Form it 230 Separate Tax on Lump Sum Distributions Tax Year 2024-2026

Understanding the Form IT-230 for Lump Sum Distributions

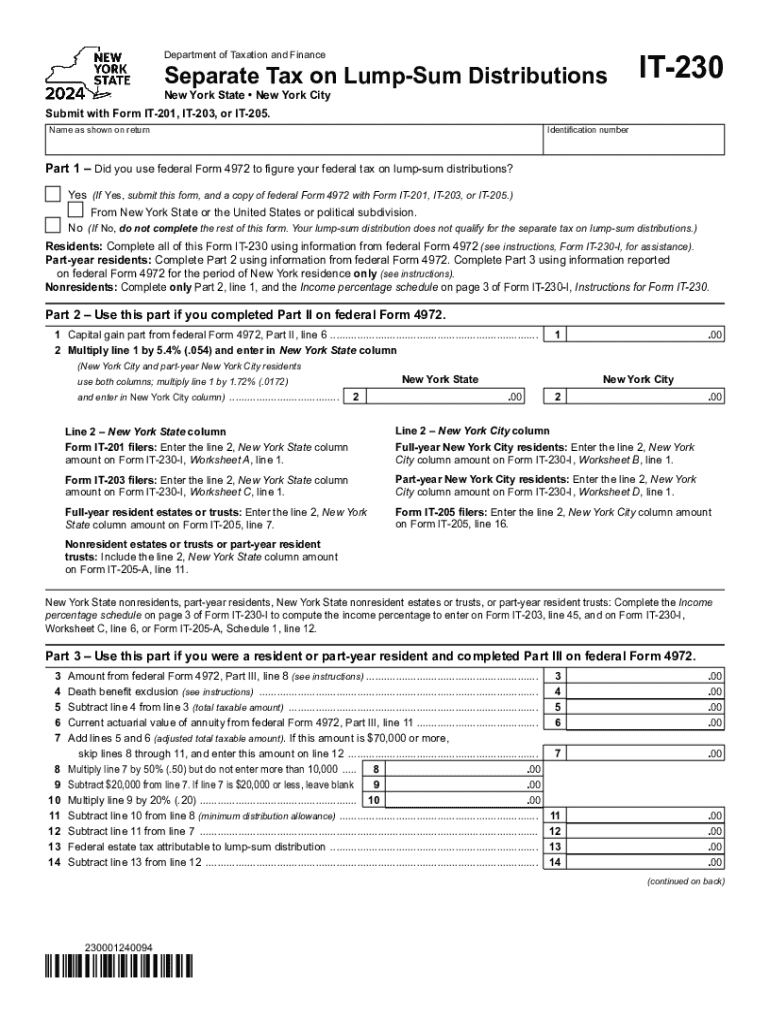

The Form IT-230, also known as the Separate Tax on Lump Sum Distributions, is a tax form used by individuals in the United States to report and calculate taxes on lump sum distributions from retirement plans. This form is particularly relevant for taxpayers who receive a one-time payment from pensions or retirement accounts, which may be subject to different tax rates compared to regular income. Understanding the nuances of this form is essential for accurate tax reporting and compliance.

Steps to Complete the Form IT-230

Completing the Form IT-230 involves several key steps. First, gather all necessary documentation regarding the lump sum distribution, including the total amount received and any applicable tax withholding. Next, accurately fill out the form by providing personal information, the amount of the distribution, and any deductions or credits that may apply. It is crucial to review the form for accuracy before submission, as errors can lead to delays or penalties.

Obtaining the Form IT-230

The Form IT-230 can be obtained through various channels. Taxpayers can download the form directly from the official state tax website or request a physical copy through the mail. Additionally, many tax preparation software programs include the form, allowing users to complete it electronically. Ensuring you have the correct version of the form for the applicable tax year is important for compliance.

Key Elements of the Form IT-230

Key elements of the Form IT-230 include the taxpayer's identification information, details about the lump sum distribution, and calculations for the tax owed. The form typically requires information on the total distribution amount, any tax withheld, and the specific tax rate that applies to the lump sum. Understanding these elements helps taxpayers accurately determine their tax liability and ensures proper reporting.

State-Specific Rules for the Form IT-230

State-specific rules may apply when filing the Form IT-230. Different states may have unique regulations regarding lump sum distributions, including varying tax rates or exemptions. It is essential for taxpayers to familiarize themselves with their state's specific requirements to ensure compliance and avoid potential issues with their tax filings.

Filing Deadlines and Important Dates

Filing deadlines for the Form IT-230 typically align with the general tax filing deadlines set by the IRS. Taxpayers should be aware of these dates to avoid late filing penalties. Additionally, if any extensions are filed, it is important to note how they affect the submission of this specific form. Keeping track of these important dates ensures timely and accurate tax reporting.

Penalties for Non-Compliance

Failure to properly file the Form IT-230 can result in penalties, including fines and interest on unpaid taxes. Non-compliance may also lead to audits or further scrutiny from tax authorities. Understanding the potential consequences of not filing or inaccurately completing the form emphasizes the importance of diligent tax practices and adherence to regulations.

Create this form in 5 minutes or less

Find and fill out the correct form it 230 separate tax on lump sum distributions tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 230 separate tax on lump sum distributions tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxation 230 and how does it relate to airSlate SignNow?

Taxation 230 refers to specific tax regulations that businesses must comply with. airSlate SignNow helps streamline the documentation process related to taxation 230 by allowing users to easily send and eSign necessary tax documents, ensuring compliance and efficiency.

-

How can airSlate SignNow assist with taxation 230 compliance?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing documents related to taxation 230. By using our solution, businesses can ensure that all necessary forms are completed accurately and submitted on time, reducing the risk of penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to provide cost-effective solutions for managing documents related to taxation 230, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing taxation 230 documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing taxation 230 documents. These features enhance efficiency and ensure that all necessary steps are followed in the documentation process.

-

Can airSlate SignNow integrate with other software for taxation 230 management?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses use for taxation 230 management. This integration allows for a smoother workflow, enabling users to manage their tax documents alongside other business processes.

-

What are the benefits of using airSlate SignNow for taxation 230?

Using airSlate SignNow for taxation 230 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our solution simplifies the eSigning process, allowing businesses to focus on their core operations while ensuring tax documents are handled correctly.

-

Is airSlate SignNow secure for handling sensitive taxation 230 documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to taxation 230 are protected. We utilize advanced encryption and security protocols to safeguard sensitive information throughout the signing process.

Get more for Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

Find out other Form IT 230 Separate Tax On Lump Sum Distributions Tax Year

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement