it 201 Tax Form 2017

What is the IT 201 Tax Form

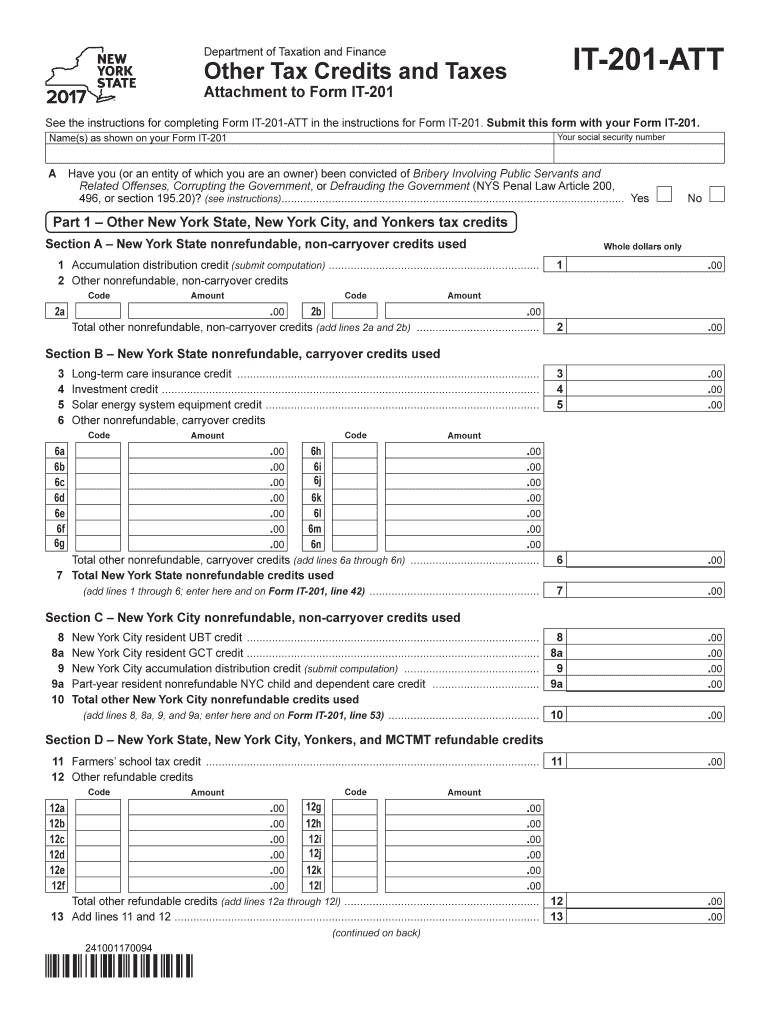

The IT 201 Tax Form is a crucial document used by residents of New York State for filing personal income tax returns. This form allows individuals to report their income, claim deductions, and calculate their tax liability for the year. It is essential for ensuring compliance with state tax laws and for determining any potential refund or amount owed to the state. The IT 201 is designed for single filers, married couples filing jointly, and heads of household, making it versatile for various taxpayer situations.

How to Obtain the IT 201 Tax Form

To obtain the IT 201 Tax Form, individuals can visit the New York State Department of Taxation and Finance website, where the form is available for download in PDF format. Additionally, physical copies can be requested through local tax offices or by calling the department directly. It is advisable to ensure you have the most current version of the form, as updates may occur annually to reflect changes in tax laws.

Steps to Complete the IT 201 Tax Form

Completing the IT 201 Tax Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any relevant deduction records.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Claim any deductions and credits you are eligible for, following the instructions provided.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form to validate it before submission.

Legal Use of the IT 201 Tax Form

The IT 201 Tax Form is legally binding when completed accurately and submitted to the New York State Department of Taxation and Finance. To ensure its legal validity, all information must be truthful and reflective of your financial situation. Filing this form is a requirement for residents earning income in New York, and failure to file can result in penalties or legal repercussions. Proper use of the form aids in maintaining compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IT 201 Tax Form typically align with federal tax deadlines. Generally, the due date for filing is April 15 of the following year for individuals. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, especially during tax season, to avoid late filing penalties.

Form Submission Methods

The IT 201 Tax Form can be submitted through various methods:

- Online: Taxpayers can file electronically using approved software, which often simplifies the process and speeds up refunds.

- Mail: Completed forms can be mailed to the appropriate address listed in the form instructions, ensuring it is sent well before the deadline.

- In-Person: Individuals may also submit their forms at designated tax offices for assistance and verification.

Quick guide on how to complete it 201 tax form 2017

Complete It 201 Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal green alternative to conventional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage It 201 Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest way to alter and eSign It 201 Tax Form without any hassle

- Obtain It 201 Tax Form and click on Get Form to begin.

- Utilize the tools at your disposal to finish your document.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow supplies specifically for that function.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and select the Done button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the frustration of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document handling requirements in just a few clicks from any device you prefer. Modify and eSign It 201 Tax Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 201 tax form 2017

Create this form in 5 minutes!

How to create an eSignature for the it 201 tax form 2017

How to make an eSignature for the It 201 Tax Form 2017 in the online mode

How to make an eSignature for the It 201 Tax Form 2017 in Chrome

How to make an electronic signature for signing the It 201 Tax Form 2017 in Gmail

How to create an electronic signature for the It 201 Tax Form 2017 straight from your smart phone

How to make an eSignature for the It 201 Tax Form 2017 on iOS devices

How to create an electronic signature for the It 201 Tax Form 2017 on Android

People also ask

-

What is the IT 201 Tax Form and why do I need it?

The IT 201 Tax Form is a state tax form used in New York for filing personal income taxes. It's essential for individuals who need to report their income, credits, and deductions to ensure compliance with state tax laws. Using airSlate SignNow, you can easily prepare and eSign your IT 201 Tax Form, streamlining the filing process.

-

How can airSlate SignNow help me with the IT 201 Tax Form?

airSlate SignNow offers an intuitive platform for creating, sending, and eSigning your IT 201 Tax Form. The software ensures your documents are securely transmitted and legally binding, making tax filing simpler and more efficient. Plus, you can access your forms from any device, enhancing convenience.

-

Is airSlate SignNow cost-effective for managing tax forms like the IT 201 Tax Form?

Yes, airSlate SignNow provides a cost-effective solution for managing tax forms, including the IT 201 Tax Form. With flexible pricing plans tailored for both individuals and businesses, users can choose an option that fits their budget while still accessing comprehensive document management features.

-

Can I integrate airSlate SignNow with my accounting software for filing the IT 201 Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with many accounting and tax software applications. This integration ensures that your IT 201 Tax Form is ready for submission, allowing data to flow easily between platforms and reducing the potential for errors.

-

What security measures does airSlate SignNow have for protecting my IT 201 Tax Form?

airSlate SignNow prioritizes the security of your documents, including the IT 201 Tax Form. With features like end-to-end encryption, two-factor authentication, and secure cloud storage, you can be confident that your sensitive tax information remains protected throughout the signing process.

-

How long does it take to eSign the IT 201 Tax Form using airSlate SignNow?

eSigning the IT 201 Tax Form with airSlate SignNow is quick and user-friendly. Most users can complete the signing process in just minutes, allowing you to focus on getting your tax filings submitted on time without complications.

-

What are the benefits of using airSlate SignNow for the IT 201 Tax Form?

Using airSlate SignNow for your IT 201 Tax Form provides numerous benefits, such as improved accuracy, speed, and convenience. Easily revisit previously signed documents and maintain electronic records without clutter, ensuring you stay organized and compliant.

Get more for It 201 Tax Form

Find out other It 201 Tax Form

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast