Instructions for Form it 230 Separate Tax on Lump Sum 2022

What is the Instructions for Form IT 230 Separate Tax on Lump Sum

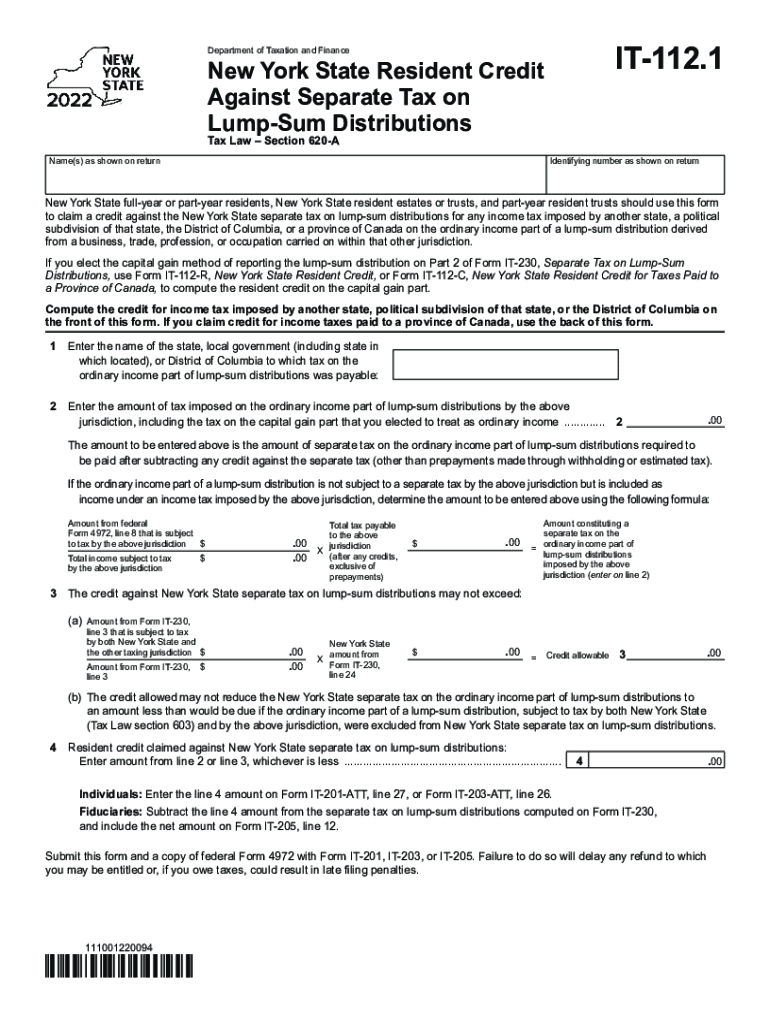

The Instructions for Form IT 230 Separate Tax on Lump Sum is a document provided by the state tax authority that outlines how to report and pay taxes on certain lump sum payments. This form is typically used by individuals who receive a one-time payment, such as a bonus or severance, and need to calculate the appropriate tax liability. It is essential for taxpayers to understand the specifics of this form to ensure compliance with state tax laws.

Steps to Complete the Instructions for Form IT 230 Separate Tax on Lump Sum

Completing the Instructions for Form IT 230 involves several key steps:

- Gather necessary documents, including your payment details and any relevant tax information.

- Review the instructions carefully to understand the specific calculations required for your lump sum payment.

- Fill out the form accurately, ensuring that all figures are correct and match your documentation.

- Double-check your entries for any errors before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the Instructions for Form IT 230 Separate Tax on Lump Sum

The legal use of the Instructions for Form IT 230 is crucial for ensuring that taxpayers fulfill their obligations under state tax law. This form is legally binding when completed correctly and submitted on time. Failure to adhere to the guidelines may result in penalties, interest on unpaid taxes, or even legal action. Understanding the legal implications of this form helps taxpayers navigate their responsibilities effectively.

Filing Deadlines / Important Dates

Timely filing of the Instructions for Form IT 230 is essential. The specific deadlines may vary based on the tax year and state regulations. Generally, taxpayers should be aware of the following important dates:

- Filing deadline for the current tax year.

- Any extensions that may apply.

- Due dates for estimated tax payments related to lump sum income.

Key Elements of the Instructions for Form IT 230 Separate Tax on Lump Sum

Understanding the key elements of the Instructions for Form IT 230 can simplify the filing process. Important components include:

- Definitions of lump sum payments and taxable income.

- Detailed instructions on how to calculate the tax owed.

- Information on exemptions or deductions that may apply.

- Contact information for assistance if needed.

Examples of Using the Instructions for Form IT 230 Separate Tax on Lump Sum

Examples can provide clarity on how to apply the Instructions for Form IT 230 in real-life scenarios. For instance, if an employee receives a severance payment of $10,000, they would use the instructions to determine the applicable tax rate and calculate the amount owed. Another example could involve a contractor receiving a large bonus at the end of the year, requiring them to file the form to report the additional income accurately.

Quick guide on how to complete instructions for form it 230 separate tax on lump sum

Complete Instructions For Form IT 230 Separate Tax On Lump Sum seamlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form IT 230 Separate Tax On Lump Sum on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortless ways to adjust and eSign Instructions For Form IT 230 Separate Tax On Lump Sum

- Obtain Instructions For Form IT 230 Separate Tax On Lump Sum and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Annotate important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Edit and eSign Instructions For Form IT 230 Separate Tax On Lump Sum to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 230 separate tax on lump sum

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 230 separate tax on lump sum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form it 230?

Form it 230 is designed to streamline document signing and management processes for businesses. It allows users to create, send, and eSign documents efficiently, ensuring compliance and record-keeping. With airSlate SignNow, managing form it 230 becomes a seamless experience.

-

How much does it cost to use form it 230 with airSlate SignNow?

Pricing for using form it 230 with airSlate SignNow varies based on the subscription plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. For the best value, consider our annual plans, which also provide full access to our features.

-

What features are included in form it 230?

Form it 230 includes features like customizable templates, automated workflows, and real-time notifications. Users can easily track document status and manage eSignatures, simplifying the signing process. The robust functionality of airSlate SignNow enhances user experience with form it 230.

-

How can form it 230 benefit my business?

Implementing form it 230 can signNowly reduce the time spent on document processing. This allows your team to focus more on core business activities. airSlate SignNow also ensures that your documents are secure and legally binding, providing peace of mind.

-

Does form it 230 integrate with other software?

Yes, form it 230 seamlessly integrates with various software platforms, including popular CRM and document management systems. This integration helps streamline your workflow and enhances productivity. airSlate SignNow's flexibility makes it easy to incorporate form it 230 into your existing processes.

-

Is it easy to learn how to use form it 230?

Absolutely! Form it 230 is designed to be user-friendly, making it easy for anyone to adopt. With intuitive navigation and helpful resources, airSlate SignNow ensures that even those without technical expertise can efficiently manage their documents.

-

Can I customize form it 230 for my specific needs?

Yes, form it 230 is highly customizable to meet your specific requirements. You can tailor templates and workflows according to your business processes. This flexibility provided by airSlate SignNow allows you to maximize the advantages of form it 230.

Get more for Instructions For Form IT 230 Separate Tax On Lump Sum

- Residential or rental lease extension agreement rhode island form

- Commercial rental lease application questionnaire rhode island form

- Apartment lease rental application questionnaire rhode island form

- Residential rental lease application rhode island form

- Salary verification form for potential lease rhode island

- Rhode island tenant 497325214 form

- Notice of default on residential lease rhode island form

- Landlord tenant lease co signer agreement rhode island form

Find out other Instructions For Form IT 230 Separate Tax On Lump Sum

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile