Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

What is the Form 100 ES Corporation Estimated Tax

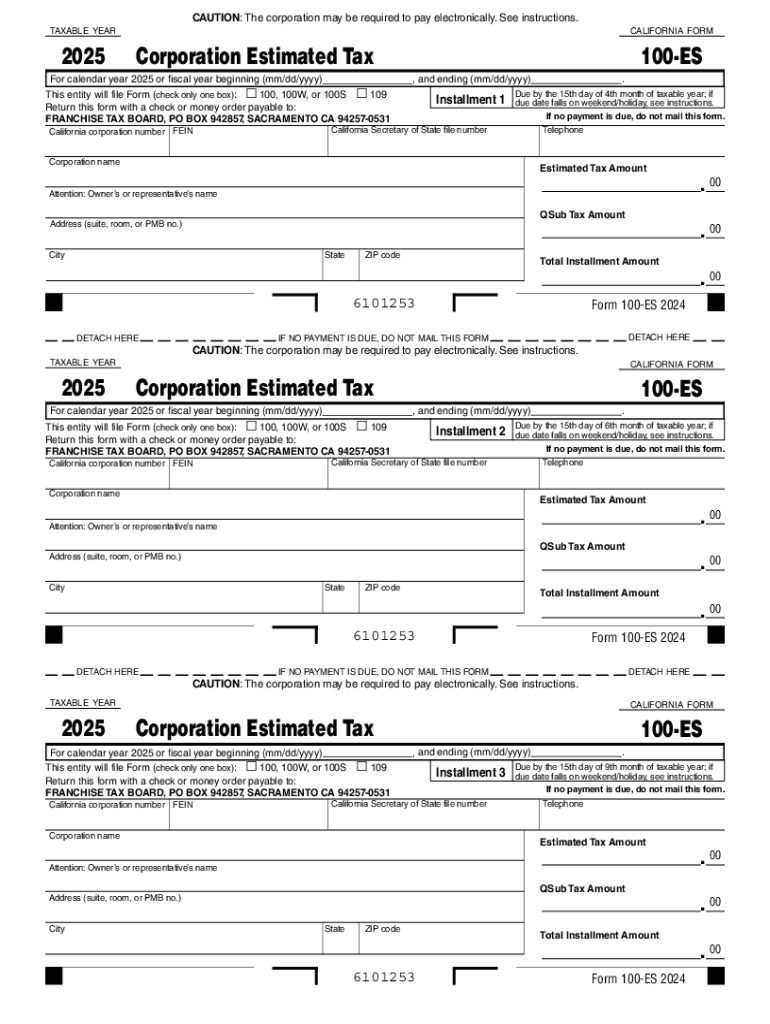

The Form 100 ES is a California tax form used by S corporations to report and pay estimated taxes. This form is essential for corporations that expect to owe tax of five hundred dollars or more during the tax year. By submitting the Form 100 ES, corporations can ensure they meet their tax obligations and avoid penalties for underpayment. It is specifically designed for S corporations operating in California, reflecting the state's unique tax regulations.

How to Use the Form 100 ES Corporation Estimated Tax

Using the Form 100 ES involves several straightforward steps. First, corporations must calculate their estimated tax liability based on their expected income for the year. Next, they will fill out the form with the appropriate financial information, including the estimated tax amount due. Once completed, the form can be submitted either online or by mail, depending on the corporation's preference. It is important to keep a copy of the submitted form for record-keeping and future reference.

Steps to Complete the Form 100 ES Corporation Estimated Tax

Completing the Form 100 ES requires careful attention to detail. Begin by gathering necessary financial documents, such as previous tax returns and income statements. Then, follow these steps:

- Determine your estimated taxable income for the year.

- Calculate the estimated tax based on California's tax rates.

- Fill out the Form 100 ES with your corporation's information and estimated tax amount.

- Review the form for accuracy before submission.

Finally, submit the form by the designated deadline to avoid penalties.

Key Elements of the Form 100 ES Corporation Estimated Tax

The Form 100 ES contains several key elements that must be accurately filled out. These include the corporation's name, address, and California Corporation Number. Additionally, the estimated tax amount due must be clearly stated. It is also important to include the payment method, whether by check or electronic payment. Ensuring all these elements are correct is crucial for compliance with California tax laws.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Form 100 ES. Typically, estimated tax payments are due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. For example, for a calendar year taxpayer, the deadlines would be April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 100 ES can be submitted through various methods. Corporations have the option to file online through the California Franchise Tax Board's website, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its benefits, but electronic filing is generally recommended for its speed and convenience.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100 e s corporation estimated tax form 100 es corporation estimated tax 771940858

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 100 es voucher printable?

The form 100 es voucher printable is a document used for tax purposes in certain jurisdictions. It allows taxpayers to report and pay their taxes efficiently. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring compliance and accuracy.

-

How can I obtain the form 100 es voucher printable?

You can obtain the form 100 es voucher printable directly from the airSlate SignNow platform. Our user-friendly interface allows you to generate and customize the form quickly. Simply log in, select the form, and start filling it out.

-

Is there a cost associated with using the form 100 es voucher printable?

Using the form 100 es voucher printable through airSlate SignNow is part of our subscription plans. We offer various pricing tiers to suit different business needs. Check our pricing page for detailed information on costs and features included.

-

What features does airSlate SignNow offer for the form 100 es voucher printable?

airSlate SignNow provides several features for the form 100 es voucher printable, including eSigning, document tracking, and secure storage. These features streamline the process, making it easier to manage your tax documents. Additionally, you can collaborate with team members in real-time.

-

Can I integrate the form 100 es voucher printable with other software?

Yes, airSlate SignNow allows integration with various software applications, enhancing your workflow. You can connect it with CRM systems, cloud storage, and other tools to manage your documents more efficiently. This integration ensures that your form 100 es voucher printable is always accessible.

-

What are the benefits of using airSlate SignNow for the form 100 es voucher printable?

Using airSlate SignNow for the form 100 es voucher printable offers numerous benefits, including time savings and improved accuracy. Our platform simplifies the eSigning process, reducing the chances of errors. Additionally, you can access your documents anytime, anywhere, enhancing flexibility.

-

Is the form 100 es voucher printable secure with airSlate SignNow?

Absolutely! The form 100 es voucher printable is secured with advanced encryption and compliance measures on airSlate SignNow. We prioritize the safety of your documents, ensuring that your sensitive information remains protected. You can trust us to handle your data securely.

Get more for Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

Find out other Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself