Schedule CT 1040AW Part Year Resident Income Allocation Form

What is the Schedule CT 1040AW Part Year Resident Income Allocation

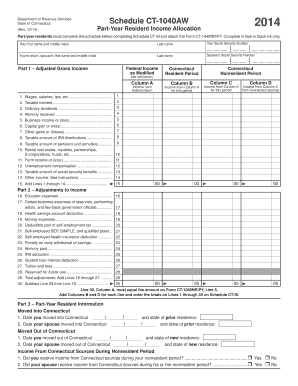

The Schedule CT 1040AW Part Year Resident Income Allocation is a tax form used by individuals who have lived in Connecticut for part of the tax year. This form allows taxpayers to allocate their income based on the time spent as a resident of Connecticut versus the time spent as a non-resident. This allocation is essential for accurately reporting income and determining the correct tax liability for part-year residents.

How to use the Schedule CT 1040AW Part Year Resident Income Allocation

To effectively use the Schedule CT 1040AW, taxpayers must first gather all relevant income information for the year. This includes wages, interest, dividends, and any other sources of income. Next, individuals should determine the amount of time spent as a resident and non-resident in Connecticut. The form guides users through the process of calculating the allocated income, ensuring that only the income earned while a resident is taxed by the state. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties.

Steps to complete the Schedule CT 1040AW Part Year Resident Income Allocation

Completing the Schedule CT 1040AW involves several key steps:

- Gather all income documentation for the year, including W-2s and 1099s.

- Determine the residency period in Connecticut and the corresponding income earned during that time.

- Fill out the form by entering the total income and the allocated income for the period of residency.

- Double-check calculations to ensure accuracy before submission.

- Submit the completed form along with your Connecticut income tax return.

Key elements of the Schedule CT 1040AW Part Year Resident Income Allocation

Important elements of the Schedule CT 1040AW include:

- Residency Period: Clearly defining the time spent as a resident versus a non-resident.

- Income Allocation: Properly calculating the income earned during the residency period.

- Filing Requirements: Understanding the filing requirements specific to part-year residents.

- Tax Rates: Being aware of the applicable tax rates for the income reported.

Legal use of the Schedule CT 1040AW Part Year Resident Income Allocation

The Schedule CT 1040AW is a legal document that must be completed accurately to comply with Connecticut tax laws. It is used to report income correctly and ensure that taxpayers pay the appropriate amount of tax based on their residency status. Misreporting or failing to file this form can lead to legal consequences, including fines or penalties from the state.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Schedule CT 1040AW. Typically, the filing deadline aligns with the federal tax return deadline, which is usually April fifteenth. However, if taxpayers need additional time, they can apply for an extension, but it is essential to check the specific guidelines for Connecticut to avoid any late fees.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1040aw part year resident income allocation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule CT 1040AW Part Year Resident Income Allocation?

The Schedule CT 1040AW Part Year Resident Income Allocation is a form used by part-year residents of Connecticut to allocate their income for tax purposes. This form helps ensure that you accurately report your income earned while residing in the state, which is crucial for compliance with state tax laws.

-

How can airSlate SignNow help with the Schedule CT 1040AW Part Year Resident Income Allocation?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including the Schedule CT 1040AW Part Year Resident Income Allocation. With our user-friendly interface, you can easily manage your tax documents and ensure they are submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Schedule CT 1040AW Part Year Resident Income Allocation?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can manage your Schedule CT 1040AW Part Year Resident Income Allocation without breaking the bank.

-

What features does airSlate SignNow offer for managing tax documents like the Schedule CT 1040AW Part Year Resident Income Allocation?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking. These tools streamline the process of completing and submitting your Schedule CT 1040AW Part Year Resident Income Allocation, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my Schedule CT 1040AW Part Year Resident Income Allocation?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your Schedule CT 1040AW Part Year Resident Income Allocation alongside your other financial tools. This integration enhances your workflow and improves efficiency.

-

What are the benefits of using airSlate SignNow for my Schedule CT 1040AW Part Year Resident Income Allocation?

Using airSlate SignNow for your Schedule CT 1040AW Part Year Resident Income Allocation provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, ensuring that your documents are handled quickly and securely.

-

How secure is airSlate SignNow when handling sensitive documents like the Schedule CT 1040AW Part Year Resident Income Allocation?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents, including the Schedule CT 1040AW Part Year Resident Income Allocation. You can trust that your information is safe with us.

Get more for Schedule CT 1040AW Part Year Resident Income Allocation

Find out other Schedule CT 1040AW Part Year Resident Income Allocation

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template