Www Revenue Louisiana Govtaxforms1300401F OldL 4 Employees Withholding Allowance Certificate 2023

What is the L-4 Employees Withholding Allowance Certificate?

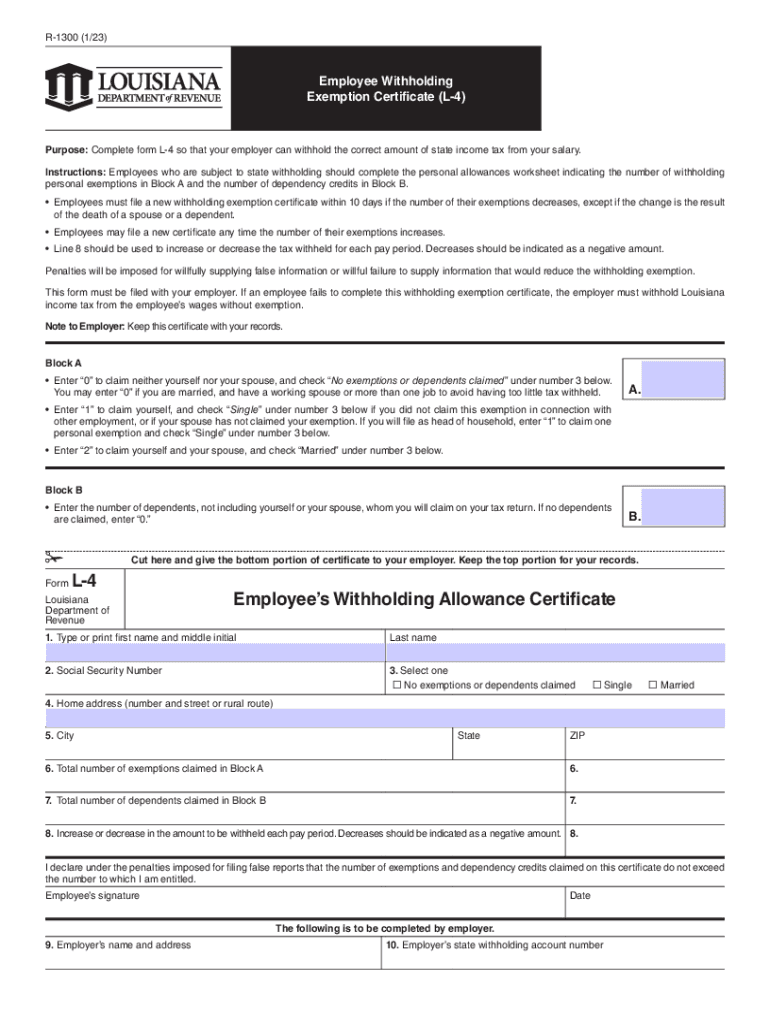

The L-4 form, officially known as the Employees Withholding Allowance Certificate, is a crucial document used by employees in Louisiana to determine the amount of state income tax to be withheld from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted based on the employee's financial situation, including their allowances, marital status, and any additional deductions they may qualify for.

By accurately completing the L-4 form, employees can manage their tax liabilities effectively, avoiding underpayment or overpayment of state taxes. This form is specifically tailored to comply with Louisiana state tax regulations, making it an important tool for both employees and employers.

Steps to Complete the L-4 Employees Withholding Allowance Certificate

Completing the L-4 form involves several straightforward steps:

- Obtain the Form: The L-4 form can be downloaded from the Louisiana Department of Revenue's website or obtained from your employer.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Determine Allowances: Calculate the number of allowances you are entitled to claim based on your personal and financial situation. This includes considerations for dependents and any additional deductions.

- Sign and Date: After completing the form, sign and date it to certify that the information provided is accurate.

- Submit the Form: Return the completed L-4 form to your employer, who will use it to adjust your state tax withholding accordingly.

Legal Use of the L-4 Employees Withholding Allowance Certificate

The L-4 form is legally recognized in Louisiana as a valid document for determining state income tax withholding. It must be filled out accurately to ensure compliance with state tax laws. Employers are required to maintain these forms on file for their employees and must adhere to the withholding amounts specified by the completed forms.

Failure to complete the L-4 form correctly may lead to incorrect tax withholdings, which can result in penalties for both the employee and employer. Therefore, understanding the legal implications and ensuring accuracy when filling out the form is essential for all parties involved.

State-Specific Rules for the L-4 Employees Withholding Allowance Certificate

Louisiana has specific guidelines regarding the L-4 form that employees and employers must follow. These include:

- The form must be completed by all employees who wish to have state income tax withheld from their paychecks.

- Employees can claim allowances based on their personal circumstances, including marital status and dependents.

- Employers are responsible for ensuring that the withholding amounts are calculated based on the information provided in the L-4 form.

- Employees may update their L-4 form at any time if their financial situation changes, such as a change in marital status or the birth of a child.

Examples of Using the L-4 Employees Withholding Allowance Certificate

Understanding practical scenarios can help clarify how the L-4 form is utilized:

- Single Employee: A single employee with no dependents may claim one allowance, resulting in a higher withholding amount compared to claiming zero allowances.

- Married Employee: A married employee with two children may claim three allowances, reducing their withholding and increasing their take-home pay.

- Change in Circumstances: An employee who gets married or has a child should submit a new L-4 form to adjust their allowances accordingly.

Filing Deadlines and Important Dates for the L-4 Form

It is important to be aware of key deadlines related to the L-4 form:

- Employees should submit their L-4 form to their employer as soon as they start a new job or experience a change in their tax situation.

- Employers must ensure that withholding adjustments based on the L-4 form are reflected in the employee's next paycheck.

- Annual tax returns in Louisiana are typically due on May fifteenth, making it essential for employees to ensure their withholding is accurate throughout the year.

Quick guide on how to complete wwwrevenuelouisianagovtaxforms1300401f oldl 4 employees withholding allowance certificate

Effortlessly Prepare Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

Easily Modify and eSign Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate

- Locate Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Mark important sections of the documents or obscure confidential information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuelouisianagovtaxforms1300401f oldl 4 employees withholding allowance certificate

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuelouisianagovtaxforms1300401f oldl 4 employees withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an L4 form and how can airSlate SignNow help?

An L4 form is a document that may require electronic signature for various business purposes. With airSlate SignNow, you can easily create, send, and eSign L4 forms, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for L4 forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans allow you to send and eSign L4 forms at a competitive price, ensuring you get value for your money.

-

What features does airSlate SignNow offer for managing L4 forms?

airSlate SignNow provides a range of features for managing L4 forms, including customizable templates, real-time tracking, and automated reminders. These tools streamline the signing process and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for L4 forms?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Salesforce, Google Drive, and Slack, making it easy to manage L4 forms within your existing workflow.

-

How secure is my data when using airSlate SignNow for L4 forms?

Security is a top priority for airSlate SignNow. When using our platform for L4 forms, your data is protected with advanced encryption and compliance with industry standards, ensuring your sensitive information remains safe.

-

Can I track the status of my L4 forms sent via airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your sent L4 forms in real-time. You'll receive notifications when the document is viewed, signed, or completed, keeping you updated throughout the process.

-

Is there a mobile app for signing L4 forms with airSlate SignNow?

Yes, airSlate SignNow offers a user-friendly mobile app that allows you to sign L4 forms on the go. This means you can manage and eSign documents anytime, anywhere, from your smartphone or tablet.

Get more for Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate

Find out other Www revenue louisiana govtaxforms1300401F oldL 4 Employees Withholding Allowance Certificate

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself