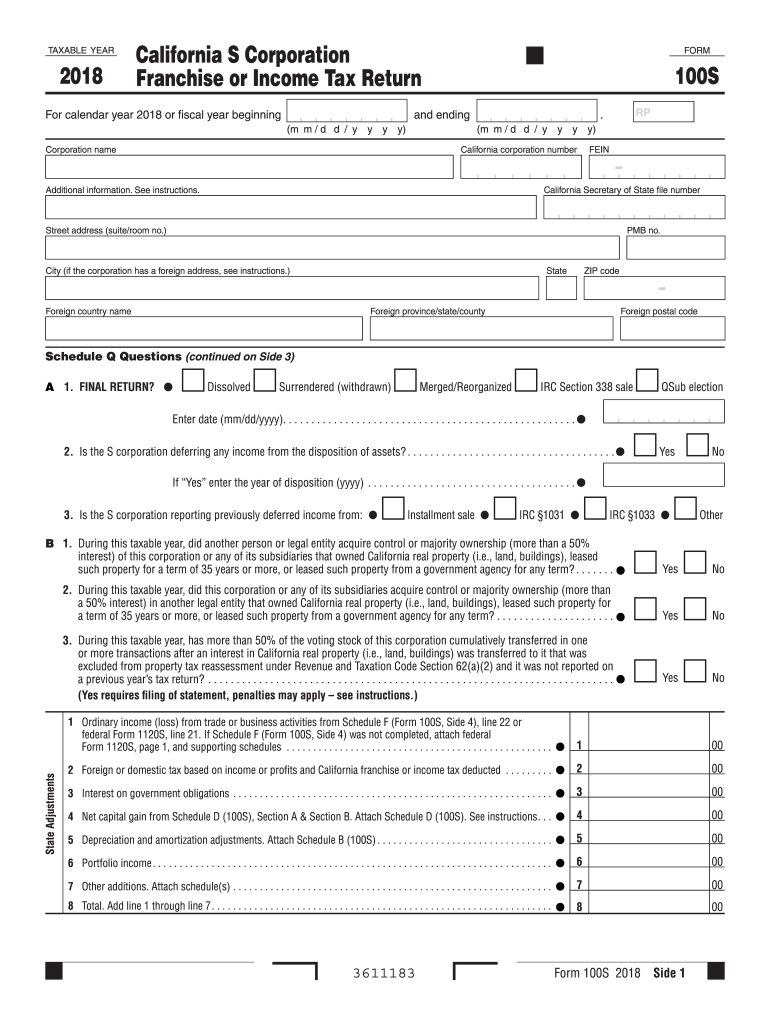

California Form 100s Instructions PDF 2019

What is the California Form 100s Instructions PDF

The California Form 100s Instructions PDF provides detailed guidelines for completing the California Form 100S, which is specifically designed for S corporations operating in California. This document outlines the necessary information required for tax reporting, including income, deductions, and credits. It serves as a comprehensive resource for taxpayers to understand their obligations and ensure compliance with state tax laws.

Steps to Complete the California Form 100s Instructions PDF

Completing the California Form 100s requires careful attention to detail. Here are the steps to follow:

- Download the latest version of the California Form 100s Instructions PDF from the Franchise Tax Board website.

- Review the instructions thoroughly to understand the required sections and information.

- Gather necessary documents, such as financial statements and prior year tax returns.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check your entries for accuracy and completeness.

- Sign and date the form, if required.

Legal Use of the California Form 100s Instructions PDF

The California Form 100s Instructions PDF is legally binding when completed and submitted according to the guidelines set forth by the Franchise Tax Board. To ensure that your submission is valid, it is essential to comply with all eSignature regulations and provide accurate information. The use of a reliable electronic signature solution can enhance the legal standing of your document, making it easier to manage and store securely.

Filing Deadlines / Important Dates

Timely filing of the California Form 100s is crucial to avoid penalties. The general deadline for filing is the fifteenth day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. If additional time is needed, corporations can file for an extension, but it is important to understand that this does not extend the time for payment of taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Submitting the California Form 100s can be done through various methods:

- Online: Use the California Franchise Tax Board's online services to submit electronically, which is often faster and more secure.

- Mail: Print the completed form and send it to the appropriate address provided in the instructions.

- In-Person: Visit a local Franchise Tax Board office to submit the form directly, if preferred.

Required Documents

When completing the California Form 100s, certain documents are necessary to support your entries. These may include:

- Financial statements (income statement and balance sheet)

- Previous year’s tax return

- Documentation for any deductions or credits claimed

- Records of any estimated tax payments made during the year

Penalties for Non-Compliance

Failing to comply with the filing requirements for the California Form 100s can result in significant penalties. Common penalties include:

- Late filing penalties, which can increase based on the duration of the delay.

- Interest on unpaid taxes, accruing from the original due date until payment is made.

- Potential loss of S corporation status if the form is not filed correctly or on time.

Quick guide on how to complete california form 100s instructions 2019 pdf

Effortlessly Create California Form 100s Instructions Pdf on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage California Form 100s Instructions Pdf on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The easiest way to modify and eSign California Form 100s Instructions Pdf effortlessly

- Obtain California Form 100s Instructions Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes needing new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign California Form 100s Instructions Pdf to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 100s instructions 2019 pdf

Create this form in 5 minutes!

How to create an eSignature for the california form 100s instructions 2019 pdf

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What are the essential franchise tax board California forms that businesses need?

Businesses typically require several essential franchise tax board California forms, including the Form 100 and Form 100-ES for corporations. These forms are crucial for filing state income taxes and estimated taxes. Ensuring that you have the correct forms is vital for compliance and avoiding penalties.

-

How can airSlate SignNow assist with completing franchise tax board California forms?

airSlate SignNow streamlines the process of completing franchise tax board California forms by providing easy-to-use templates. Users can fill out, sign, and send these forms quickly without the hassle of manual paperwork. This simplifies compliance and increases efficiency for California-based businesses.

-

Are there any costs associated with using airSlate SignNow for franchise tax board California forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The plans are cost-effective and designed to provide value, allowing businesses to choose the right features for managing their franchise tax board California forms. You can start with a free trial to explore its features before committing.

-

What features does airSlate SignNow provide for managing franchise tax board California forms?

airSlate SignNow offers features like eSignature capabilities, document templates, and automatic reminders for deadlines related to franchise tax board California forms. These features enhance productivity and ensure that your forms are filed on time. The platform also provides cloud storage for easy access and retrieval.

-

How can I ensure the security of my franchise tax board California forms with airSlate SignNow?

airSlate SignNow prioritizes security by implementing industry-standard encryption and secure storage for all documents, including franchise tax board California forms. The platform complies with various regulations to ensure your sensitive information remains protected. Additionally, you can set access controls for added security.

-

Can airSlate SignNow integrate with other software to manage franchise tax board California forms?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to manage franchise tax board California forms alongside your existing workflows. Popular integrations include CRM systems, cloud storage solutions, and accounting software. This capability enhances efficiency and reduces the complexity of managing documents.

-

What benefits does using airSlate SignNow provide for franchise tax board California forms?

Using airSlate SignNow for franchise tax board California forms offers numerous benefits, including time savings and improved accuracy in document management. The platform reduces the chances of errors in filling out forms and helps in tracking the status of submissions. Additionally, eSigning allows for faster processing times.

Get more for California Form 100s Instructions Pdf

Find out other California Form 100s Instructions Pdf

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form