R 1300 125 This Form Must Be Filed with Your Em 2025-2026

Understanding the Louisiana Form R-1300

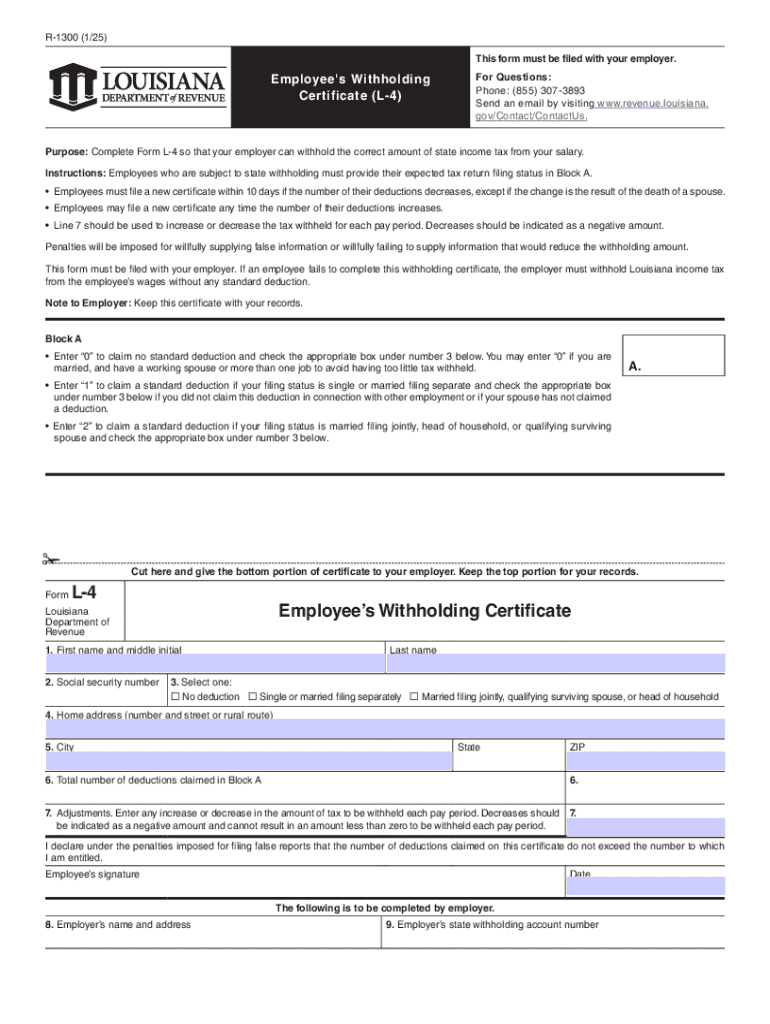

The Louisiana Form R-1300 is an essential document for employers in Louisiana to report employee withholding information. This form is specifically designed to gather details about the state income tax withholding from employees' wages. Employers must ensure that they accurately complete this form to comply with state tax regulations. The information collected helps the Louisiana Department of Revenue track and manage tax withholdings effectively.

Steps to Complete the Louisiana Form R-1300

Completing the Louisiana Form R-1300 involves several key steps:

- Gather employee information, including names, Social Security numbers, and addresses.

- Calculate the amount of state income tax to withhold based on the employee's earnings and the information provided on their Louisiana Employee Withholding Certificate (Form L-4).

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

Filing Deadlines for the Louisiana Form R-1300

Employers must be aware of the filing deadlines associated with the Louisiana Form R-1300. Typically, this form should be filed quarterly, aligning with the state's tax reporting schedule. It is crucial to submit the form by the due date to avoid penalties. Employers should check the Louisiana Department of Revenue’s official guidelines for specific dates and any updates to the filing schedule.

Required Documents for Filing the Louisiana Form R-1300

To file the Louisiana Form R-1300, employers need to have certain documents ready:

- Employee Withholding Certificates (Form L-4) for each employee.

- Payroll records that detail employee earnings and the amounts withheld for state income tax.

- Any previous tax filings that may be relevant for reference.

Submission Methods for the Louisiana Form R-1300

Employers have several options for submitting the Louisiana Form R-1300. The form can be filed electronically through the Louisiana Department of Revenue's online portal, which is often the preferred method for its convenience. Alternatively, employers can submit the form by mail or in person at designated tax offices. It is advisable to keep a copy of the submitted form for records.

Penalties for Non-Compliance with the Louisiana Form R-1300

Failure to file the Louisiana Form R-1300 on time or inaccuracies in the information provided can lead to penalties. The Louisiana Department of Revenue may impose fines based on the severity of the non-compliance. Employers should ensure timely and accurate submissions to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct r 1300 125 this form must be filed with your em

Create this form in 5 minutes!

How to create an eSignature for the r 1300 125 this form must be filed with your em

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Form R 1300?

The Louisiana Form R 1300 is a tax form used for reporting certain tax information in the state of Louisiana. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and eSigning the Louisiana Form R 1300.

-

How can airSlate SignNow help with the Louisiana Form R 1300?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the Louisiana Form R 1300. With its intuitive interface, users can quickly complete the form and send it securely. This streamlines the process, saving time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Louisiana Form R 1300?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features included, such as eSigning and document management. Investing in airSlate SignNow can enhance your efficiency when handling the Louisiana Form R 1300.

-

What features does airSlate SignNow offer for managing the Louisiana Form R 1300?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to manage the Louisiana Form R 1300 and ensure that all necessary information is accurately captured. Additionally, users can collaborate in real-time, enhancing productivity.

-

Can I integrate airSlate SignNow with other software for the Louisiana Form R 1300?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Louisiana Form R 1300. This means you can connect with tools you already use, making the process even more efficient.

-

What are the benefits of using airSlate SignNow for the Louisiana Form R 1300?

Using airSlate SignNow for the Louisiana Form R 1300 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are safely stored and easily accessible, allowing for quick retrieval and submission of the form.

-

Is airSlate SignNow user-friendly for completing the Louisiana Form R 1300?

Yes, airSlate SignNow is designed with user-friendliness in mind. The platform's intuitive interface makes it easy for anyone to navigate and complete the Louisiana Form R 1300 without extensive training. This accessibility helps businesses of all sizes manage their documentation effectively.

Get more for R 1300 125 This Form Must Be Filed With Your Em

Find out other R 1300 125 This Form Must Be Filed With Your Em

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement