Form it 201 ATT "Other Tax Credits and Taxes" New York 2021

What is the Form IT 201 ATT "Other Tax Credits And Taxes" New York

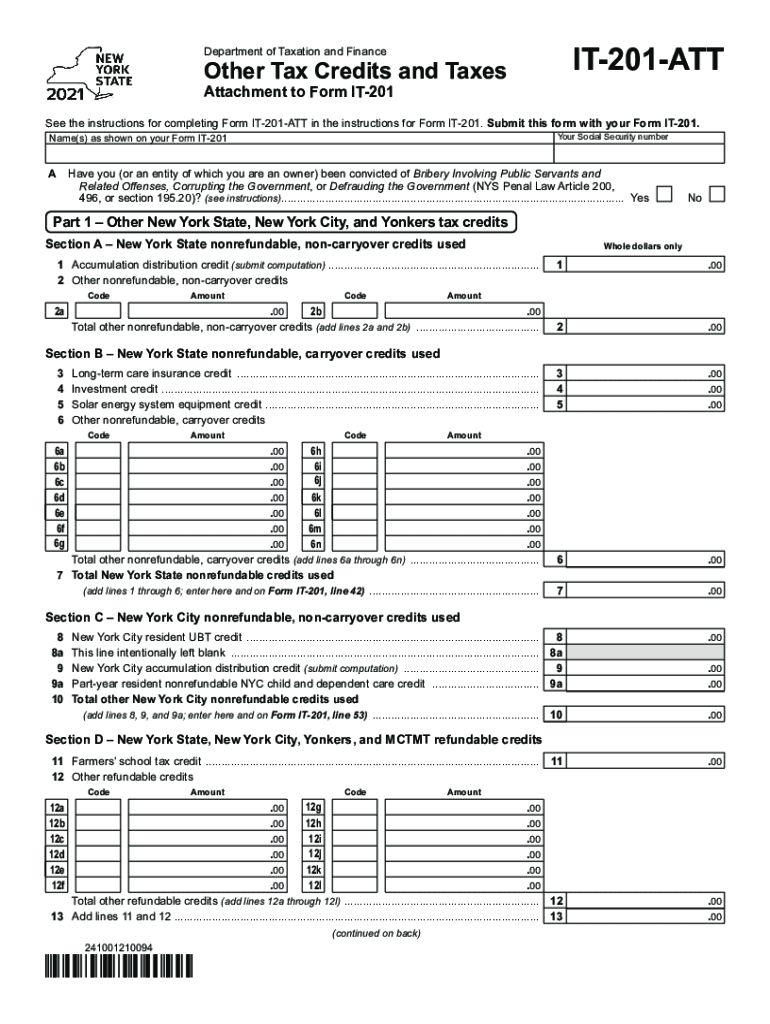

The Form IT 201 ATT, known as the "Other Tax Credits And Taxes," is a crucial document for New York taxpayers. It allows individuals to claim various tax credits and report additional taxes that may apply to their specific financial situations. This form is particularly relevant for those who wish to ensure they receive all eligible tax benefits while complying with state tax regulations. Understanding the purpose of this form is essential for accurate tax reporting and maximizing potential refunds.

Steps to complete the Form IT 201 ATT "Other Tax Credits And Taxes" New York

Completing the Form IT 201 ATT involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and records of any applicable tax credits. Next, carefully fill out each section of the form, providing detailed information about your income, deductions, and any other relevant financial data. It is important to double-check your entries for accuracy before submitting the form. Finally, submit the completed form by the designated deadline to avoid penalties.

Key elements of the Form IT 201 ATT "Other Tax Credits And Taxes" New York

The Form IT 201 ATT includes several key elements that taxpayers must understand. These elements consist of sections for reporting income, claiming credits, and detailing any additional taxes owed. Each section is designed to capture specific information, such as the type of credit being claimed and the amount. Familiarity with these elements helps ensure that taxpayers provide complete and accurate information, which is essential for the proper processing of their tax returns.

Eligibility Criteria

To use the Form IT 201 ATT, taxpayers must meet certain eligibility criteria. Generally, this form is intended for New York residents who are filing their state income tax returns. Specific eligibility may depend on factors such as income level, filing status, and the types of credits being claimed. It is advisable for taxpayers to review these criteria carefully to determine their eligibility before completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 201 ATT are critical for taxpayers to observe. Typically, the form must be submitted by the same deadline as the New York state income tax return, which is usually April 15. However, taxpayers should check for any updates or changes to deadlines that may occur in a given tax year. Being aware of these important dates helps prevent late submissions and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form IT 201 ATT. The form can be filed electronically through the New York State Department of Taxation and Finance website, which is often the quickest method for processing. Alternatively, taxpayers may choose to mail the completed form to the appropriate address listed in the instructions. In-person submissions may also be possible at designated tax offices, providing additional flexibility for those who prefer face-to-face interactions.

Quick guide on how to complete form it 201 att ampquotother tax credits and taxesampquot new york

Effortlessly prepare Form IT 201 ATT "Other Tax Credits And Taxes" New York on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form IT 201 ATT "Other Tax Credits And Taxes" New York on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form IT 201 ATT "Other Tax Credits And Taxes" New York with ease

- Obtain Form IT 201 ATT "Other Tax Credits And Taxes" New York and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with the tools that airSlate SignNow specifically provides for that function.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Form IT 201 ATT "Other Tax Credits And Taxes" New York to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 201 att ampquotother tax credits and taxesampquot new york

Create this form in 5 minutes!

How to create an eSignature for the form it 201 att ampquotother tax credits and taxesampquot new york

How to create an e-signature for a PDF in the online mode

How to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is nys it 201 att and how does it relate to airSlate SignNow?

NYS IT 201 ATT refers to a specific set of guidelines for electronic signatures in New York State. airSlate SignNow is fully compliant with these regulations, ensuring that your eSigned documents are not only legally binding but also secure. This makes airSlate SignNow an ideal solution for businesses looking to adhere to the nys it 201 att standards.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to varying business needs, including options suitable for solo users, small teams, and large enterprises. Each plan provides access to essential features that comply with nys it 201 att standards, ensuring you can eSign documents efficiently and affordably. You can explore these options on our pricing page.

-

What features does airSlate SignNow offer to meet nys it 201 att requirements?

airSlate SignNow provides a robust set of features designed to facilitate electronic signatures while meeting nys it 201 att specifications. These include customizable templates, secure document storage, and comprehensive audit trails, ensuring that every eSignature is traceable and compliant. This empowers organizations to streamline their signing processes confidently.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time and costs associated with traditional paper-based processes. The platform not only allows for quick eSigning but also enhances security, ensuring compliance with nys it 201 att regulations. This can improve operational efficiency, client satisfaction, and accelerate document turnaround times.

-

Is airSlate SignNow compatible with other software systems?

Yes! airSlate SignNow seamlessly integrates with a variety of third-party applications such as Google Drive, Salesforce, and Microsoft Office. This interoperability allows users to work within the ecosystems they already use while ensuring compliance with nys it 201 att standards across platforms. Streamlined integrations save time and increase productivity.

-

How secure is airSlate SignNow for document eSigning?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and complies with industry regulations, including nys it 201 att requirements, to protect your sensitive information. This ensures that all eSigned documents are secure, giving you and your clients peace of mind throughout the signing process.

-

Can airSlate SignNow help with document tracking?

Absolutely! airSlate SignNow includes comprehensive tracking features that allow you to monitor the status of your documents in real-time. This capability aligns with nys it 201 att requirements by providing a clear audit trail, ensuring that you can verify when a document was eSigned and by whom, enhancing accountability.

Get more for Form IT 201 ATT "Other Tax Credits And Taxes" New York

Find out other Form IT 201 ATT "Other Tax Credits And Taxes" New York

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy