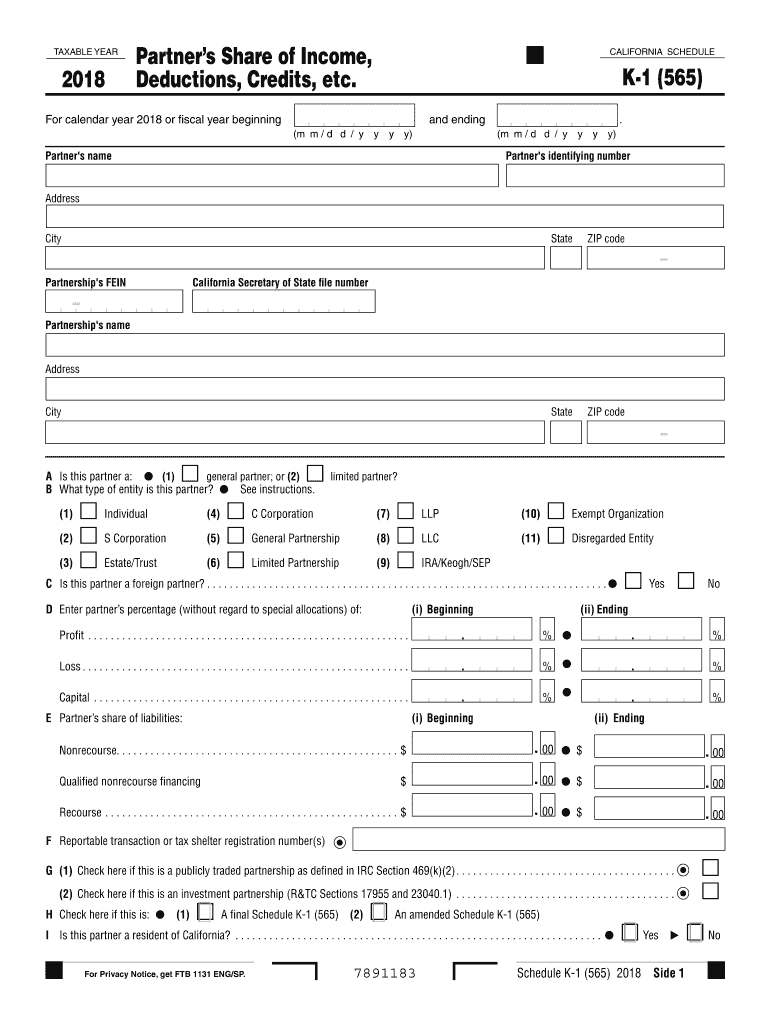

California K 1 Form 2019

What is the California K-1 Form

The California K-1 form, formally known as the California Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for individual tax filings. The California K-1 is crucial for ensuring that all parties involved in a partnership or corporation accurately report their earnings and pay the appropriate taxes.

Steps to Complete the California K-1 Form

Completing the California K-1 form involves several key steps:

- Gather Necessary Information: Collect all relevant financial data from the partnership or corporation, including income, deductions, and credits.

- Fill Out the Form: Enter the entity's information, including its name, address, and tax identification number. Then, input the partner's or shareholder's details.

- Report Income and Deductions: Accurately report the share of income, deductions, and credits allocated to the individual. This includes ordinary income, rental income, and any other relevant figures.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete. Mistakes can lead to delays or issues with tax filings.

- Distribute Copies: Provide copies of the completed K-1 form to all partners or shareholders, as they will need this information for their personal tax returns.

Legal Use of the California K-1 Form

The California K-1 form has legal significance as it serves as a record of income distribution among partners or shareholders. To be considered valid, the form must be completed accurately and submitted in accordance with California tax laws. Compliance with these regulations is essential, as inaccuracies can lead to penalties or audits. The form must also be provided to the California Franchise Tax Board when required, ensuring that all income is reported and taxed appropriately.

Who Issues the California K-1 Form

The California K-1 form is issued by partnerships, S corporations, estates, and trusts to their partners or shareholders. The entity is responsible for preparing and distributing the K-1 forms to each individual, ensuring that all necessary information is included. It is important for entities to issue these forms in a timely manner, as partners and shareholders rely on them for their tax filings. Failure to provide the K-1 form can result in complications for the individuals involved.

Filing Deadlines / Important Dates

Filing deadlines for the California K-1 form align with the tax return deadlines for the entity issuing the form. Generally, partnerships and S corporations must provide K-1 forms to their partners or shareholders by March 15 for calendar year filers. Individuals receiving the K-1 form must include the information on their personal tax returns, which are typically due by April 15. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with tax regulations.

Examples of Using the California K-1 Form

The California K-1 form is commonly used in various scenarios, including:

- Partnerships: Partners report their share of income and losses from the partnership, which affects their personal tax returns.

- S Corporations: Shareholders receive K-1 forms detailing their share of the corporation's income, which they must report on their individual tax filings.

- Estates and Trusts: Beneficiaries use the K-1 form to report income distributed to them from the estate or trust, ensuring that all income is accounted for in their tax returns.

Quick guide on how to complete california k 1 form

Effortlessly Prepare California K 1 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage California K 1 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign California K 1 Form

- Obtain California K 1 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with the tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign California K 1 Form and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california k 1 form

Create this form in 5 minutes!

How to create an eSignature for the california k 1 form

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the significance of 2017 565 in the context of airSlate SignNow?

The term 2017 565 refers to a signNow update in regulatory compliance for eSignatures that airSlate SignNow fully supports. This ensures that your documents are legally binding and compliant with the latest standards. By using airSlate SignNow, you can confidently sign documents while adhering to 2017 565 regulations.

-

How does airSlate SignNow pricing compare when considering the features related to 2017 565?

airSlate SignNow offers competitive pricing plans that include features tailored to meet compliance with 2017 565. Our plans provide access to secure eSignatures and document management tools, ensuring that your eSigning process is streamlined. Investing in airSlate SignNow not only saves you money but also enhances compliance with 2017 565 requirements.

-

What key features of airSlate SignNow align with 2017 565 standards?

AirSlate SignNow includes features such as advanced authentication methods, audit trails, and secure storage, all of which are crucial for meeting 2017 565 standards. These features ensure that not only are you signing documents securely, but you also have a comprehensive record of transactions. This aligns your business practices with 2017 565 compliance, enhancing overall trust in your operations.

-

Can airSlate SignNow integrate with other platforms to support processes involving 2017 565?

Yes, airSlate SignNow seamlessly integrates with various applications like CRM systems, cloud storage solutions, and productivity tools, all essential for maintaining compliance with 2017 565. These integrations allow your workflow to remain efficient while ensuring that all document transactions meet the required compliance standards. This way, you enhance your productivity without sacrificing legal security related to 2017 565.

-

What benefits can businesses expect from using airSlate SignNow with respect to 2017 565 compliance?

When businesses utilize airSlate SignNow in reference to 2017 565, they can expect enhanced legal protection, faster contract turnaround times, and improved customer satisfaction. By ensuring compliance with 2017 565, your business can operate more efficiently while gaining trust from clients. This ultimately leads to a stronger brand reputation and increased business opportunities.

-

How does airSlate SignNow ensure the security of documents tied to 2017 565?

AirSlate SignNow implements robust encryption and security protocols to protect documents related to 2017 565. This means that your sensitive information remains confidential and secure during the signing process. By prioritizing security, airSlate SignNow ensures compliance with 2017 565 standards while giving you peace of mind.

-

Is the user interface of airSlate SignNow designed for ease of use while ensuring 2017 565 compliance?

Absolutely! airSlate SignNow features an intuitive user interface that is easy to navigate, making it accessible for all users while ensuring compliance with 2017 565. Our design philosophy focuses on user experience, allowing friendly interactions with the digital signing process without compromising on necessary legal standards. Users can efficiently manage and sign documents while remaining compliant with 2017 565.

Get more for California K 1 Form

- Agreement cleaning form

- Unincorporated association template form

- Articles incorporation organization form

- Independent contractor agreement contract form

- Supplemental agreement granting consent to sublessee regarding use of leased property form

- Employer appeal letter for unemployment form

- Sample letter court form

- Board of trustees resolution form

Find out other California K 1 Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free