Summary of Federal Form W 2 Statements, It2

Understanding the Summary of Federal Form W-2 Statements

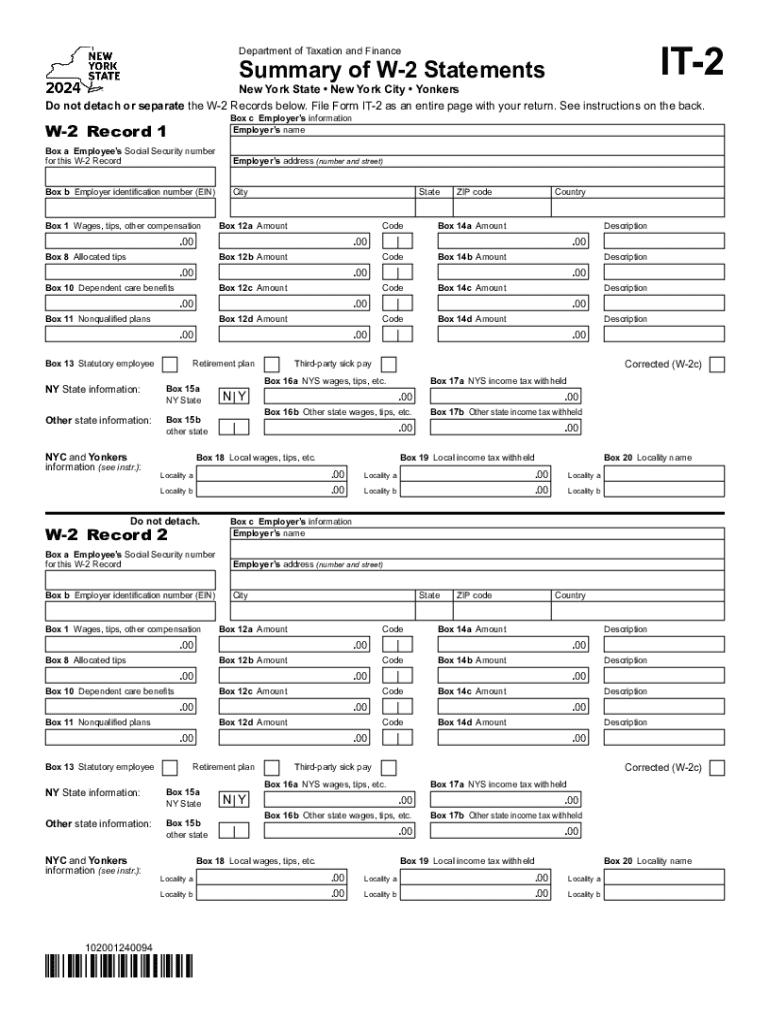

The Summary of Federal Form W-2 Statements provides a comprehensive overview of an employee's annual earnings and tax withholdings. This form is crucial for both employees and employers, as it summarizes the income earned and the taxes paid throughout the year. Each W-2 form includes information such as wages, tips, and other compensation, along with federal, state, and local tax withholdings. Understanding this summary helps taxpayers accurately report their income when filing their tax returns.

Steps to Complete the Summary of Federal Form W-2 Statements

Completing the Summary of Federal Form W-2 Statements involves several key steps:

- Gather all W-2 forms received from employers.

- Verify the accuracy of the information on each W-2, including Social Security numbers and earnings.

- Summarize total wages, tips, and other compensation from all forms.

- Calculate total federal, state, and local tax withholdings.

- Ensure that the totals match the amounts reported on your tax return.

Following these steps ensures that all income and tax information is accurately represented, facilitating a smoother tax filing process.

Filing Deadlines and Important Dates

For the 2024 tax year, the deadline for employers to issue W-2 forms to employees is typically January 31. Employees should ensure they receive their W-2 forms by this date to prepare their tax returns promptly. The deadline for filing federal tax returns is usually April 15, unless it falls on a weekend or holiday, in which case it may be extended to the next business day. Being aware of these dates helps taxpayers avoid penalties and ensures timely compliance with tax regulations.

Legal Use of the Summary of Federal Form W-2 Statements

The Summary of Federal Form W-2 Statements is legally required for reporting income and tax withholdings to the Internal Revenue Service (IRS). Employers must provide this form to employees to ensure accurate tax reporting. Failure to issue W-2 forms can result in penalties for employers, while employees may face issues with their tax filings if they do not receive their forms. Understanding the legal implications of this summary is essential for both employers and employees to maintain compliance with tax laws.

Key Elements of the Summary of Federal Form W-2 Statements

Key elements of the Summary of Federal Form W-2 Statements include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Wages and Tips: Total earnings, including tips and other compensation.

- Tax Withholdings: Amounts withheld for federal, state, and local taxes.

- Retirement Contributions: Contributions to retirement plans, if applicable.

These elements are crucial for accurately reporting income and ensuring compliance with tax obligations.

Obtaining the Summary of Federal Form W-2 Statements

To obtain the Summary of Federal Form W-2 Statements, employees should first check with their employers. Employers are required to provide this summary by the end of January each year. If an employee does not receive their W-2 form, they can request a copy from their employer. Additionally, employees can access their W-2 forms through payroll services or online employee portals if their employer offers such services. Keeping track of these forms is essential for accurate tax reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the summary of federal form w 2 statements it2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 2 2024?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. With the advancements in technology expected in it 2 2024, our platform is designed to integrate seamlessly with various applications, enhancing productivity and efficiency.

-

What are the pricing options for airSlate SignNow in 2024?

In 2024, airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can choose a plan that fits your budget while still benefiting from the latest features and updates related to it 2 2024.

-

What features does airSlate SignNow offer for it 2 2024?

airSlate SignNow provides a range of features including customizable templates, advanced security options, and real-time tracking of document status. As we move into it 2 2024, these features are continuously updated to ensure compliance and enhance user experience.

-

How can airSlate SignNow benefit my business in it 2 2024?

By using airSlate SignNow, your business can streamline document workflows, reduce turnaround times, and improve overall efficiency. As we approach it 2 2024, leveraging our platform will help you stay competitive in a rapidly evolving digital landscape.

-

Can airSlate SignNow integrate with other software in it 2 2024?

Yes, airSlate SignNow is designed to integrate with a variety of third-party applications, making it easier for businesses to manage their workflows. As we look forward to it 2 2024, our integration capabilities will continue to expand, allowing for seamless connectivity with your existing tools.

-

Is airSlate SignNow secure for handling sensitive documents in it 2 2024?

Absolutely! airSlate SignNow prioritizes security with features like encryption and secure access controls. As we enter it 2 2024, we remain committed to maintaining the highest security standards to protect your sensitive documents.

-

What support options are available for airSlate SignNow users in it 2 2024?

airSlate SignNow offers comprehensive support options including live chat, email support, and a detailed knowledge base. As we move into it 2 2024, our support team is dedicated to ensuring that you have all the resources you need to maximize your experience with our platform.

Get more for Summary Of Federal Form W 2 Statements, It2

Find out other Summary Of Federal Form W 2 Statements, It2

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document