Schedule I Form 1041 Alternative Minimum TaxEstates 2023

Understanding Schedule I Form 1041 for Alternative Minimum Tax

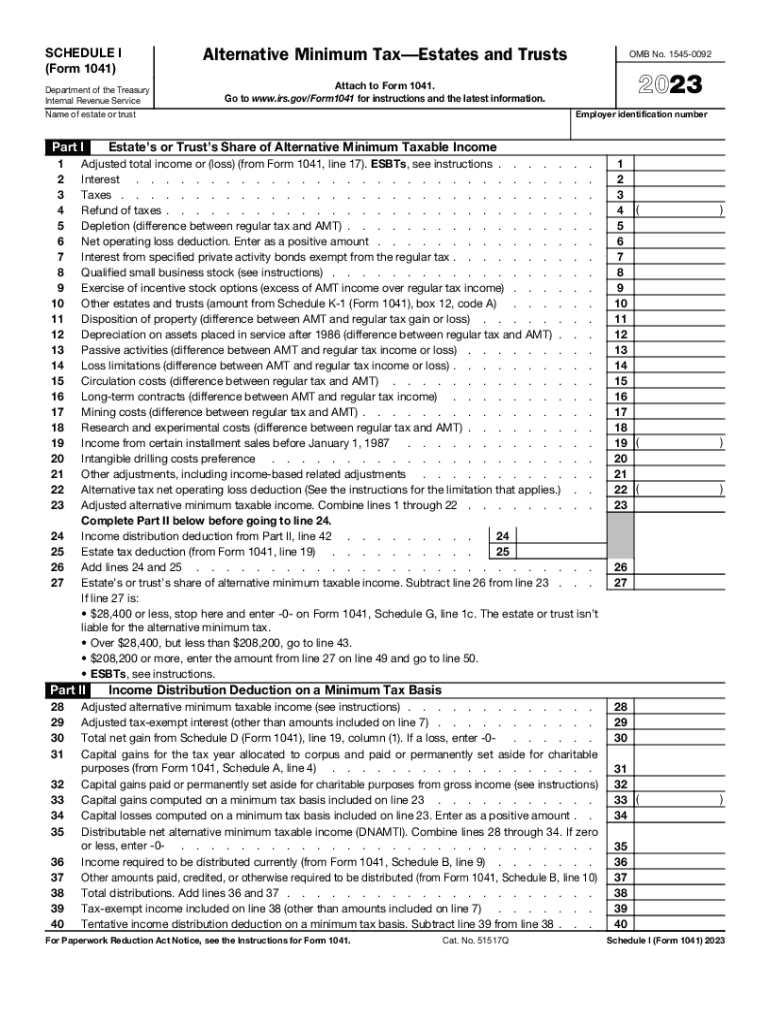

The Schedule I Form 1041 is specifically designed for estates and trusts to report alternative minimum tax (AMT) liabilities. This form is essential for ensuring compliance with IRS regulations regarding the taxation of estates and trusts. The AMT is a separate tax calculation that ensures that certain taxpayers pay a minimum amount of tax, regardless of deductions and credits. Understanding how this form operates is crucial for fiduciaries managing estates or trusts, as it helps in accurately reporting income and calculating any AMT owed.

Steps to Complete Schedule I Form 1041

Completing the Schedule I Form 1041 involves several key steps:

- Gather all necessary financial documents related to the estate or trust, including income statements and deduction records.

- Begin filling out the form by entering the basic information about the estate or trust, including its name and tax identification number.

- Calculate the alternative minimum taxable income (AMTI) by adjusting the regular taxable income with specific AMT adjustments and preferences.

- Determine the AMT exemption amount applicable to the estate or trust and apply it to the AMTI.

- Complete the remaining sections of the form to report any tax owed and ensure all calculations are accurate.

Obtaining Schedule I Form 1041

The Schedule I Form 1041 can be obtained directly from the IRS website or through tax preparation software. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax professionals can provide this form as part of their services. Ensuring you have the correct version for the tax year is important, as forms may be updated annually.

IRS Guidelines for Schedule I Form 1041

The IRS provides specific guidelines for completing the Schedule I Form 1041. These guidelines detail the necessary information required, the calculations for AMT, and the filing procedures. It is essential to refer to the IRS instructions for the current tax year to ensure compliance. The guidelines also clarify any recent changes in tax laws or reporting requirements that may affect how the form is filled out.

Filing Deadlines for Schedule I Form 1041

Filing deadlines for the Schedule I Form 1041 align with the general deadlines for Form 1041. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the estate or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Legal Use of Schedule I Form 1041

The legal use of the Schedule I Form 1041 is primarily for reporting alternative minimum tax liabilities for estates and trusts. Fiduciaries must ensure that the form is completed accurately to avoid penalties for non-compliance. This form is a legal document that must be filed with the IRS, and it is subject to audit, so maintaining accurate records and documentation is essential for legal protection and compliance.

Quick guide on how to complete schedule i form 1041 alternative minimum taxestates

Effortlessly Prepare Schedule I Form 1041 Alternative Minimum TaxEstates on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule I Form 1041 Alternative Minimum TaxEstates on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and eSign Schedule I Form 1041 Alternative Minimum TaxEstates with Ease

- Find Schedule I Form 1041 Alternative Minimum TaxEstates and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional hand-signed signature.

- Review the information and click on the Done button to finalize your updates.

- Select your preferred method for sending your form, whether it be via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate the worries of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Schedule I Form 1041 Alternative Minimum TaxEstates to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule i form 1041 alternative minimum taxestates

Create this form in 5 minutes!

How to create an eSignature for the schedule i form 1041 alternative minimum taxestates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to schedule 1 2023?

airSlate SignNow is a user-friendly platform that enables businesses to send and eSign documents. With the need for efficient document management, understanding how to manage schedule 1 2023 tax forms digitally can simplify your workflow and improve compliance.

-

How much does airSlate SignNow cost for managing schedule 1 2023 documents?

airSlate SignNow offers competitive pricing plans tailored to different business needs. By choosing a plan, you can efficiently handle schedule 1 2023 document signing without incurring high costs associated with paper-based methods.

-

What features does airSlate SignNow provide for efficient handling of schedule 1 2023?

With airSlate SignNow, users have access to features like templates, in-person signing, and automated workflows. These tools are specifically beneficial for preparing and managing schedule 1 2023 documents efficiently.

-

Can I integrate airSlate SignNow with other applications for schedule 1 2023?

Yes, airSlate SignNow seamlessly integrates with numerous applications, making it easy to manage schedule 1 2023 alongside your existing systems. This integration facilitates better data flow and eases the document management process.

-

What are the benefits of using airSlate SignNow for schedule 1 2023 submissions?

Using airSlate SignNow for schedule 1 2023 submissions streamlines the signing process, reduces turnaround time, and enhances security. This allows businesses to focus more on growth while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for managing schedule 1 2023?

Absolutely! airSlate SignNow is designed with an intuitive interface that allows users of all skill levels to manage their schedule 1 2023 documents easily. The platform’s simplicity ensures a smooth experience for both senders and signers.

-

How does airSlate SignNow ensure the security of my schedule 1 2023 documents?

airSlate SignNow prioritizes security by implementing encryption and secure cloud storage for all documents, including schedule 1 2023. This ensures that sensitive information remains protected during the signing process and beyond.

Get more for Schedule I Form 1041 Alternative Minimum TaxEstates

- Megs security authorization form megs security authorization form

- Dtmb 460 michigan form

- Form it 250 claim for credit for purchase of an automated external defribrillator tax year 772088716

- Gdpr compliance contract template form

- General construction contract template form

- General consult contract template form

- General contractor contract template form

- General for service contract template form

Find out other Schedule I Form 1041 Alternative Minimum TaxEstates

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself