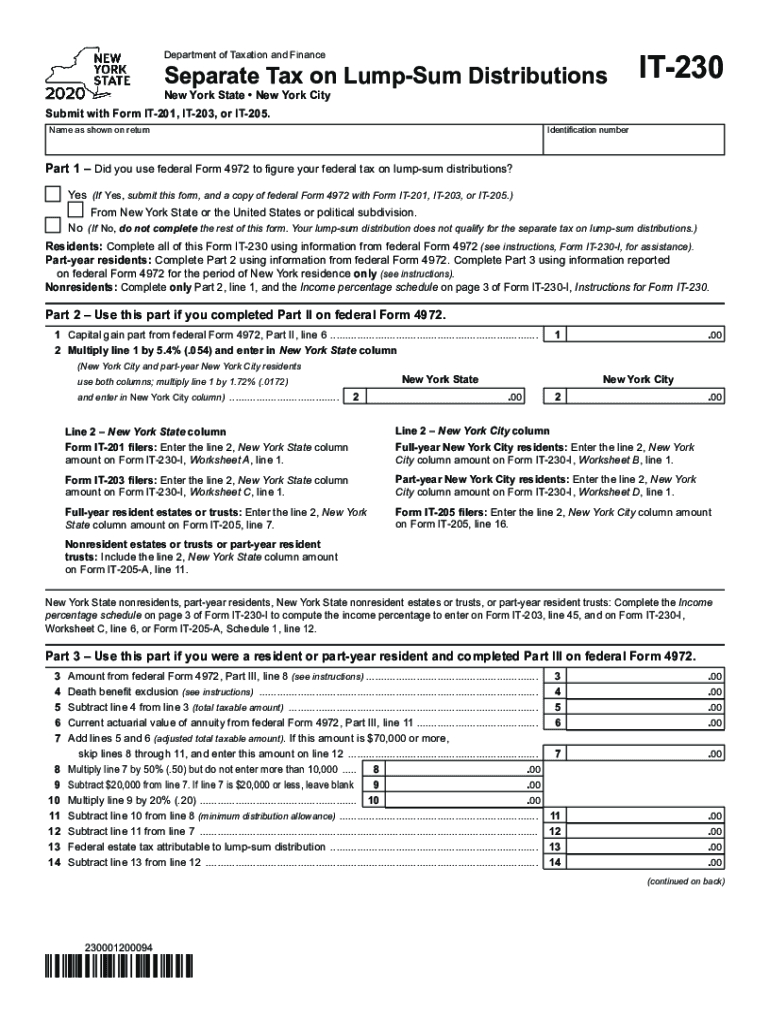

Attach to Form it 201, it 203 or it 205 2020

What is the Attach To Form IT 201, IT 203 Or IT 205

The Attach To Form IT 201, IT 203, or IT 205 is a crucial document used in the context of New York State tax filings. This form is typically utilized by taxpayers to provide additional information or to attach necessary schedules and documents that support their income tax returns. It is essential for ensuring that all relevant details are submitted to the state tax authorities, thereby facilitating accurate processing of tax returns.

Steps to Complete the Attach To Form IT 201, IT 203 Or IT 205

Completing the Attach To Form IT 201, IT 203, or IT 205 involves several key steps:

- Gather all necessary documentation, including income statements and any relevant schedules.

- Carefully read the instructions provided with the form to ensure compliance with all requirements.

- Fill out the form accurately, providing all requested information and ensuring that all attachments are included.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with your main tax return by the appropriate deadline.

Legal Use of the Attach To Form IT 201, IT 203 Or IT 205

The Attach To Form IT 201, IT 203, or IT 205 is legally binding when completed and submitted in accordance with New York State tax laws. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing accurate information, maintaining proper documentation, and submitting the form within the designated timeframes.

Filing Deadlines / Important Dates

Filing deadlines for the Attach To Form IT 201, IT 203, or IT 205 align with the general tax filing deadlines set by the IRS. Typically, individual income tax returns are due by April fifteenth. However, it is important to verify any specific deadlines that may apply to your situation, including extensions or changes in filing dates due to state regulations.

Required Documents

When completing the Attach To Form IT 201, IT 203, or IT 205, it is essential to include all required documents. These may include:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Supporting schedules that provide details on deductions or credits claimed.

- Any other documentation that substantiates the information reported on your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Attach To Form IT 201, IT 203, or IT 205 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing services, which often streamline the process. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. It is advisable to check the New York State Department of Taxation and Finance website for the latest submission guidelines and options.

Quick guide on how to complete attach to form it 201 it 203 or it 205

Complete Attach To Form IT 201, IT 203 Or IT 205 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Attach To Form IT 201, IT 203 Or IT 205 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Attach To Form IT 201, IT 203 Or IT 205 smoothly

- Find Attach To Form IT 201, IT 203 Or IT 205 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Attach To Form IT 201, IT 203 Or IT 205 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attach to form it 201 it 203 or it 205

Create this form in 5 minutes!

How to create an eSignature for the attach to form it 201 it 203 or it 205

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow's it 230?

The pricing for airSlate SignNow's it 230 is designed to be cost-effective, offering various plans suitable for different business needs. Whether you are a small startup or a large enterprise, you can find a tier that fits your budget, allowing you to leverage the powerful eSigning features without breaking the bank.

-

What features does airSlate SignNow offer for it 230?

airSlate SignNow includes a range of features within the it 230 platform, such as unlimited document uploads, customizable templates, and real-time tracking of your documents. These features make managing eSignatures seamless and efficient for businesses of any size.

-

How can airSlate SignNow's it 230 benefit my business?

Implementing airSlate SignNow’s it 230 can signNowly streamline your document workflows and enhance productivity. By utilizing this solution, your team can save valuable time, reduce paper usage, and improve customer satisfaction through faster transactions.

-

Does airSlate SignNow integrate with other tools in it 230?

Yes, airSlate SignNow supports numerous integrations within the it 230 ecosystem, enabling you to connect seamlessly with popular tools like Salesforce, Google Drive, and Microsoft Office. This interoperability enhances functionality, making it easier for your team to collaborate.

-

Is it easy to use airSlate SignNow's it 230 for new users?

Absolutely! airSlate SignNow's it 230 is designed with user-friendliness in mind, featuring an intuitive interface that requires minimal training. New users can quickly learn to send and eSign documents, ensuring a smooth transition to digital workflows.

-

What security measures are in place for documents using it 230?

airSlate SignNow prioritizes security, implementing advanced encryption and secure access protocols for all documentation processed through it 230. Your sensitive data is protected, giving you peace of mind as you manage important business contracts and agreements.

-

Can I access airSlate SignNow's it 230 on mobile devices?

Yes, airSlate SignNow’s it 230 is fully optimized for mobile devices, allowing you to manage and sign documents on the go. This mobility ensures that you can stay connected and productive, regardless of your location.

Get more for Attach To Form IT 201, IT 203 Or IT 205

- Illinois statewide forms approved name change minor

- Approved statewide forms motion forms illinois courts

- Illinois statewide forms approved notice of court date

- Namechangeorderadult revised dv v2d2 final form

- Illinois order for waiver of court fees form

- Illinois request for name change adult form

- Illinois standardized forms approved illinois courts

- Illinois order for name change adult form

Find out other Attach To Form IT 201, IT 203 Or IT 205

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement