Form 8854 2023

What is the Form 8854

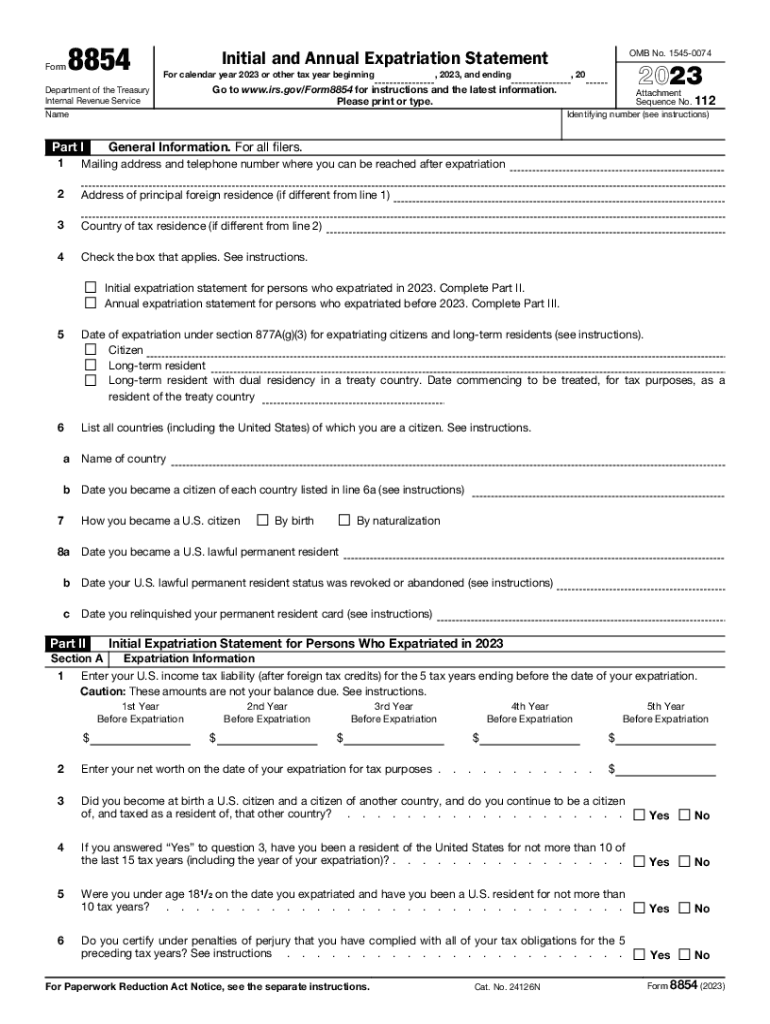

The Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form required by the Internal Revenue Service (IRS) for individuals who are expatriating from the United States. This form is essential for reporting your expatriation status and ensuring compliance with U.S. tax obligations. It is particularly relevant for individuals who have renounced their U.S. citizenship or terminated their long-term resident status. Completing this form accurately is crucial to avoid potential penalties and complications related to the U.S. exit tax.

How to use the Form 8854

Using Form 8854 involves providing detailed information about your expatriation, including your net worth, tax obligations, and compliance with U.S. tax laws for the five years preceding your expatriation. The form helps the IRS determine if you are subject to the exit tax, which applies to individuals whose net worth exceeds a specified threshold. It is important to fill out the form correctly and submit it along with your final tax return to ensure that all necessary information is disclosed to the IRS.

Steps to complete the Form 8854

Completing Form 8854 requires several steps to ensure accuracy and compliance:

- Gather Documentation: Collect financial documents that reflect your net worth and tax filings for the past five years.

- Complete the Form: Fill out all sections of the form, including personal information, net worth, and tax compliance history.

- Review for Accuracy: Double-check all entries to ensure that the information is complete and correct.

- Submit the Form: File the form with your final tax return, ensuring it is sent to the appropriate IRS address.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 8854 is crucial for compliance. Generally, the form must be submitted by the due date of your final tax return, which is typically April 15 for most taxpayers. If you are living abroad, you may qualify for an automatic extension, but it is important to check the specific rules that apply to expatriates. Missing the deadline can result in penalties, so keeping track of these dates is essential.

Penalties for Non-Compliance

Failure to file Form 8854 or inaccuracies in the information provided can lead to significant penalties. The IRS may impose an exit tax on individuals who do not comply with the reporting requirements. Additionally, not filing the form can result in a penalty of $10,000. It is important to understand these consequences and ensure that you meet all obligations to avoid financial repercussions.

Required Documents

When completing Form 8854, certain documents are necessary to support the information you provide. These may include:

- Financial statements that reflect your net worth.

- Tax returns for the previous five years.

- Documentation of any foreign tax obligations.

- Records of any gifts or inheritances received.

Having these documents ready will facilitate a smoother filing process and ensure that you meet all reporting requirements.

Quick guide on how to complete form 8854

Prepare Form 8854 effortlessly on any device

Online document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Form 8854 on any device using the airSlate SignNow Android or iOS applications and streamline your document processes today.

How to modify and electronically sign Form 8854 seamlessly

- Obtain Form 8854 and click on Get Form to initiate the process.

- Leverage the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools available from airSlate SignNow specifically designed for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate reprinting new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form 8854 to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8854

Create this form in 5 minutes!

How to create an eSignature for the form 8854

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 990 n postcard?

A 990 n postcard is a simplified filing option for small tax-exempt organizations. This postcard allows eligible nonprofits to report their annual financial information to the IRS quickly and efficiently, making it essential for compliance and transparency.

-

How can airSlate SignNow help with 990 n postcard submissions?

airSlate SignNow simplifies the process of signing and sending your 990 n postcard electronically. With our platform, you can easily prepare your documents, collect signatures, and track your submissions, ensuring a hassle-free filing experience.

-

What are the costs associated with filing a 990 n postcard?

The 990 n postcard itself is free to file with the IRS, but using airSlate SignNow may involve subscription fees for access to our eSigning services. Our pricing plans are designed to be cost-effective, allowing you to manage your nonprofit's documentation efficiently.

-

Can I integrate airSlate SignNow with other software to manage my 990 n postcard filings?

Yes, airSlate SignNow offers seamless integrations with various accounting and nonprofit management software. This means you can manage your 990 n postcard filings alongside other important organizational tasks, streamlining your workflow and saving time.

-

What features does airSlate SignNow provide to assist with 990 n postcard filings?

Our platform offers robust features such as customizable templates, eSignature capabilities, and document tracking. These tools are designed to enhance your overall experience when preparing and submitting your 990 n postcard, making the process more efficient.

-

Is airSlate SignNow user-friendly for filing a 990 n postcard?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple for anyone to eSign and send documents. Even if you're unfamiliar with technology, you can easily navigate our system to file your 990 n postcard without difficulty.

-

What are the benefits of using airSlate SignNow for nonprofit organizations?

By using airSlate SignNow, nonprofit organizations benefit from reduced paperwork, quicker processing times, and enhanced compliance with filing requirements like the 990 n postcard. Our solutions help save time and resources, allowing you to focus on your mission.

Get more for Form 8854

- Washington dc conditional waiver and release on final payment washington dc conditional lien waiver on final payment for to be form

- Form 2271 concessionaires sales tax return and payment form 2271 concessionaires sales tax return and payment

- Tax court petition sample form

- Fillable cms179 form

- Borang m form

- Refractive surgery referral pcli for doctors of optometry form

- Irs form 8300 fillable

- Athlete contract template form

Find out other Form 8854

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free