Form it 201 ATT Other Tax Credits and Taxes Tax NY Gov 2022

Overview of Form IT 201 ATT

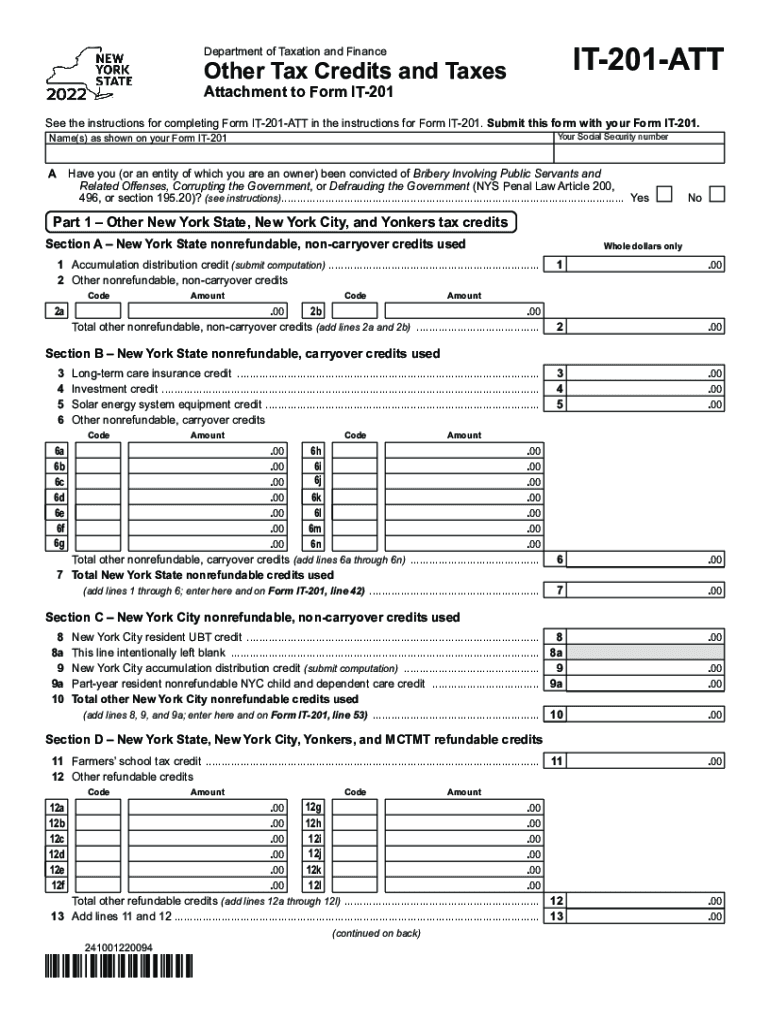

The Form IT 201 ATT is a crucial document for taxpayers in New York who are looking to claim various tax credits and adjustments. This form allows individuals to report additional credits that may reduce their overall tax liability. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and maximizing potential refunds.

Steps to Complete Form IT 201 ATT

Completing the Form IT 201 ATT involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements and prior year tax returns. Next, carefully fill out the form, ensuring that all personal information is correct. Pay special attention to the sections that pertain to specific credits, as these will require detailed information about eligibility and amounts. After completing the form, review it thoroughly for any errors before submission.

Eligibility Criteria for Form IT 201 ATT

To successfully utilize the Form IT 201 ATT, taxpayers must meet certain eligibility criteria. This includes being a resident of New York and having income that qualifies for specific tax credits. Additionally, individuals must ensure that they have not exceeded the income limits set for each credit. Familiarizing oneself with these criteria can streamline the filing process and help avoid potential issues with the New York State Department of Taxation and Finance.

Required Documents for Form IT 201 ATT

When preparing to file the Form IT 201 ATT, it is important to have all required documents readily available. Essential documents include W-2 forms, 1099 forms, and any other income verification documents. Additionally, taxpayers should gather documentation supporting their claims for credits, such as receipts or statements related to educational expenses or childcare. Having these documents organized will facilitate a smoother filing experience.

Filing Deadlines for Form IT 201 ATT

Timely submission of the Form IT 201 ATT is critical to avoid penalties and ensure that taxpayers receive their refunds promptly. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays. Staying informed about these deadlines helps taxpayers plan their filing accordingly.

Form Submission Methods

Taxpayers have multiple options for submitting the Form IT 201 ATT. The form can be filed electronically using approved tax software, which often streamlines the process and reduces the likelihood of errors. Alternatively, individuals may choose to print and mail the completed form to the appropriate tax office. It is important to follow the instructions carefully for whichever method is selected to ensure successful submission.

Quick guide on how to complete form it 201 att other tax credits and taxes taxnygov

Complete Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features you require to create, alter, and electronically sign your documents swiftly and without hindrances. Manage Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

Steps to modify and eSign Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov with ease

- Find Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov and select Get Form to begin.

- Make use of the tools available to populate your form.

- Emphasize important sections of the documents or redact sensitive details using specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your revisions.

- Select your preferred method to share the form via email, SMS, an invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, cumbersome form navigation, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 201 att other tax credits and taxes taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 201 att other tax credits and taxes taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IT 201 ATT?

airSlate SignNow is an eSigning solution that allows businesses to send and sign documents efficiently. The integration of IT 201 ATT enables users to manage their documentation processes seamlessly, ensuring compliance and security.

-

What are the pricing options available for IT 201 ATT users of airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to cater to different business needs. IT 201 ATT users can benefit from competitive pricing models that ensure they get a cost-effective solution for their eSigning requirements.

-

What features does airSlate SignNow include specifically for IT 201 ATT?

airSlate SignNow includes a variety of features tailored for IT 201 ATT, such as customizable workflows, templates, and secure eSignature options. These features streamline the signing process and enhance productivity within organizations.

-

How does airSlate SignNow improve document turnaround time for IT 201 ATT?

By leveraging airSlate SignNow, IT 201 ATT users can signNowly reduce document turnaround times. The platform allows for quick sending and signing of documents, resulting in faster approvals and improved workflow efficiency.

-

Can airSlate SignNow integrate with other software relevant to IT 201 ATT?

Yes, airSlate SignNow offers seamless integration with a variety of software applications that are commonly used in IT 201 ATT. This allows users to centralize their operations and improve collaboration across different tools.

-

What security measures are in place for IT 201 ATT users of airSlate SignNow?

airSlate SignNow prioritizes security for IT 201 ATT users by employing advanced encryption and authentication protocols. These measures ensure that all documents and signatures remain protected throughout the signing process.

-

What benefits does airSlate SignNow offer to businesses in the IT 201 ATT sector?

Businesses within the IT 201 ATT sector can enhance their efficiency, reduce paper usage, and improve compliance with airSlate SignNow. The platform's user-friendly design and comprehensive features make it an ideal solution for modern document management.

Get more for Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov

- Final notice of forfeiture and request to vacate property under contract for deed south carolina form

- Buyers request for accounting from seller under contract for deed south carolina form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed south carolina form

- General notice of default for contract for deed south carolina form

- South carolina disclosure form

- Sc disclosure residential property form

- South carolina deed 497325511 form

- Notice of default for past due payments in connection with contract for deed south carolina form

Find out other Form IT 201 ATT Other Tax Credits And Taxes Tax NY gov

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed