Form it 611 1 Claim for Brownfield Redevelopment Tax Credit Tax Year 2024-2026

What is the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

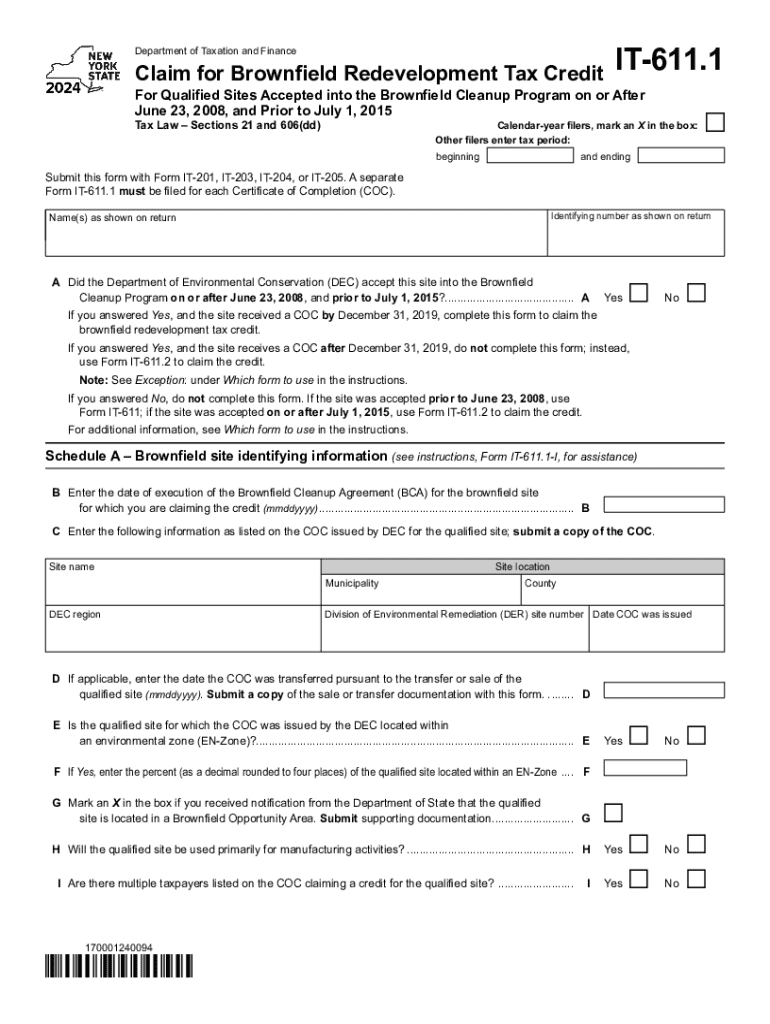

The Form IT 611 1 is a tax form used in the United States for claiming the Brownfield Redevelopment Tax Credit. This credit is designed to incentivize the cleanup and redevelopment of contaminated properties, commonly referred to as brownfields. By providing tax relief, the form aims to encourage businesses and developers to invest in revitalizing these areas, ultimately contributing to economic growth and environmental sustainability. The form must be completed accurately to ensure eligibility for the tax credit, which can significantly reduce the tax burden for qualifying projects.

How to use the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

Using the Form IT 611 1 involves several steps to ensure proper completion and submission. First, gather all necessary documentation related to the brownfield redevelopment project, including costs incurred for cleanup and redevelopment. Next, fill out the form with accurate details regarding the project, including location, expenses, and any supporting evidence of eligibility. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. It is crucial to keep copies of the submitted form and all supporting documents for your records.

Steps to complete the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

Completing the Form IT 611 1 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the appropriate tax authority.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the brownfield site, including its location and the nature of contamination.

- List all eligible costs associated with the cleanup and redevelopment efforts.

- Attach supporting documentation, such as invoices and contracts, to substantiate your claims.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to ensure consideration for the tax credit.

Eligibility Criteria

To qualify for the Brownfield Redevelopment Tax Credit using Form IT 611 1, certain eligibility criteria must be met. The property must be classified as a brownfield, meaning it is contaminated or perceived to be contaminated. Additionally, the cleanup and redevelopment activities must comply with state and federal environmental regulations. The costs claimed must be directly related to the remediation efforts, and the taxpayer must be the one who incurred these expenses. It is important to review the specific guidelines provided by the tax authority to ensure all criteria are satisfied.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 611 1 are crucial for taxpayers seeking the Brownfield Redevelopment Tax Credit. Generally, the form must be submitted by the tax return due date for the year in which the expenses were incurred. It is advisable to check for any specific state deadlines or extensions that may apply. Missing the deadline can result in the loss of the tax credit, so keeping track of these important dates is essential for successful filing.

Required Documents

When completing the Form IT 611 1, several documents are required to support your claim for the Brownfield Redevelopment Tax Credit. These documents typically include:

- Invoices and receipts for cleanup and redevelopment costs.

- Contracts with contractors or consultants involved in the remediation process.

- Environmental assessment reports that detail the contamination and cleanup efforts.

- Proof of ownership or lease agreements for the property.

Having these documents ready will streamline the completion of the form and strengthen your claim.

Create this form in 5 minutes or less

Find and fill out the correct form it 611 1 claim for brownfield redevelopment tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 611 1 claim for brownfield redevelopment tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year is a tax form used to claim credits for the redevelopment of brownfield sites. This form helps businesses offset costs associated with environmental cleanup and redevelopment, making it essential for eligible projects.

-

How can airSlate SignNow assist with Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year. Our user-friendly interface ensures that all necessary signatures are obtained quickly, reducing delays in the submission process.

-

What are the pricing options for using airSlate SignNow for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced integrations for handling Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year, we have a plan that fits your budget.

-

What features does airSlate SignNow offer for managing Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all designed to simplify the process of managing Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year. These tools help ensure accuracy and compliance while saving time.

-

Can I integrate airSlate SignNow with other software for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year alongside your existing tools. This enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Using airSlate SignNow for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps businesses save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for handling Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including encryption and secure access controls. You can confidently manage Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year knowing that your sensitive information is safe.

Get more for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

Find out other Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP