1099 Int Form 2014

What is the 1099 Int Form

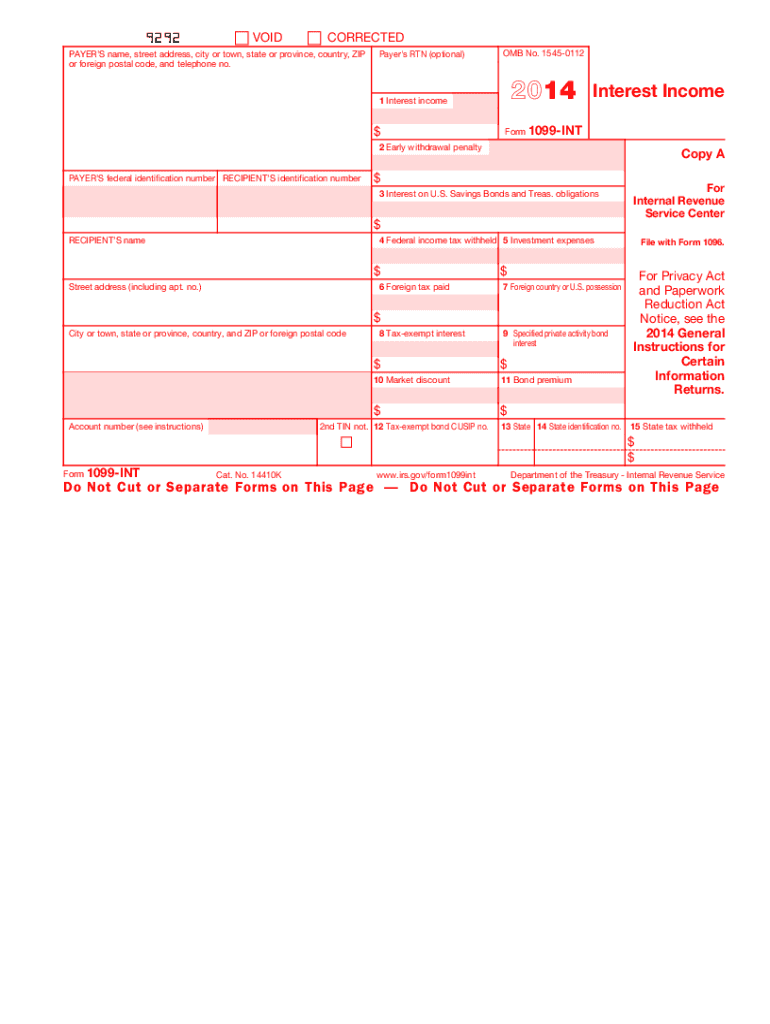

The 1099 Int Form is a tax document used in the United States to report interest income earned by individuals and businesses. This form is essential for taxpayers who have received interest payments from banks, financial institutions, or other entities. The information provided on the 1099 Int Form is used by the Internal Revenue Service (IRS) to ensure that taxpayers accurately report their income on their tax returns. It typically includes details such as the payer's name, the recipient's name, the amount of interest paid, and any federal income tax withheld.

How to use the 1099 Int Form

To effectively use the 1099 Int Form, taxpayers should first ensure they receive the form from any financial institution that has paid them interest during the tax year. Once received, it is important to review the form for accuracy. Taxpayers should then use the information on the form to complete their income tax return, typically on Schedule B of Form 1040. This ensures that all interest income is reported correctly, which is crucial for compliance with tax laws.

Steps to complete the 1099 Int Form

Completing the 1099 Int Form involves several key steps:

- Gather all relevant information, including your name, address, and taxpayer identification number.

- Obtain the 1099 Int Form from your bank or financial institution.

- Fill in the payer's information, including their name, address, and taxpayer identification number.

- Enter the total amount of interest earned in the appropriate box on the form.

- If applicable, include any federal income tax withheld.

- Review the completed form for accuracy before submission.

Legal use of the 1099 Int Form

The legal use of the 1099 Int Form is governed by IRS regulations. It must be filed by the payer for any interest payments exceeding ten dollars during the tax year. Failure to provide this form can result in penalties for the payer. Additionally, recipients must report the income shown on the form when filing their taxes to avoid underreporting income, which can lead to further penalties and interest charges from the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099 Int Form is crucial for compliance. Generally, the form must be sent to recipients by January thirty-first of the year following the tax year in which the interest was paid. Payers must also file the form with the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Keeping track of these dates helps avoid penalties and ensures timely reporting.

Who Issues the Form

The 1099 Int Form is issued by financial institutions, including banks, credit unions, and other entities that pay interest to individuals or businesses. These institutions are responsible for reporting the interest payments made to their clients and must provide a copy of the form to both the IRS and the recipient. It is important for recipients to keep track of all forms received to accurately report their interest income during tax filing.

Quick guide on how to complete 2014 1099 int form

Complete 1099 Int Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent sustainable option to traditional printed and signed papers, enabling you to access the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Manage 1099 Int Form on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign 1099 Int Form with ease

- Obtain 1099 Int Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and hit the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1099 Int Form while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1099 int form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1099 int form

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the 1099 Int Form and why do I need it?

The 1099 Int Form is used to report interest income received by individuals and businesses. If you earn interest income from banks or other financial institutions, you’ll need this form to report your earnings to the IRS. Using airSlate SignNow makes it easy to manage and sign your 1099 Int Form electronically, ensuring compliance and timely submission.

-

How can airSlate SignNow help with my 1099 Int Form?

With airSlate SignNow, you can easily create, send, and eSign your 1099 Int Form securely and efficiently. Our platform streamlines the process, allowing you to fill out necessary fields and collect signatures without the hassle of paper forms. This saves you time and improves accuracy in your tax reporting.

-

Is there a cost to use airSlate SignNow for the 1099 Int Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features specifically for managing forms like the 1099 Int Form. Our plans are designed to be cost-effective, providing you with the tools necessary for efficient document management and eSigning. You can choose a plan that fits your budget while ensuring compliance with IRS requirements.

-

What features does airSlate SignNow offer for the 1099 Int Form?

airSlate SignNow provides a range of features to enhance your experience with the 1099 Int Form, including customizable templates, secure storage, and real-time tracking of document status. Additionally, our platform supports multiple integrations, allowing you to connect with other services you use for tax preparation and financial management.

-

Can I integrate airSlate SignNow with other software for managing the 1099 Int Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your 1099 Int Form alongside your other financial documentation. This integration helps streamline your workflow and ensures that all your data is consistent and up-to-date.

-

How secure is airSlate SignNow for handling sensitive information on the 1099 Int Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your sensitive information on the 1099 Int Form, ensuring that your data is safe during transmission and storage. You can confidently manage your documents knowing that your privacy is safeguarded.

-

What are the benefits of using airSlate SignNow for eSigning my 1099 Int Form?

Using airSlate SignNow for eSigning your 1099 Int Form offers numerous benefits, including faster turnaround times and reduced paperwork. Our platform simplifies the signature process, allowing you to collect signatures from multiple parties easily and securely. This not only speeds up the filing process but also minimizes the risk of errors.

Get more for 1099 Int Form

- Child care subsidy form

- Statement of income for the renewal of the guaranteed income supplement the allowance or allowance for the survivor for payment form

- Publications and forms for importing vehicles and engines

- Pbc record suspension application guide guide form

- View the privacy notice statement at httpwww form

- Sample program completion letter pn form

- Wa vehicle impound form

- Dr 2183 form

Find out other 1099 Int Form

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast