Using Form 1023 EZ, and Have Read and Understand the Requirements to Be Exempt under Section 501c3 2018-2026

Understanding Form 1023 EZ

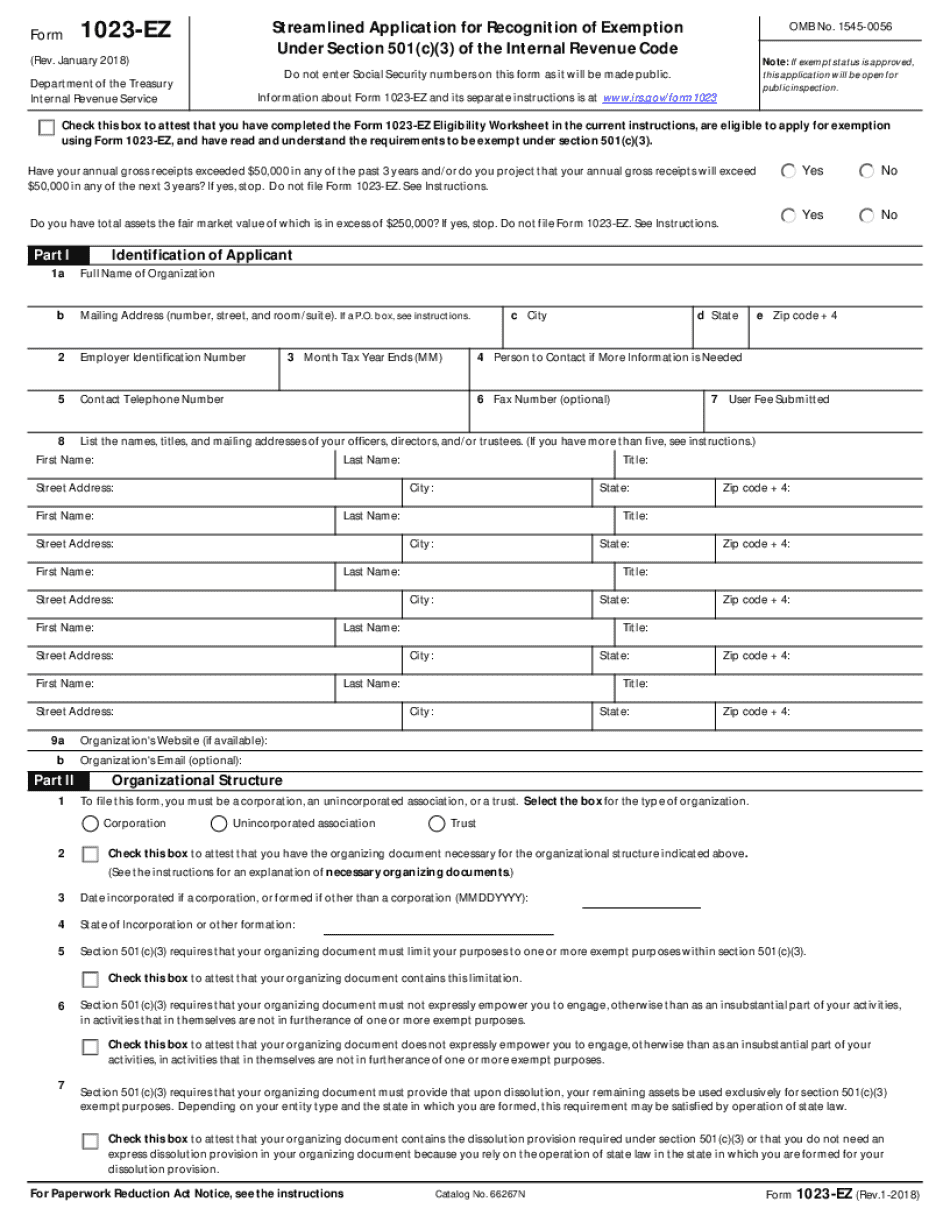

The Form 1023 EZ is a streamlined application for organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is designed for smaller organizations that meet specific eligibility criteria, allowing them to apply for federal tax exemption without the extensive documentation required by the standard Form 1023. By using Form 1023 EZ, organizations can save time and resources while ensuring compliance with IRS regulations.

Eligibility Criteria for Form 1023 EZ

To qualify for the Form 1023 EZ, organizations must meet several key criteria:

- The organization must be a domestic entity, formed in the United States.

- It must have gross receipts of less than $50,000 in the past three years, or projected gross receipts of less than $50,000 in the next three years.

- The total assets of the organization must be valued at less than $250,000.

- The organization must not be a private foundation or a supporting organization.

- It must operate exclusively for exempt purposes, such as charitable, religious, educational, or scientific activities.

Steps to Complete Form 1023 EZ

Completing the Form 1023 EZ involves several straightforward steps:

- Gather necessary information about your organization, including its mission, structure, and financial data.

- Access the Form 1023 EZ online through the IRS website or download the form for offline completion.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically through the IRS online portal or by mail, depending on your preference.

Required Documents for Form 1023 EZ

When submitting Form 1023 EZ, organizations must include specific documentation to support their application:

- A copy of the organizing documents, such as articles of incorporation or bylaws.

- A statement of the organization's purpose and activities.

- Financial statements, including a budget for the current year and a projection for the next two years.

- Any additional information that demonstrates the organization’s eligibility for tax-exempt status.

Form Submission Methods

Organizations can submit Form 1023 EZ through various methods:

- Online Submission: The preferred method is to submit the form electronically via the IRS website. This method is quicker and allows for immediate confirmation of receipt.

- Mail Submission: Alternatively, organizations can print the completed form and mail it to the appropriate IRS address. This method may take longer for processing.

IRS Guidelines for Form 1023 EZ

The IRS provides specific guidelines to assist organizations in completing Form 1023 EZ. It is essential to review these guidelines to ensure compliance with all requirements. The guidelines outline the eligibility criteria, required documentation, and detailed instructions for filling out the form. Organizations should also be aware of any updates or changes to the form or the application process by regularly checking the IRS website.

Handy tips for filling out Using Form 1023 EZ, And Have Read And Understand The Requirements To Be Exempt Under Section 501c3 online

Quick steps to complete and e-sign Using Form 1023 EZ, And Have Read And Understand The Requirements To Be Exempt Under Section 501c3 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Obtain access to a GDPR and HIPAA compliant service for maximum straightforwardness. Use signNow to e-sign and send out Using Form 1023 EZ, And Have Read And Understand The Requirements To Be Exempt Under Section 501c3 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct using form 1023 ez and have read and understand the requirements to be exempt under section 501c3

Create this form in 5 minutes!

How to create an eSignature for the using form 1023 ez and have read and understand the requirements to be exempt under section 501c3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1023 ez form and how does it relate to airSlate SignNow?

The 1023 ez form is a streamlined application for small organizations seeking tax-exempt status under IRS regulations. With airSlate SignNow, you can easily eSign and send your 1023 ez documents, ensuring a smooth submission process. Our platform simplifies the paperwork, making it easier for you to focus on your mission.

-

How much does it cost to use airSlate SignNow for filing the 1023 ez?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those filing the 1023 ez form. Our cost-effective solution ensures you can manage your documents without breaking the bank. Check our pricing page for specific plans that suit your organization.

-

What features does airSlate SignNow offer for the 1023 ez process?

airSlate SignNow provides a range of features designed to streamline the 1023 ez filing process. These include customizable templates, secure eSigning, and document tracking. Our user-friendly interface makes it easy to manage your forms efficiently.

-

Can I integrate airSlate SignNow with other tools for my 1023 ez application?

Yes, airSlate SignNow offers seamless integrations with various applications that can assist in your 1023 ez application process. Whether you need to connect with cloud storage or CRM systems, our platform supports multiple integrations to enhance your workflow. This flexibility allows you to manage your documents more effectively.

-

What are the benefits of using airSlate SignNow for my 1023 ez filing?

Using airSlate SignNow for your 1023 ez filing provides numerous benefits, including time savings and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, reducing the risk of errors. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on your organization's goals.

-

Is airSlate SignNow user-friendly for first-time 1023 ez filers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for first-time 1023 ez filers to navigate. Our intuitive interface guides you through the process, ensuring that you can complete your application without confusion. Plus, our customer support team is always available to assist you.

-

How does airSlate SignNow ensure the security of my 1023 ez documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your 1023 ez documents from unauthorized access. Our compliance with industry standards ensures that your sensitive information remains safe throughout the eSigning process.

Get more for Using Form 1023 EZ, And Have Read And Understand The Requirements To Be Exempt Under Section 501c3

- Bir form 2307withholding taxvalue added tax

- On the occupational status portion if not employed or purpose is form

- Get the pag ibig form application for provident benefits claim

- Vzv specimen collection form

- Application for an australian travel document form b 10

- Fax number include area code form

- Solid waste management districts with ex officio boards separate road districts sewer districts utilities authorities and form

- Appearance form third circuit

Find out other Using Form 1023 EZ, And Have Read And Understand The Requirements To Be Exempt Under Section 501c3

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document