form 1040 schedule b

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the purpose of Irs Form 1040 Schedule B?

Irs Form 1040 Schedule B is used to report interest and dividend income for taxpayers. By accurately completing this form, you provide the IRS with a breakdown of your income sources, which is essential for calculating your total tax liability. Failing to report this income can lead to penalties, making it crucial for compliance.

-

How can airSlate SignNow help with submitting Irs Form 1040 Schedule B?

airSlate SignNow allows users to electronically sign and submit their Irs Form 1040 Schedule B with ease. Our platform simplifies the paperwork process, ensuring that your forms are securely transmitted and legally binding. This helps you to focus on your finances rather than tedious paperwork.

-

What features does airSlate SignNow offer for Irs Form 1040 Schedule B?

airSlate SignNow offers a variety of features to streamline the submission of Irs Form 1040 Schedule B, including electronic signatures, document templates, and integration with popular accounting software. These tools are designed to enhance efficiency and accuracy when filing your taxes. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for filing Irs Form 1040 Schedule B?

Yes, airSlate SignNow is a cost-effective solution for filing Irs Form 1040 Schedule B. Our pricing plans are designed to meet various business needs, offering flexibility without sacrificing performance. You can save time and money by using our platform for your document management and eSigning needs.

-

What are the benefits of using airSlate SignNow for Irs Form 1040 Schedule B?

Using airSlate SignNow for your Irs Form 1040 Schedule B offers numerous benefits, such as enhanced security and compliance. Our platform ensures that your documents are encrypted and stored safely, minimizing the risk of data bsignNowes. Additionally, the ease of access and signature functionality speeds up your tax filing process.

-

Can I integrate airSlate SignNow with other software for Irs Form 1040 Schedule B?

Absolutely! airSlate SignNow offers seamless integration with various accounting software, which can help you manage and file your Irs Form 1040 Schedule B efficiently. This integration allows for automatic data population and simplifies tracking your tax documents, ensuring that you have everything organized in one place.

-

How does airSlate SignNow ensure compliance with Irs Form 1040 Schedule B?

airSlate SignNow is committed to ensuring compliance with Irs Form 1040 Schedule B and other tax regulations. Our platform maintains rigorous security standards and follows electronic signature laws to guarantee that your submitted documents are legally valid. This focus on compliance gives users peace of mind during tax season.

Get more for Irs Form 1040 Schedule B

Find out other Irs Form 1040 Schedule B

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast