New York Form it 201 ATT Other Tax Credits and Taxes 2020

What is the New York Form IT 201 ATT?

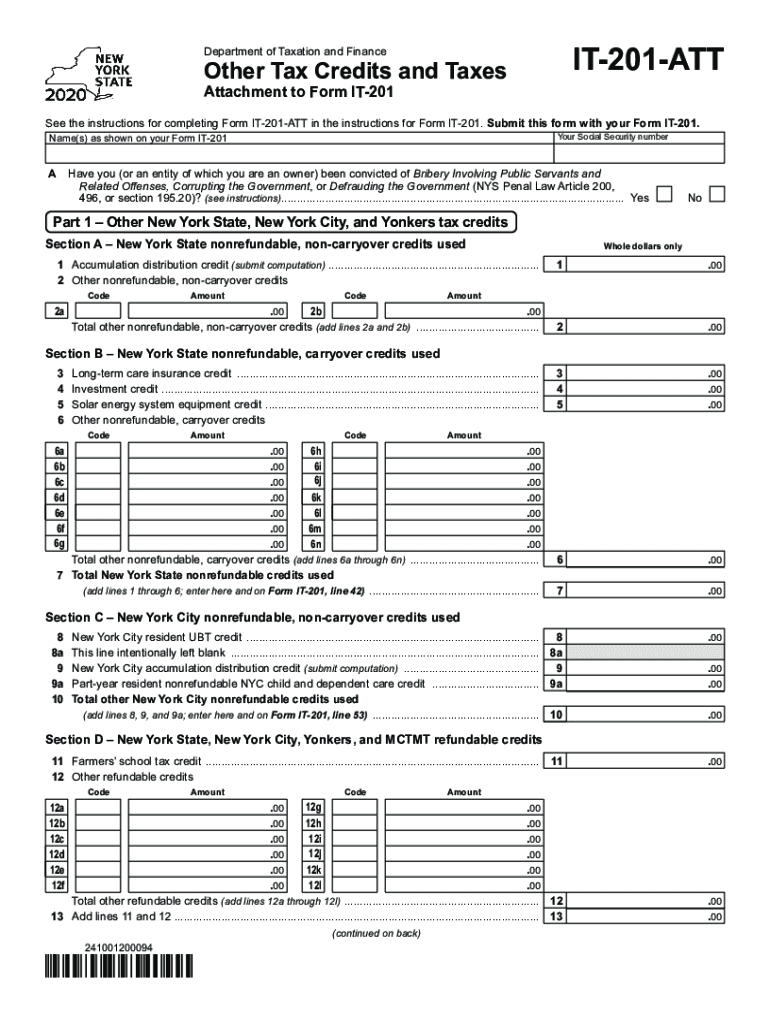

The New York Form IT 201 ATT is a tax form used by residents of New York State to claim various tax credits and adjustments. This form is specifically designed for individuals who are filing their personal income tax returns and wish to report additional credits that may reduce their overall tax liability. The IT 201 ATT allows taxpayers to detail any applicable credits, ensuring they receive the maximum benefit available under state tax laws.

Key Elements of the New York Form IT 201 ATT

Understanding the key elements of the New York Form IT 201 ATT is essential for accurate completion. The form includes sections for:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Credit Information: Specific tax credits being claimed, including eligibility requirements for each credit.

- Calculation of Credits: A detailed breakdown of how each credit is calculated and applied to the overall tax return.

- Signature and Date: Required for the form to be considered valid, ensuring the taxpayer acknowledges the accuracy of the information provided.

Steps to Complete the New York Form IT 201 ATT

Completing the New York Form IT 201 ATT involves several key steps:

- Gather Required Information: Collect all necessary documentation, including prior tax returns and information on any credits you plan to claim.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately at the top of the form.

- Detail Tax Credits: In the designated sections, list the credits you are eligible for and provide the required calculations.

- Review and Verify: Double-check all entries for accuracy to avoid errors that could delay processing.

- Sign and Date: Ensure that you sign and date the form, as this is crucial for its validity.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the New York Form IT 201 ATT. Generally, the form must be submitted by April fifteenth of each year for the preceding tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their returns, as these can impact the timing of their submissions.

Required Documents for the New York Form IT 201 ATT

When preparing to complete the New York Form IT 201 ATT, certain documents are necessary to support your claims. These may include:

- W-2 Forms: To report income earned from employers.

- 1099 Forms: For reporting other income sources, such as freelance work or interest income.

- Documentation for Tax Credits: Any supporting documents that validate your eligibility for the credits claimed.

- Previous Year’s Tax Return: For reference and to ensure consistency in reporting.

Legal Use of the New York Form IT 201 ATT

The New York Form IT 201 ATT is legally binding when filled out correctly and submitted in accordance with state tax laws. To ensure legal compliance, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes accurately reporting income, claiming only eligible credits, and maintaining proper documentation to support claims. Failure to comply with these regulations can result in penalties or audits.

Quick guide on how to complete new york form it 201 att other tax credits and taxes

Complete New York Form IT 201 ATT Other Tax Credits And Taxes seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage New York Form IT 201 ATT Other Tax Credits And Taxes on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign New York Form IT 201 ATT Other Tax Credits And Taxes effortlessly

- Locate New York Form IT 201 ATT Other Tax Credits And Taxes and click on Get Form to begin.

- Use the tools we provide to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign New York Form IT 201 ATT Other Tax Credits And Taxes and guarantee flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 201 att other tax credits and taxes

Create this form in 5 minutes!

How to create an eSignature for the new york form it 201 att other tax credits and taxes

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the new york state tax form 201 att?

The new york state tax form 201 att is used by taxpayers in New York to report their annual income and calculate their tax obligations. This form is essential for individuals who earn income in New York and want to ensure compliance with state tax regulations. Understanding this form is crucial for accurate tax preparation and filing.

-

How can I fill out the new york state tax form 201 att using airSlate SignNow?

With airSlate SignNow, you can easily fill out the new york state tax form 201 att electronically. Our platform provides a user-friendly interface that allows you to input your information and sign the document digitally. This streamlined process not only saves time but also reduces the risk of errors traditionally associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the new york state tax form 201 att?

airSlate SignNow offers various pricing plans to accommodate different user needs, ranging from individual users to businesses. The cost-effective solutions make it accessible for anyone needing to complete the new york state tax form 201 att. You can start with a free trial to explore the features before committing to a plan.

-

What features does airSlate SignNow offer for managing the new york state tax form 201 att?

airSlate SignNow provides several features to simplify managing the new york state tax form 201 att, including document sharing, electronic signatures, and real-time tracking. Additionally, users can collaborate easily with others and store completed forms securely in the cloud for easy access. These features enhance efficiency and reliability in handling tax documents.

-

Can I integrate airSlate SignNow with other applications for filing the new york state tax form 201 att?

Yes, airSlate SignNow supports integration with various applications that can enhance your tax filing experience for the new york state tax form 201 att. You can connect with platforms like Google Drive, Dropbox, and more, allowing seamless document management and storage. This integration helps streamline your workflow and keeps your tax documents organized.

-

What are the benefits of using airSlate SignNow for the new york state tax form 201 att?

Using airSlate SignNow for the new york state tax form 201 att offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your tax documents. The platform’s electronic signature feature allows for quicker approvals and eliminates the need for physical signatures. Overall, it simplifies the tax filing process while ensuring compliance with state laws.

-

Is airSlate SignNow compliant with New York tax regulations for the new york state tax form 201 att?

Yes, airSlate SignNow complies with all relevant New York tax regulations associated with the new york state tax form 201 att. The platform is designed to meet industry standards for data security and electronic signatures, ensuring that your tax documents are handled securely and appropriately. You can trust airSlate SignNow to facilitate your tax filing needs effectively.

Get more for New York Form IT 201 ATT Other Tax Credits And Taxes

Find out other New York Form IT 201 ATT Other Tax Credits And Taxes

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now