100s Form 2019

What is the 100s Form

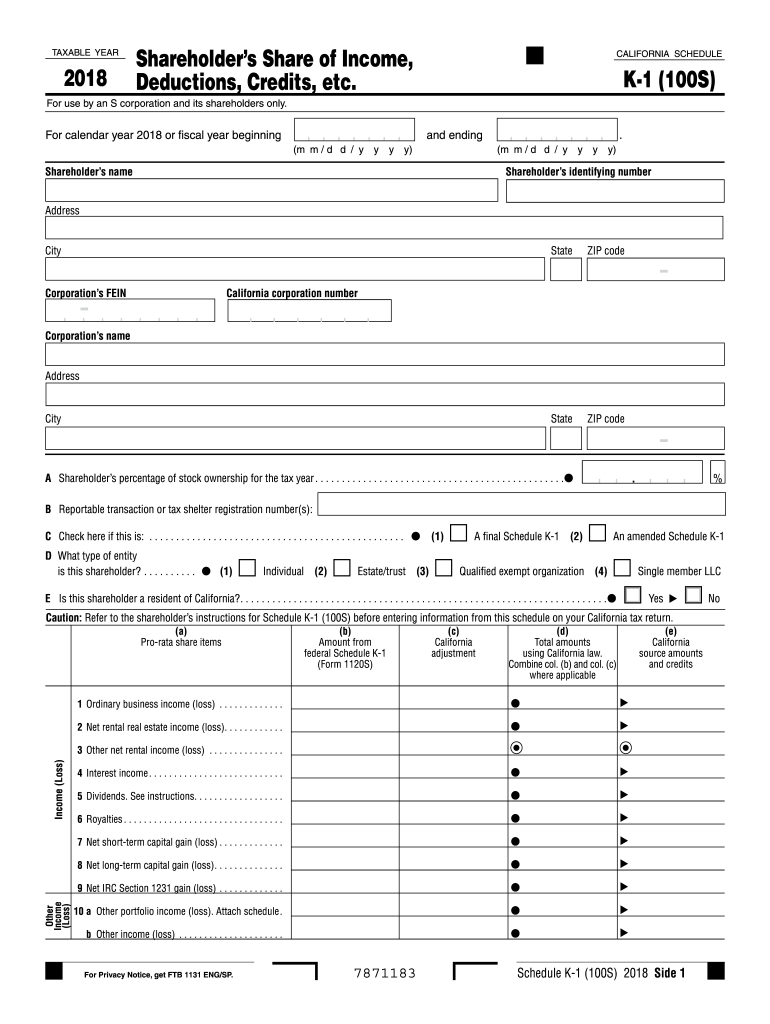

The California Schedule K-1 (Form 100S) is a tax document used by S corporations to report income, deductions, and credits to shareholders. This form provides essential information about each shareholder's share of the corporation's income, losses, and other tax-related items. It is crucial for shareholders to accurately report this information on their personal tax returns, as it affects their overall tax liability.

How to use the 100s Form

To use the California Schedule K-1 (Form 100S), shareholders must first receive the completed form from the S corporation. Once in possession of the form, shareholders should review the information for accuracy, including their share of income, deductions, and credits. This information must then be reported on their individual tax returns. It is important to keep a copy of the form for personal records, as it may be needed for future reference or in case of an audit.

Steps to complete the 100s Form

Completing the California Schedule K-1 (Form 100S) involves several steps:

- Gather necessary financial information from the S corporation, including income, deductions, and credits.

- Fill in the shareholder's details, including name, address, and identification number.

- Report the shareholder's share of income, losses, and other relevant tax items as provided by the corporation.

- Ensure all calculations are accurate and that the form is signed where required.

- Submit the completed form to the appropriate tax authorities and retain a copy for personal records.

Legal use of the 100s Form

The California Schedule K-1 (Form 100S) is legally binding when completed accurately and submitted according to state tax regulations. It is essential for shareholders to ensure that the information reported is truthful and complete, as inaccuracies can lead to penalties or legal issues. The form must be filed with the California Franchise Tax Board as part of the S corporation's tax return, and shareholders must include it with their individual tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the California Schedule K-1 (Form 100S) align with the overall tax deadlines for S corporations. Typically, S corporations must file their tax returns by the fifteenth day of the third month following the end of their fiscal year. Shareholders should expect to receive their K-1 forms shortly after the corporation files its return, allowing them to meet their individual tax filing deadlines, which are usually due by April fifteenth for most taxpayers.

Who Issues the Form

The California Schedule K-1 (Form 100S) is issued by the S corporation itself. It is the responsibility of the corporation to prepare and distribute the form to each shareholder. The corporation must ensure that the information is accurate and complies with state tax regulations before issuing the K-1 to shareholders. Shareholders should contact the corporation if they do not receive their form in a timely manner.

Quick guide on how to complete 2017 100s form

Prepare 100s Form seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 100s Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to adjust and eSign 100s Form effortlessly

- Obtain 100s Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign 100s Form while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 100s form

Create this form in 5 minutes!

How to create an eSignature for the 2017 100s form

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What are California Schedule K 1 100s instructions?

California Schedule K 1 100s instructions refer to the guidelines for completing the Schedule K-1 form used by partnerships to report income, deductions, and credits. This form is essential for California tax purposes, ensuring that each partner receives accurate information regarding their share of the business’s income. Understanding these instructions can help streamline the tax filing process.

-

How can airSlate SignNow assist with California Schedule K 1 100s instructions?

airSlate SignNow provides a streamlined electronic signing process that can simplify the collection of signatures for California Schedule K 1 100s instructions. By transforming traditional paperwork into digital formats, users can efficiently send, sign, and manage these essential documents. This not only saves time but also reduces the chances of errors.

-

Are there any costs associated with using airSlate SignNow for California Schedule K 1 100s instructions?

Yes, while airSlate SignNow offers various pricing plans, the cost can vary based on the features and number of users required. However, its overall cost-effectiveness makes it a great solution for managing documents like California Schedule K 1 100s instructions. Users can choose a plan that aligns with their business needs and budget.

-

What features does airSlate SignNow provide for managing California Schedule K 1 100s instructions?

AirSlate SignNow offers features like customizable templates, real-time tracking, and automated reminders, all of which enhance the management of California Schedule K 1 100s instructions. These tools help ensure that documents are completed accurately and on time. The platform’s user-friendly interface also facilitates an easy workflow for signing and sharing important tax documents.

-

Can airSlate SignNow integrate with other software for handling California Schedule K 1 100s instructions?

Yes, airSlate SignNow easily integrates with various accounting and document management software to assist users in managing California Schedule K 1 100s instructions. This integration allows for a seamless connection between your financial records and the signing process. You can automate workflows and ensure all data is synchronized and easily accessible.

-

What benefits does eSigning offer for California Schedule K 1 100s instructions?

eSigning simplifies the collection of signatures on California Schedule K 1 100s instructions, making it faster and more secure. By using airSlate SignNow, you eliminate the hassle of printing, scanning, and mailing documents. eSigning also provides an audit trail, enhancing the accountability of all signers.

-

Is airSlate SignNow suitable for small businesses needing California Schedule K 1 100s instructions?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that require assistance with California Schedule K 1 100s instructions. Its cost-effective pricing plans and user-friendly tools make it accessible, allowing smaller organizations to manage their signing needs without complexity.

Get more for 100s Form

Find out other 100s Form

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later