Irs Capital Form 2013

What is the Irs Capital Form

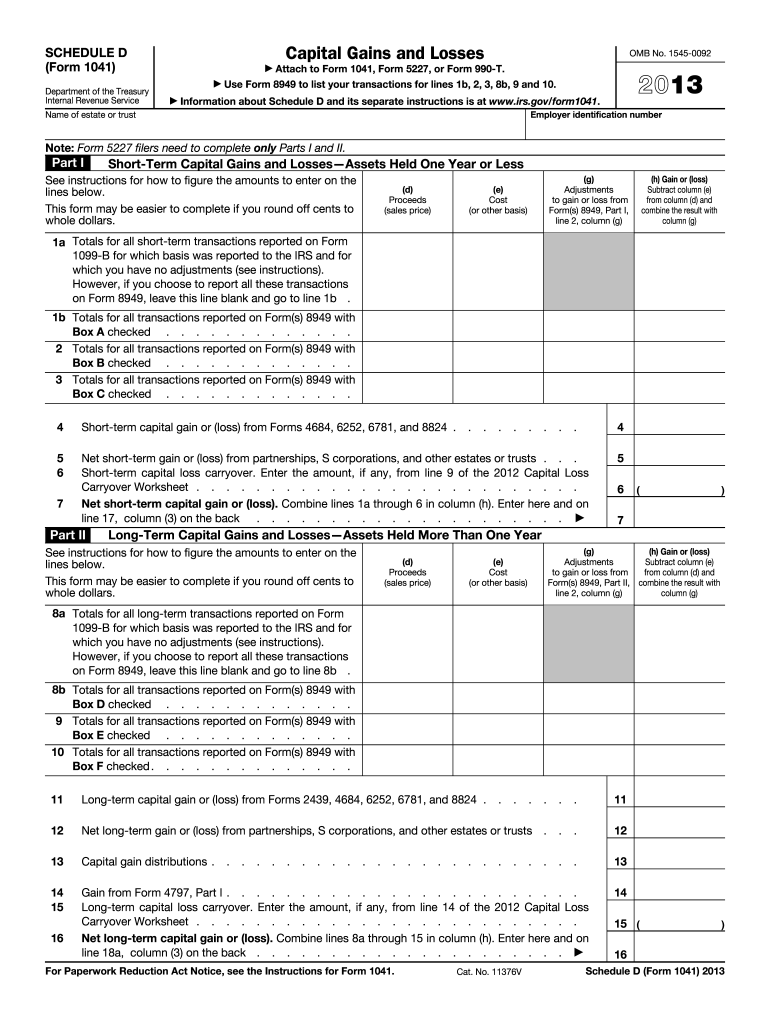

The Irs Capital Form is a specific document used in the United States tax system to report capital gains and losses. This form is essential for individuals and businesses that have engaged in the sale of assets such as stocks, bonds, or real estate. By accurately completing this form, taxpayers can determine their tax obligations related to these transactions. The information provided on the Irs Capital Form is used by the Internal Revenue Service (IRS) to assess the taxpayer's financial situation and ensure compliance with federal tax laws.

How to use the Irs Capital Form

Using the Irs Capital Form involves several key steps. First, gather all relevant financial records, including purchase and sale documents for the assets in question. Next, fill out the form by reporting the details of each transaction, including dates, amounts, and any associated costs. It is important to follow the IRS guidelines closely to ensure accurate reporting. After completing the form, review it for any errors before submitting it to the IRS. This careful attention to detail helps avoid potential issues with tax compliance.

Steps to complete the Irs Capital Form

Completing the Irs Capital Form requires a systematic approach. Begin by listing all assets sold during the tax year. For each asset, include the following information:

- Date of acquisition: When the asset was purchased.

- Date of sale: When the asset was sold.

- Sale price: The amount received from the sale.

- Cost basis: The original purchase price plus any additional costs incurred.

- Gain or loss: The difference between the sale price and the cost basis.

After entering all necessary information, calculate the total capital gains or losses for the tax year. Finally, ensure that the form is signed and dated before submission.

Legal use of the Irs Capital Form

The Irs Capital Form must be used in accordance with IRS regulations to ensure its legal validity. This includes providing accurate and truthful information regarding all transactions. Misreporting or failing to report capital gains can lead to penalties, including fines and interest on unpaid taxes. Additionally, utilizing a reliable eSignature platform can enhance the legal standing of the submitted form, as it ensures compliance with electronic signature laws such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Timely filing of the Irs Capital Form is crucial to avoid penalties. Generally, the deadline for submitting this form aligns with the annual tax return deadline, which is typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific extensions that may apply to their situation, especially for businesses or individuals with complex tax circumstances.

Required Documents

To accurately complete the Irs Capital Form, several documents are necessary. These include:

- Purchase receipts or statements for assets sold.

- Sale documents or closing statements showing the sale price.

- Records of any improvements or additional costs associated with the asset.

- Previous tax returns, if applicable, to reference prior capital gains or losses.

Having these documents organized and accessible will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete 2013 irs capital form

Effortlessly prepare Irs Capital Form on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Irs Capital Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Irs Capital Form with ease

- Locate Irs Capital Form and click Get Form to begin.

- Make use of the tools we provide to fill in your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information carefully, then click the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Capital Form while ensuring excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs capital form

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs capital form

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Irs Capital Form and how can it be used with airSlate SignNow?

The Irs Capital Form is a specific document required for reporting capital gains and losses to the IRS. With airSlate SignNow, you can easily upload, fill out, and eSign the Irs Capital Form, streamlining the submission process and ensuring compliance with IRS regulations.

-

How does airSlate SignNow ensure the security of my Irs Capital Form?

airSlate SignNow employs advanced encryption and security protocols to protect your documents, including the Irs Capital Form. Your data is secure during transmission and storage, providing peace of mind that your sensitive information remains confidential.

-

What are the costs associated with using airSlate SignNow for the Irs Capital Form?

airSlate SignNow offers a range of pricing plans to suit different business needs, making it a cost-effective solution for managing documents like the Irs Capital Form. You can choose a plan that fits your budget and includes all necessary features for eSigning and document management.

-

Can I integrate airSlate SignNow with other software for handling the Irs Capital Form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Irs Capital Form alongside other tools. Whether you use CRM systems, cloud storage, or accounting software, our integrations enhance productivity and streamline workflows.

-

What features does airSlate SignNow offer for managing the Irs Capital Form?

airSlate SignNow provides a user-friendly interface for creating, editing, and signing the Irs Capital Form. Key features include customizable templates, automated workflows, and real-time tracking, making it easier to manage your documents efficiently.

-

Is there a mobile app for completing the Irs Capital Form on the go?

Absolutely! airSlate SignNow offers a mobile app that allows you to complete and eSign the Irs Capital Form from anywhere. This flexibility ensures that you can manage your documents whether you are in the office or on the move.

-

How quickly can I get the Irs Capital Form signed using airSlate SignNow?

With airSlate SignNow, you can send the Irs Capital Form for eSigning and have it returned in minutes. Our efficient process and notifications keep all parties informed, speeding up the turnaround time for your documents.

Get more for Irs Capital Form

Find out other Irs Capital Form

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word