Form it 112 1 New York State Resident Credit Against Separate Tax on Lump Sum Distributions Tax Year 2024-2026

Understanding the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

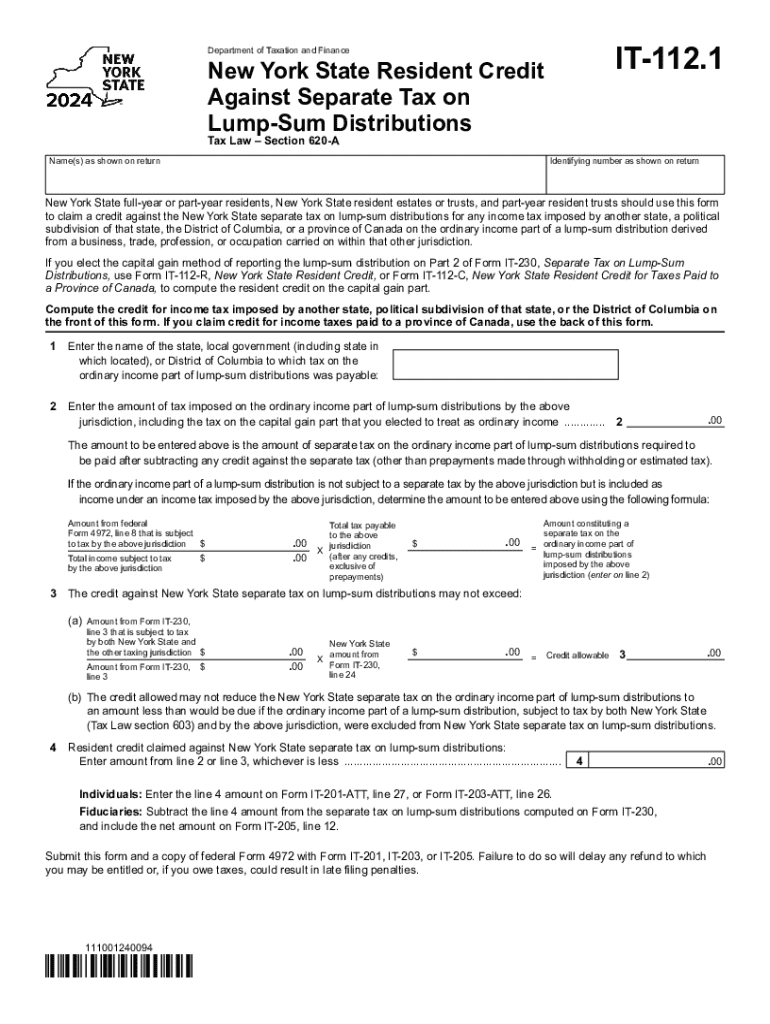

The Form IT 112 1 is a tax form used by New York State residents to claim a credit against the separate tax on lump sum distributions. This credit is particularly relevant for individuals who have received lump sum distributions from retirement plans or other qualified plans. The form allows taxpayers to reduce their overall tax liability by taking into account the taxes already paid on these distributions. Understanding the purpose and implications of this form is essential for accurate tax reporting and compliance.

Steps to Complete the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

Completing the Form IT 112 1 involves several key steps:

- Gather necessary documents, including your tax return and any documentation related to lump sum distributions.

- Fill out your personal information, including your name, address, and Social Security number.

- Report the amount of the lump sum distribution and the separate tax paid on it.

- Calculate the credit amount based on the instructions provided on the form.

- Review your completed form for accuracy before submission.

Eligibility Criteria for the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

To be eligible for the credit claimed on Form IT 112 1, taxpayers must meet specific criteria. These typically include:

- You must be a resident of New York State for the tax year in which you are filing.

- You must have received a lump sum distribution from a qualified retirement plan.

- The separate tax on the lump sum distribution must have been paid.

Meeting these criteria ensures that you can accurately claim the credit and reduce your tax liability accordingly.

How to Obtain the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

The Form IT 112 1 can be obtained through several methods. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or public libraries. It is essential to ensure you are using the correct version of the form for the applicable tax year.

Legal Use of the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

The legal use of Form IT 112 1 is confined to claiming the credit against the separate tax on lump sum distributions as permitted by New York State tax law. Taxpayers must ensure that all information provided is accurate and truthful to avoid penalties or legal issues. Misuse of the form or incorrect claims can lead to audits or fines.

Filing Deadlines for the Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

Filing deadlines for Form IT 112 1 align with the general tax return deadlines set by the IRS and New York State. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. Taxpayers should be aware of any extensions that may apply and ensure timely submission to avoid late fees or penalties.

Create this form in 5 minutes or less

Find and fill out the correct form it 112 1 new york state resident credit against separate tax on lump sum distributions tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 112 1 new york state resident credit against separate tax on lump sum distributions tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year?

Form IT 112 1 is a tax form used by New York State residents to claim a credit against the separate tax on lump sum distributions for a specific tax year. This form helps taxpayers reduce their tax liability on distributions received from retirement plans. Understanding this form is crucial for ensuring compliance and maximizing potential tax benefits.

-

How can airSlate SignNow help with Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year?

airSlate SignNow provides an efficient platform for preparing and eSigning Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year. Our solution simplifies the document management process, allowing users to fill out, sign, and send the form securely and quickly. This streamlines tax preparation and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and enterprises. Each plan provides access to essential features for managing documents, including Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year. These tools enhance efficiency and ensure that all necessary steps are completed accurately and on time.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that users can confidently manage forms like Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year. Our platform adheres to industry standards for security and data protection, providing peace of mind for users handling sensitive tax information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year alongside your existing tools. This integration helps streamline workflows and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process and ensures that all documents are stored securely, making tax season less stressful.

Get more for Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

- Letter collection company form

- Contract to assist real estate agent or realtor in closing sale of residential property form

- Bankruptcy 497328980 form

- Letter notifying death form

- State defense force national guard form

- Letter notifying death sample 497328983 form

- Agreement use property form

- Letter notifying death 497328985 form

Find out other Form IT 112 1 New York State Resident Credit Against Separate Tax On Lump Sum Distributions Tax Year

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later